Brazil

Brazil

Last updated: January 2023

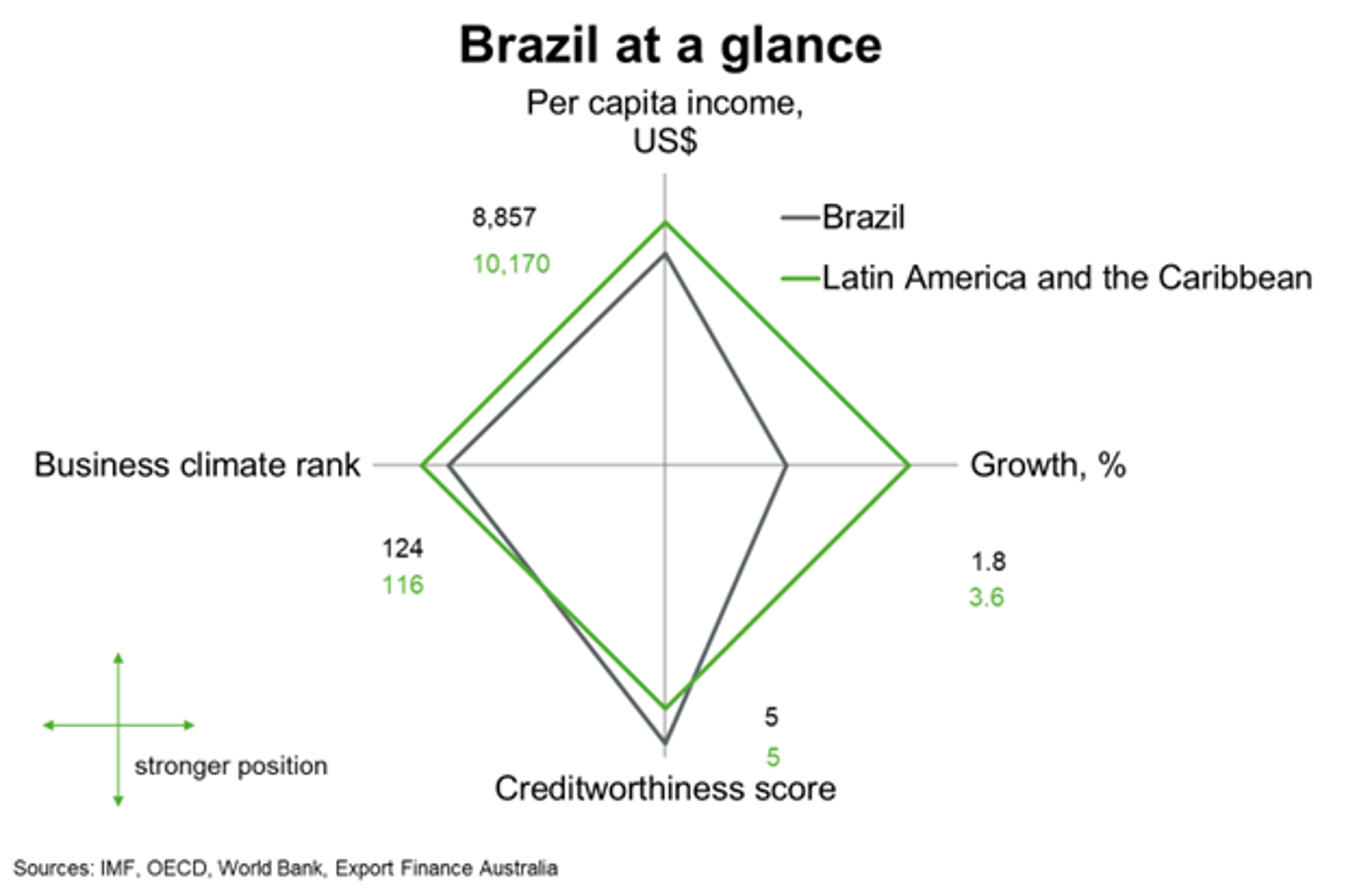

Brazil is the world’s 12th largest economy, and the largest in Latin America. Brazil has significant resources wealth, including gold, uranium, iron, and timber, and is the world’s largest producer of coffee. Per capita incomes and economic growth prospects are weaker than the average for Latin American countries. Creditworthiness and the business climate are broadly in line with the regional average.

The above chart is a cobweb diagram showing how a country measures up on four important dimensions of economic performance—per capita income, annual GDP growth, business climate rank and creditworthiness. Per capita income is in current US dollars. Annual GDP growth is the five-year average forecast between 2023 and 2027. Business climate is measured by the World Bank’s 2019 Ease of Doing Business ranking of 190 countries. Creditworthiness attempts to measure a country's ability to honour its external debt obligations and is measured by its OECD country credit risk rating. The chart shows not only how a country performs on the four dimensions, but how it measures up against other countries in the region.

