Korea—Softer growth poses risks to agricultural exporters

South Korea’s economy recorded its sharpest contraction since the global financial crisis, with GDP dropping 0.3% between the first quarter of 2019 and last quarter of 2018. Uncertainty from growing global trade tensions, softer Chinese growth and a downturn in the tech sector have weighed heavily on investment spending—which fell 10.8%. Reports suggest that large manufacturers refrained from adding additional capacity as global demand for semiconductors remains weak.

The stabilising Chinese economy and firming global demand expected later this year bode well for Korea. But uncertainty from trade wars and a struggling labour market—the unemployment rate hit a nine-year high in January—will constrain domestic spending.

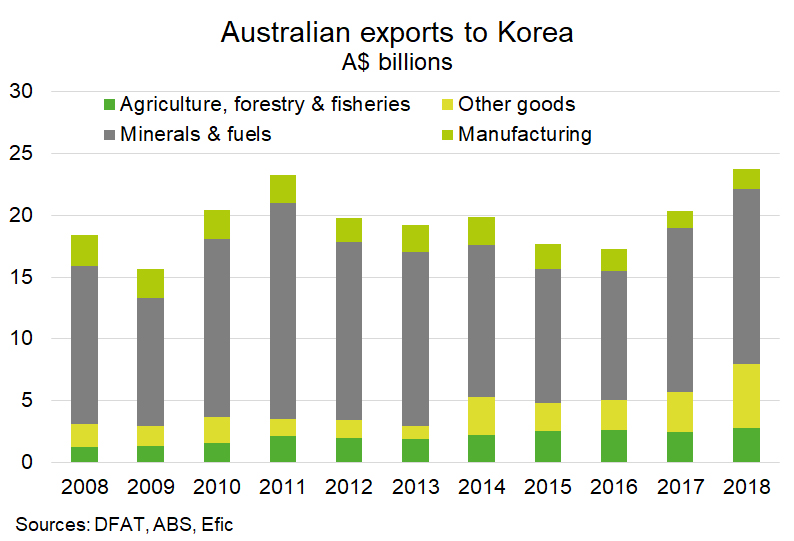

Korea is Australia’s third largest export market, after China and Japan. The lion’s share of Australia’s export receipts has traditionally consisted of coal and iron ore—47% of total exports in 2018 (Chart). Agricultural exports (12% of total exports) have grown 8% p.a. over the last decade, driven largely by higher demand for meat and wheat. Korea is Australia’s third largest market for beef exports (A$1.4 billion in 2018) and fourth largest for wheat (A$341 million). But the softer Korean economy, and in particular weaker household spending, could reduce the demand for Aussie agricultural goods.