Economic Outlook

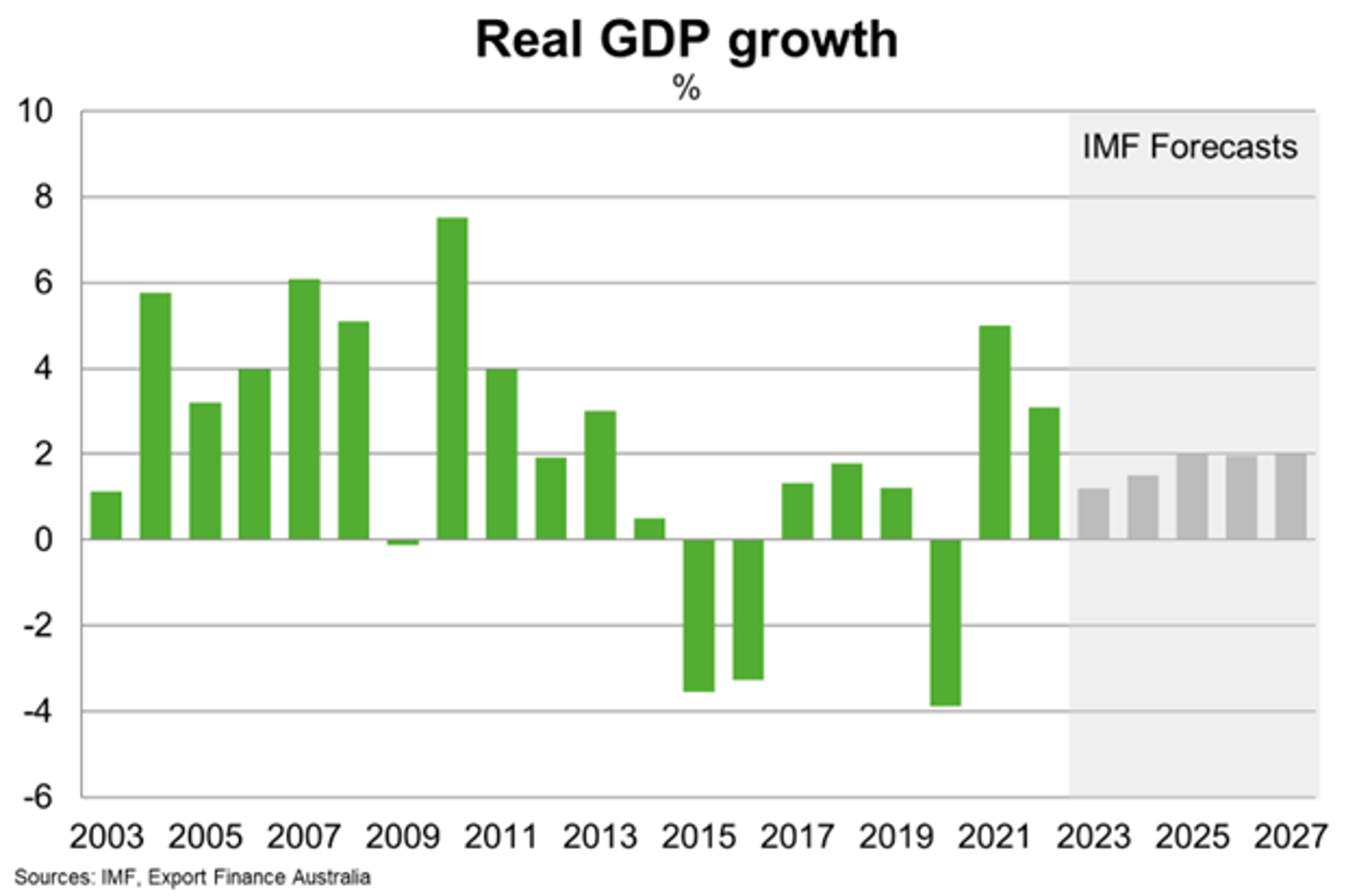

Due to various domestic and structural impediments, the economy grew at a modest 1.6% to 1.8% per annum for several years before the pandemic. Real GDP grew by 3.1% in 2022 on the back of an expanding services sector and rising consumer spending, helping to offset declines in government spending and exports. Following an aggressive interest rate hiking cycle that began in early 2021, inflation has begun to ease and the central bank has kept the benchmark interest rate steady at 13.75% since August 2022.

The IMF estimates GDP growth of just 1.2% in 2023, and 1.7% per annum, on average, from 2024 to 2027. A tighter labour market, greater consumer confidence and stable interest rates as inflation eases should support domestic demand. However, volatility in the external environment is a negative for growth. A weaker global economy and falling commodity prices weigh on export growth. Government debt remains high (at 73.5% of GDP in 2022), limiting prospects for fiscal expansion. Chronic structural constraints, such as low productivity growth, a difficult business environment, and high government debt remain key challenges for Brazil, as the economy continues its recovery from the pandemic.

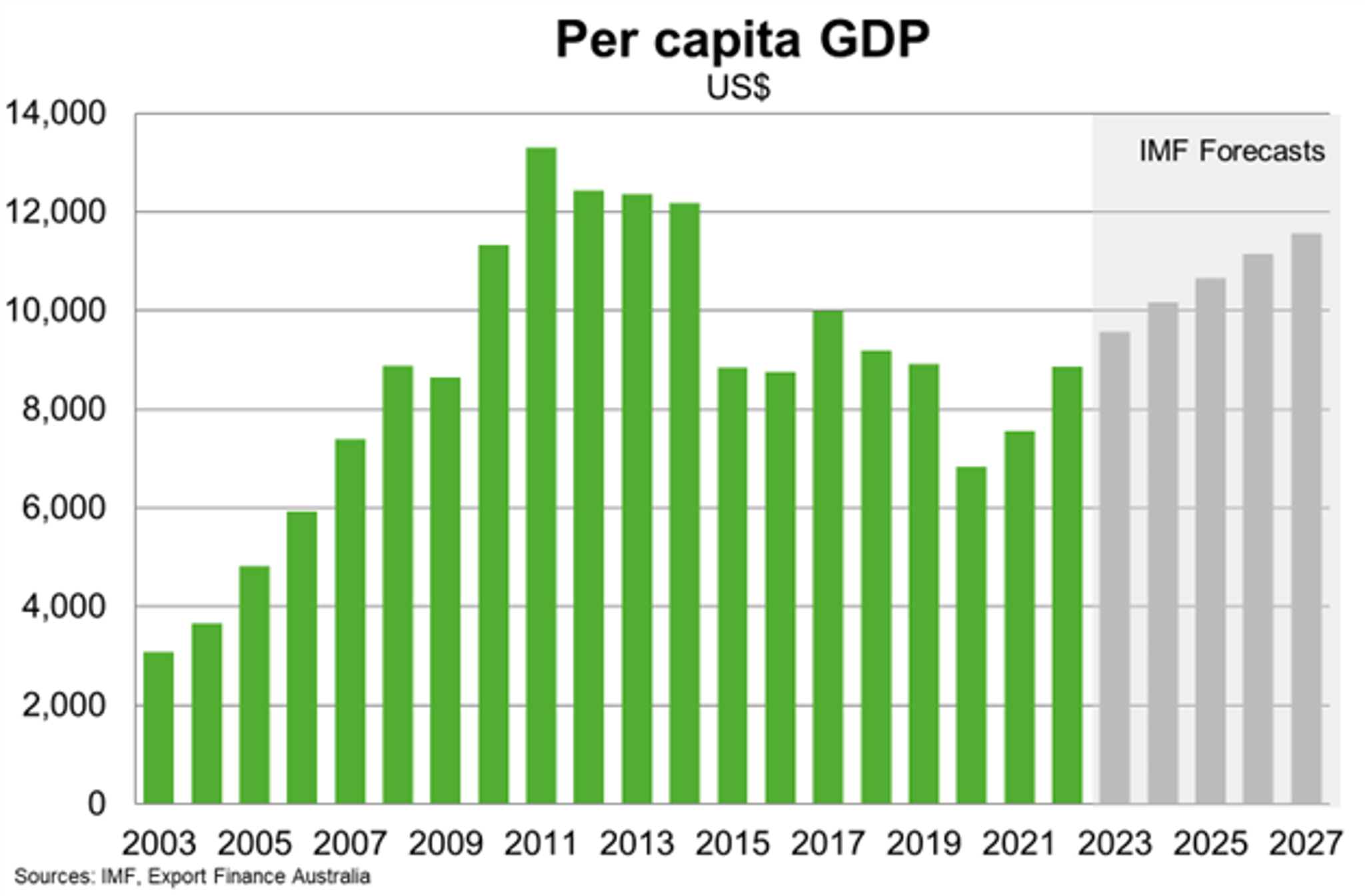

Strong GDP growth and rising commodity prices from 2004 to 2011 helped lift Brazil into upper-middle-income status and to take millions of people out of poverty. But per capita incomes sat at roughly US$9,000 in 2022, about one-third lower than in 2014. Notably, per capita incomes are on the rise again, as tighter labour market conditions in the services sector (the unemployment rate fell to 8.1% in November 2022, the lowest reading since 2015) helped to lift wages.

Country Risk

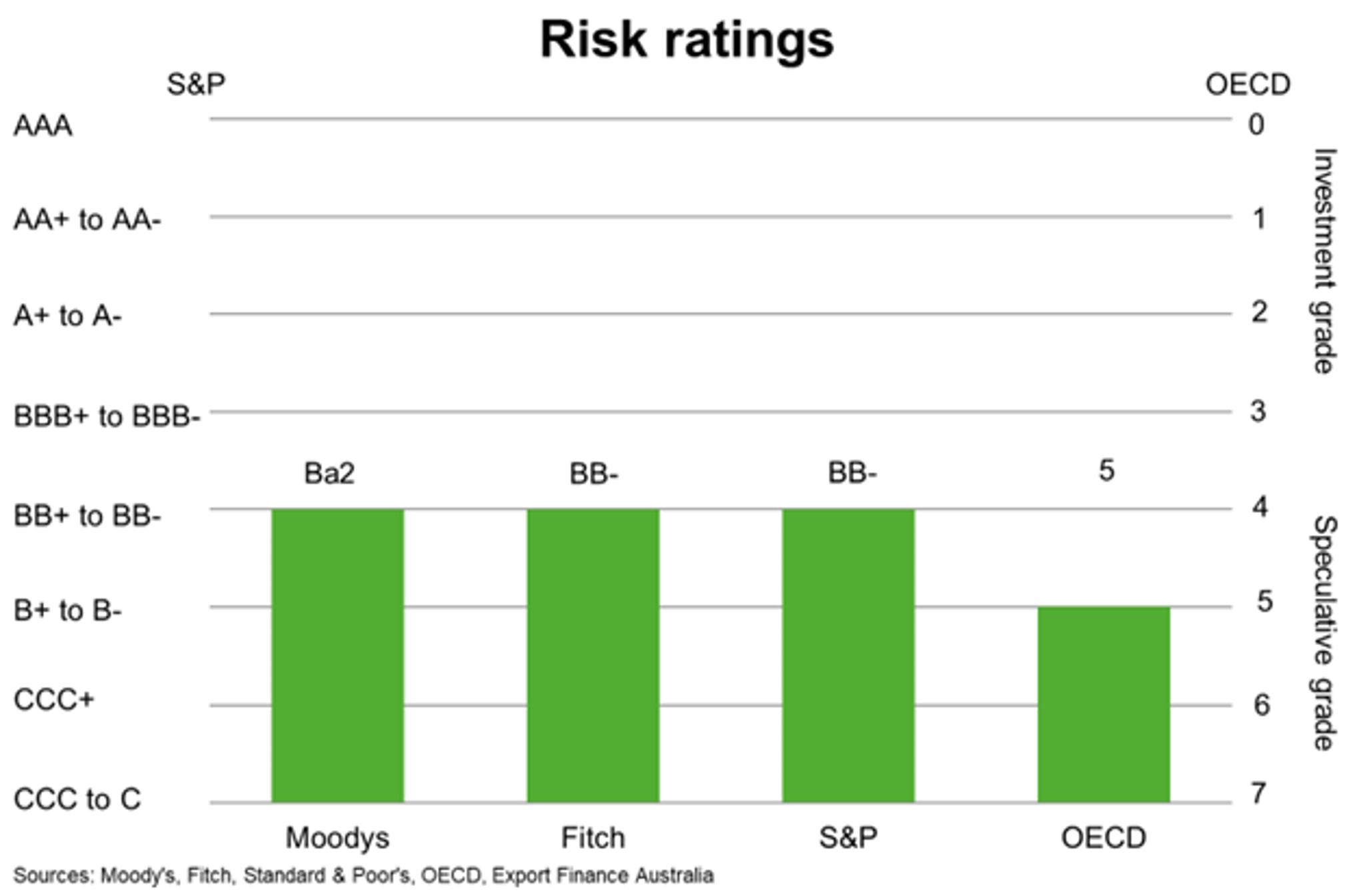

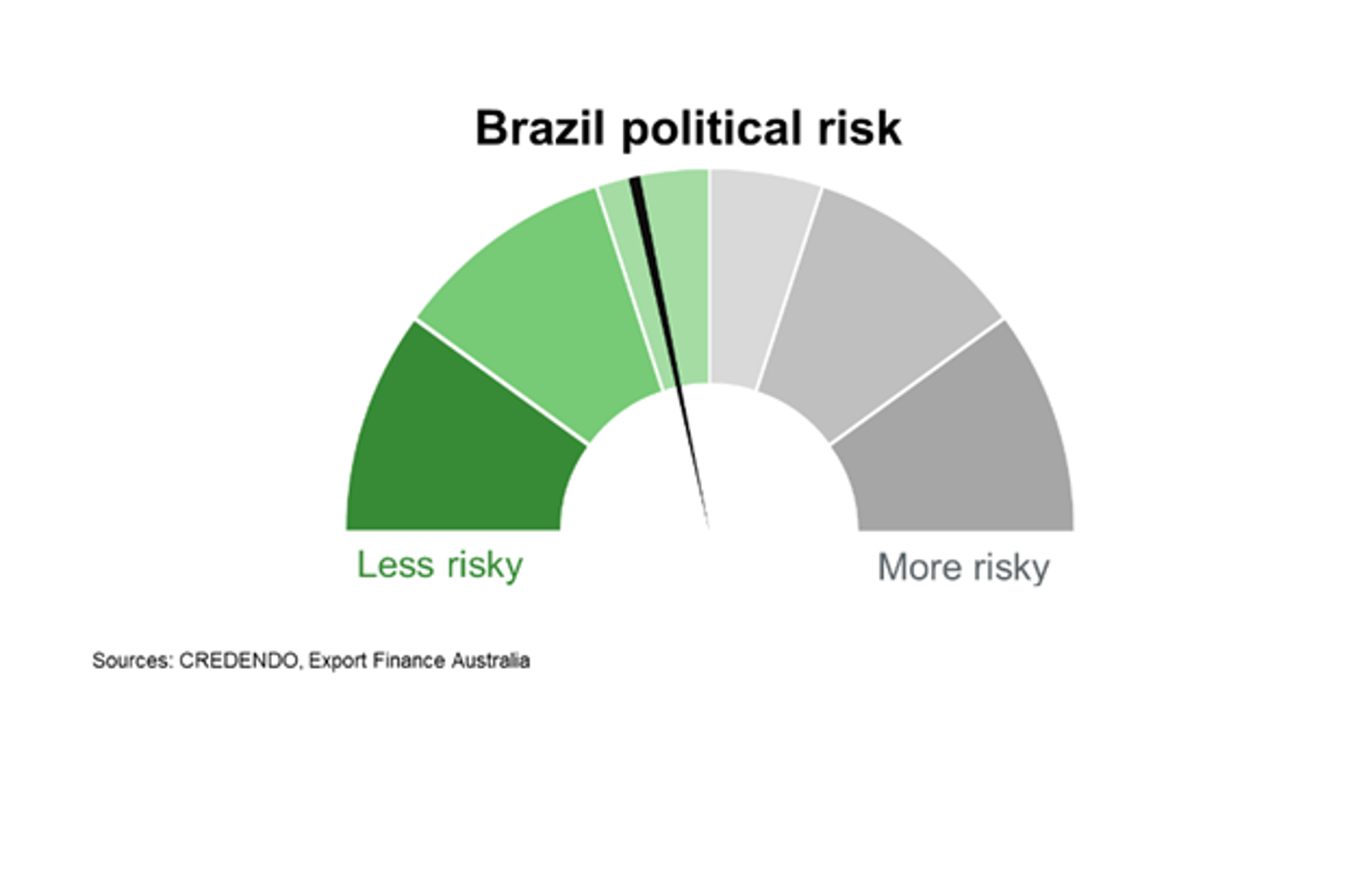

Country risk in Brazil is moderate to high. The OECD rating is 5, indicating a moderate to high probability the country will be unable or unwilling to meet its external debt obligations. Over the past five years, political tensions, tepid economic performance and growing risks to fiscal sustainability have resulted in sovereign credit rating downgrades into sub-investment grade territory.

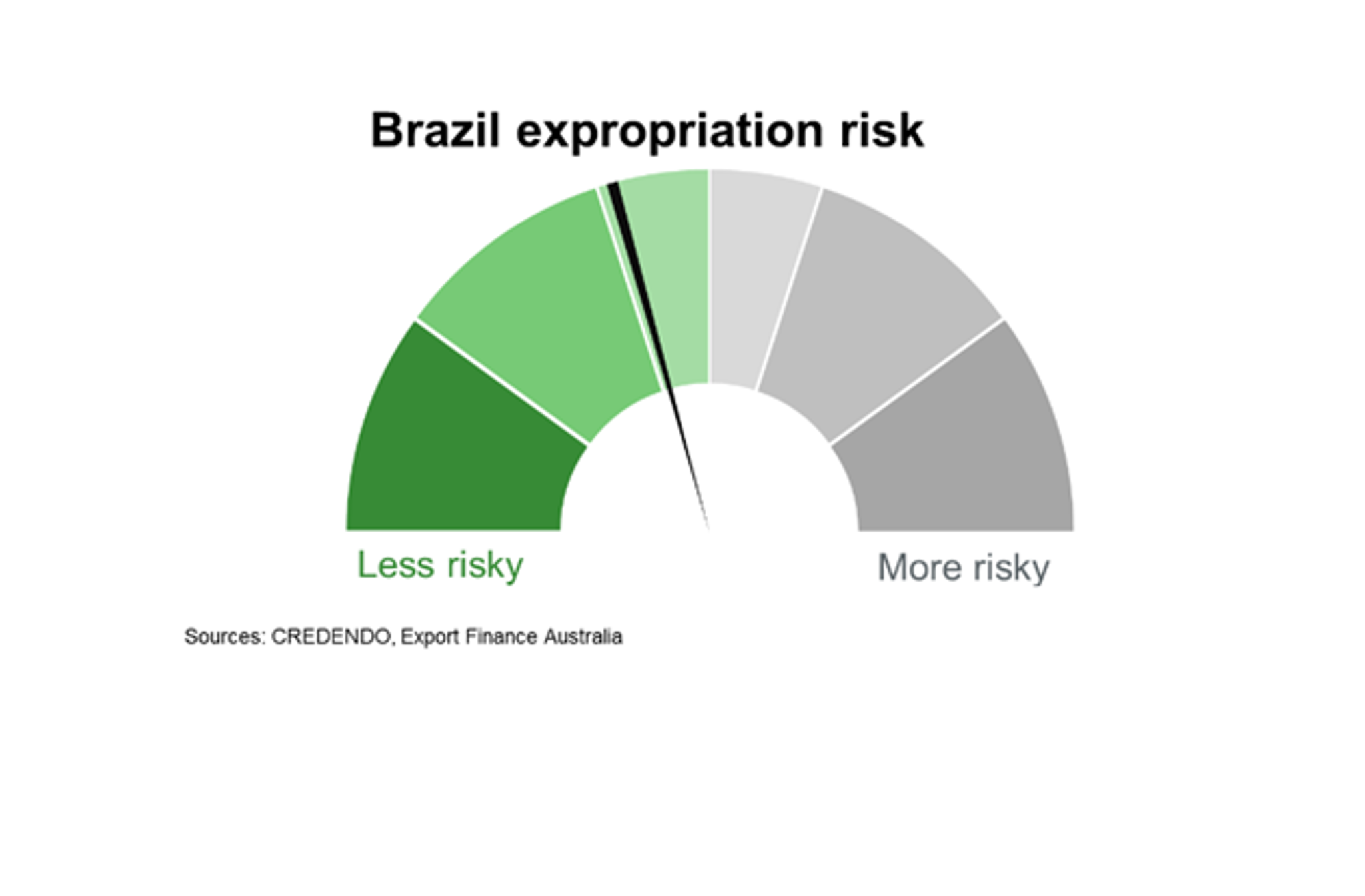

Brazil has a low to moderate risk of expropriation, as no major expropriation actions have taken place against foreign investors in recent years.

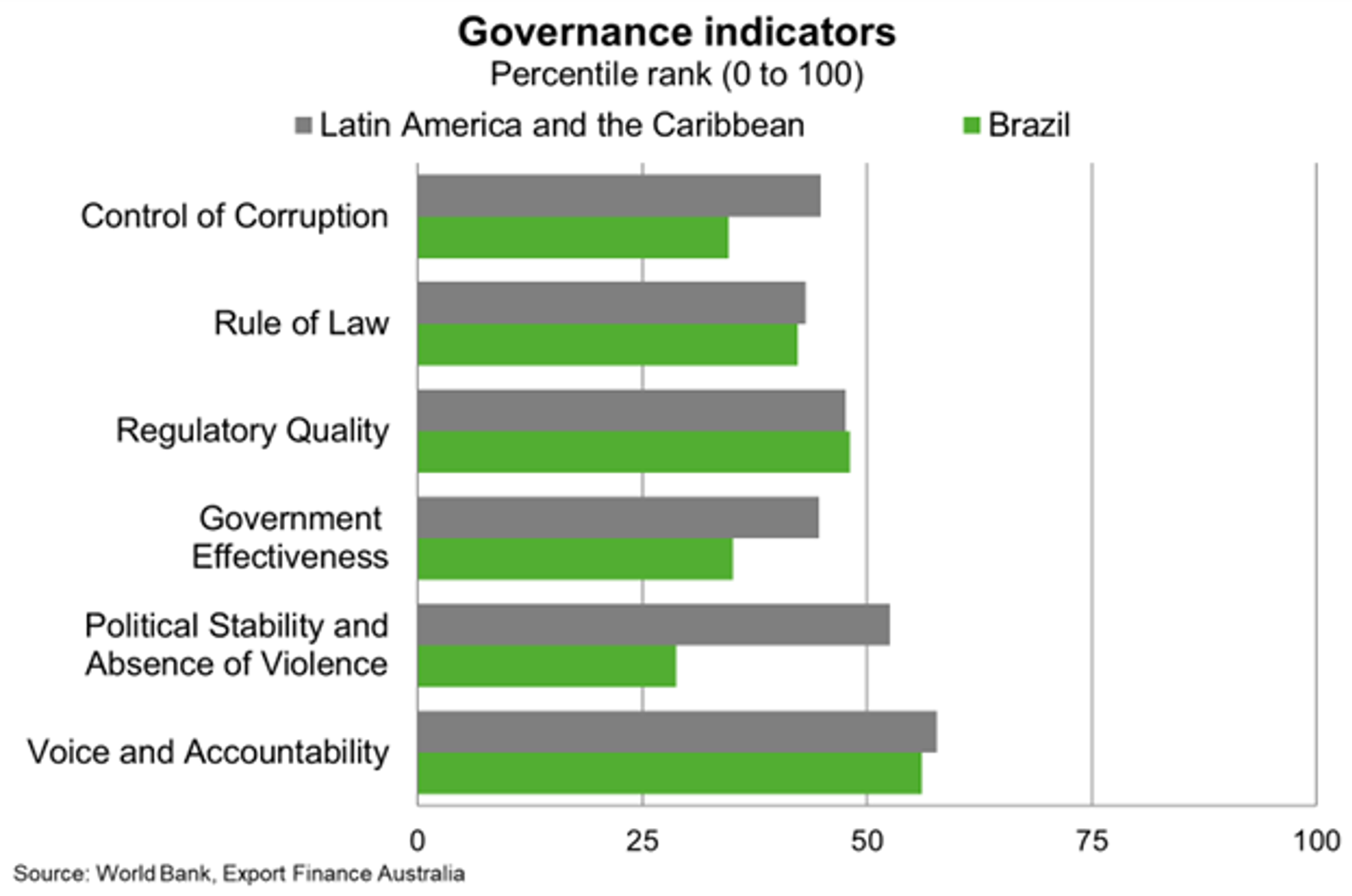

Brazil’s governance indicators are largely in line with the Latin American average. The notable exceptions are lower scores on political stability/absence of violence and government effectiveness.

Political and social risks are on the rise, as new President Luiz Inacio Lula da Silva takes over from Jair Bolsonaro. Economic policies under Lula are likely to be more state-driven, including higher social spending plans. But implementing policies will be challenging amid a legislative minority, weak economic outlook and strained public finances, raising risks to governability and political stability. Recent protests and demonstrations in Brasilia further underscore rising political stability and violence risks.

Bilateral Relations

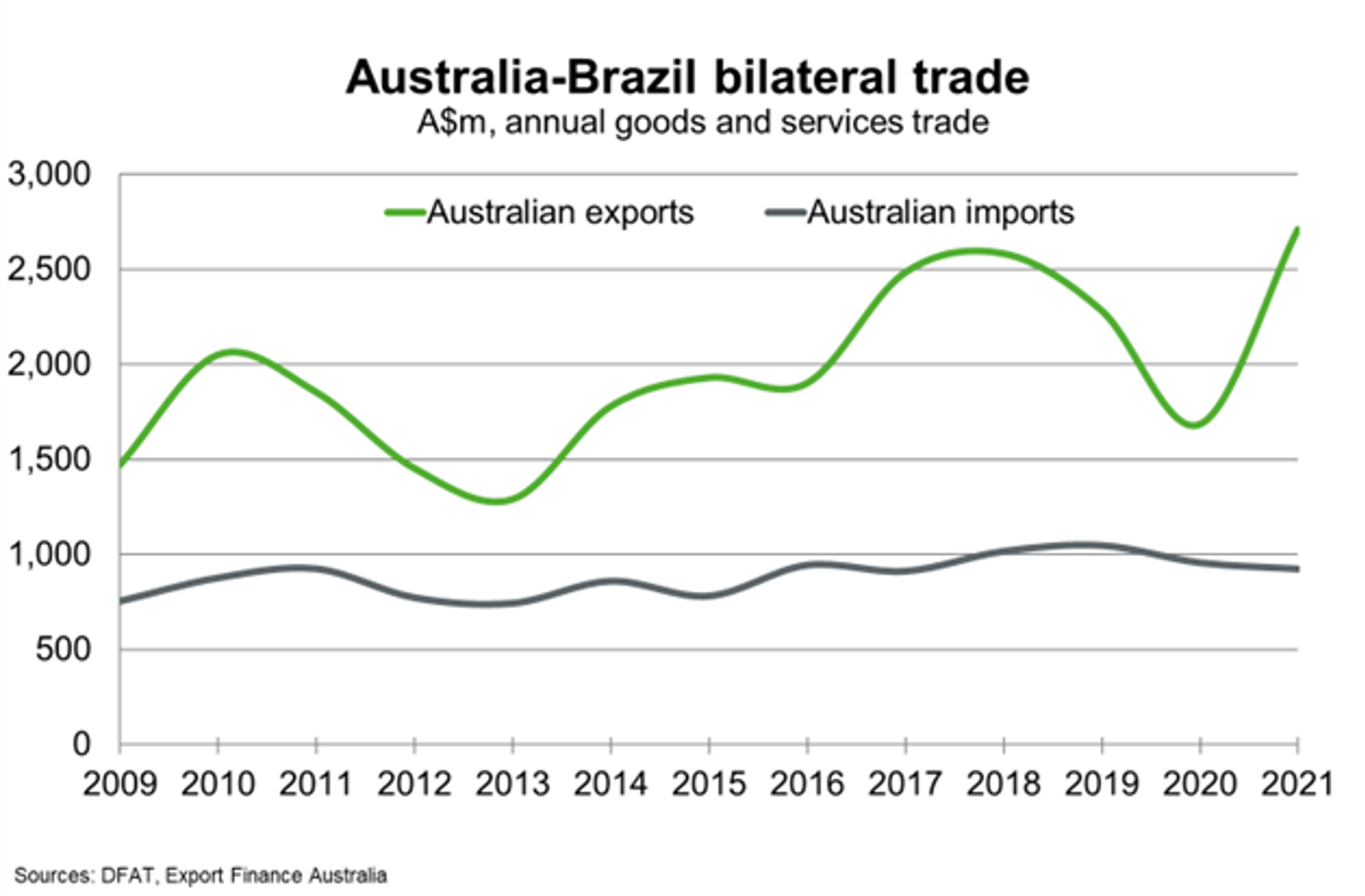

Brazil was Australia’s 28th largest trading partner in 2021, and largest export market in Latin America by a significant margin. Total goods and services trade amounted to $3.6 billion in 2021, or 0.4% of Australia’s trade portfolio. Major Australian exports included coal (about half of all goods exports in 2021) and education-related travel. Major Australian imports from Brazil in 2021 included civil engineering machinery and parts, medicine and coffee.

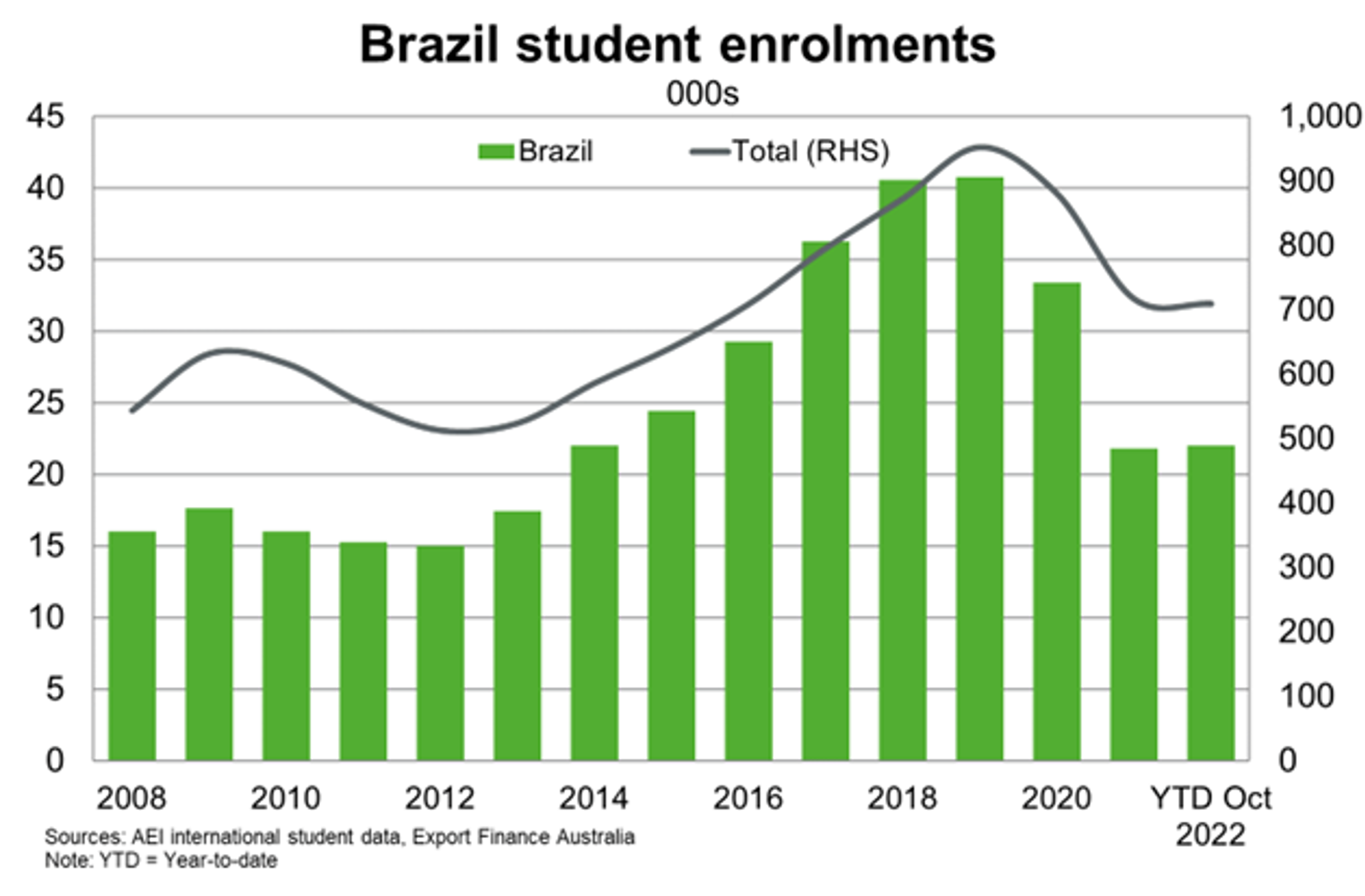

After reaching more than 40,000 in 2019, Brazilian student enrolments in Australia fell to about 33,000 in 2020 and 21,000 in 2021. Despite lower enrolments, Brazil remained the sixth largest source of international students in Australia in 2021. Brazil enrolments recovered only slightly to 22,000 in October 2022, remaining well below pre-pandemic levels. To promote enrolments in Australian universities moving forward, Australia’s top eight universities (Group of 8) have agreements with universities and research organisations in Brazil.

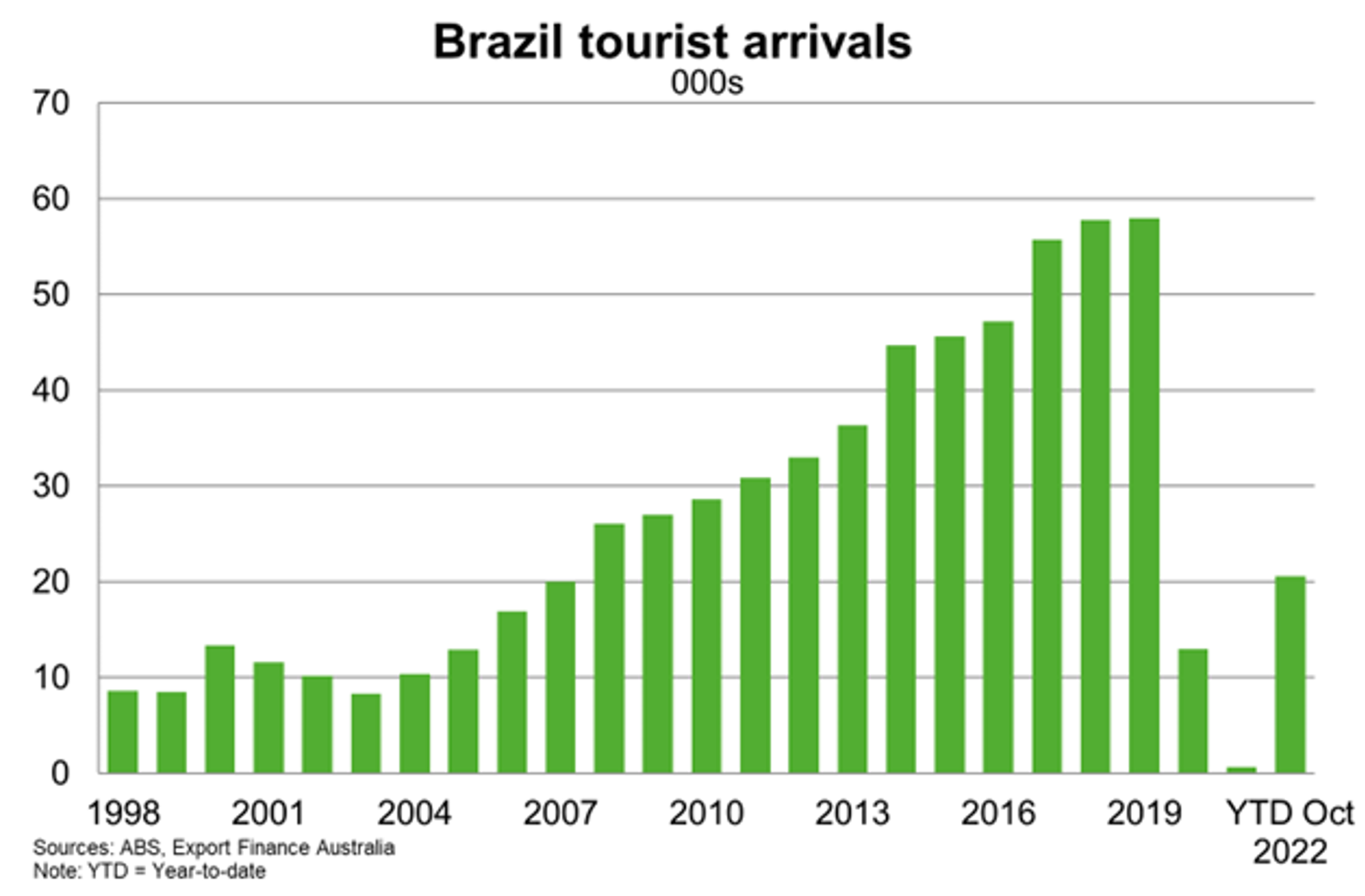

Tourism arrivals are recovering, after the COVID-19 pandemic and associated international travel restrictions hurt tourism significantly in 2020 and 2021. Brazilian tourism arrivals into Australia rebounded to 20,000 year-to-date in October 2022 from 650 in 2021 and 13,000 in 2020. Another year of open international borders and pent-up demand for travel should support further recovery in tourism, and broader services exports, in 2023.

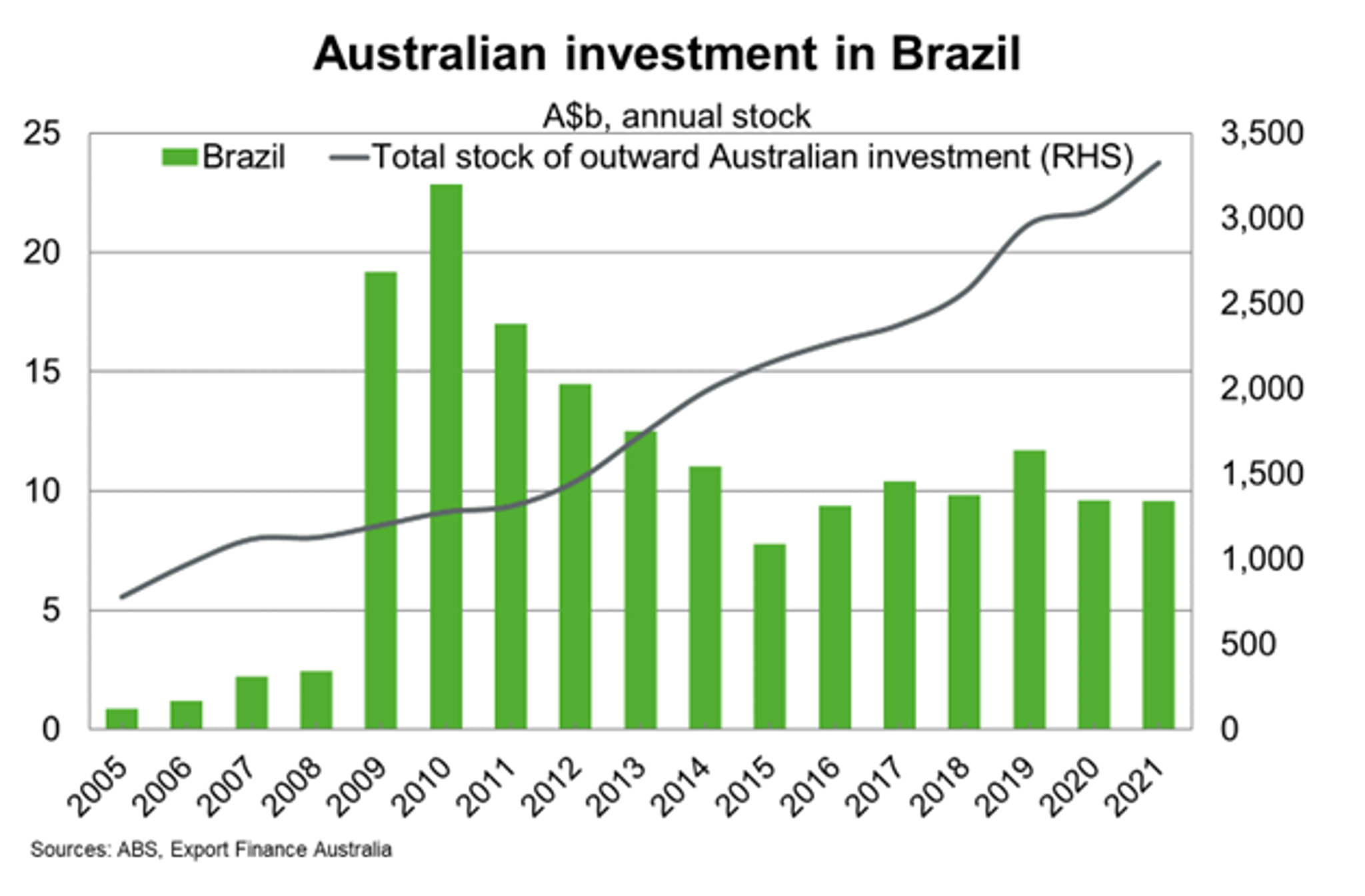

Most of Australia’s foreign direct investment in Latin America goes to Brazil. More than 75 Australian companies operate in Brazil in a wide range of sectors, including advanced manufacturing (Amcor), agribusiness (Macquarie), engineering services (Worley), financial services (Macquarie) mining (BHP Billiton), plasma products and vaccines (CSL), and retail clothing (Cotton On, Billabong, Rip Curl), among others.

Brazil’s growing infrastructure needs, and large mining and agricultural industries present investment opportunities for Australian firms. Opportunities for Australian investment includes transportation, financial and insurance services and waste management sectors

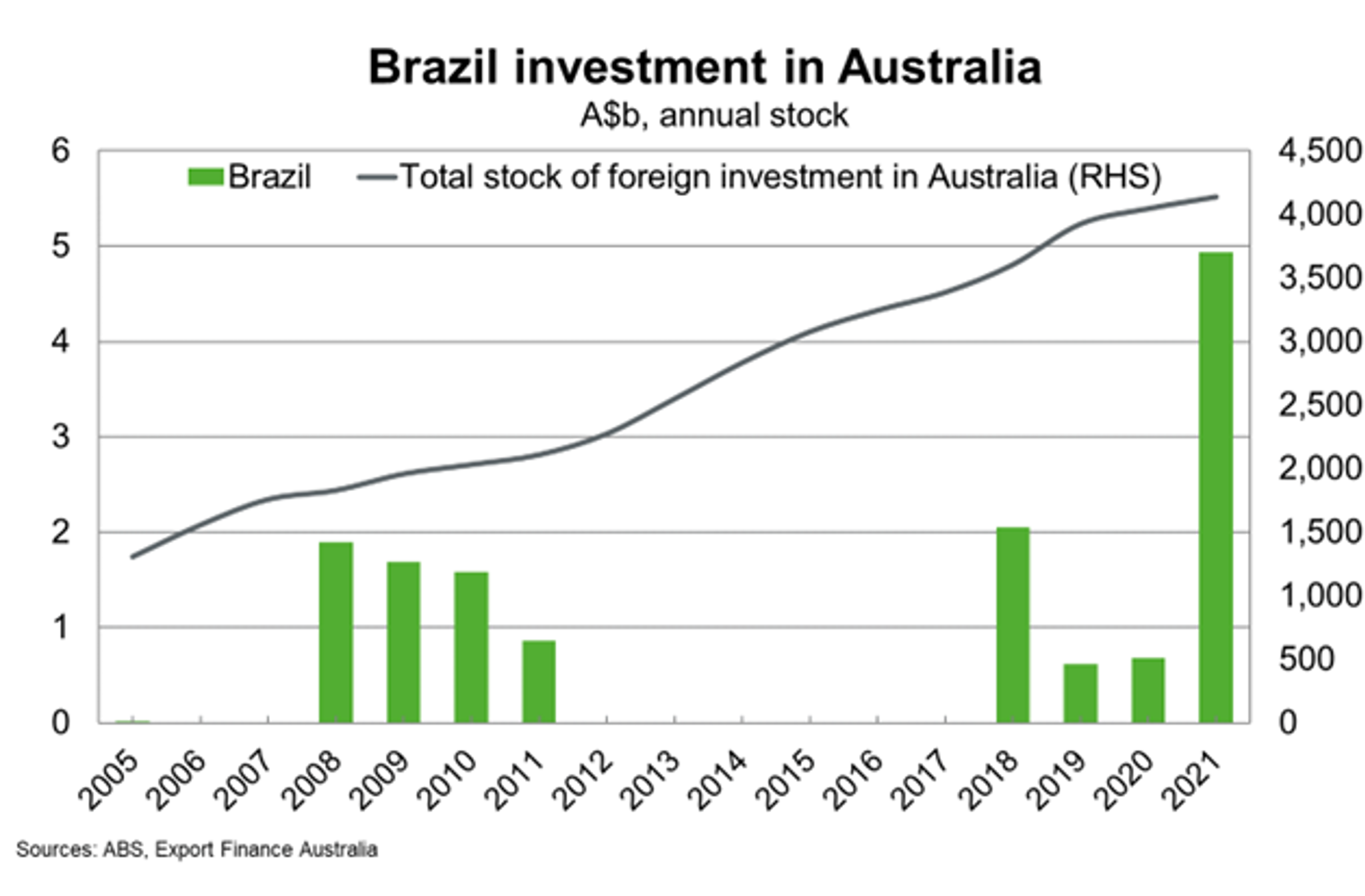

Brazilian companies continue to expand operations and invest in Australia, in part to benefit from Australia’s extensive free-trade network in Asia. For example, Minerva Foods and JBS Foods are two Brazilian meat processing companies increasing investment in manufacturing processes and facilities in Western Australia and Queensland. Continued deregulation in Brazil provides opportunities for Australian exporters of financial, agricultural, and medical technologies.

Useful Links

Department of Foreign Affairs and Trade

Austrade