Emerging markets—US fiscal stimulus could boost export opportunities

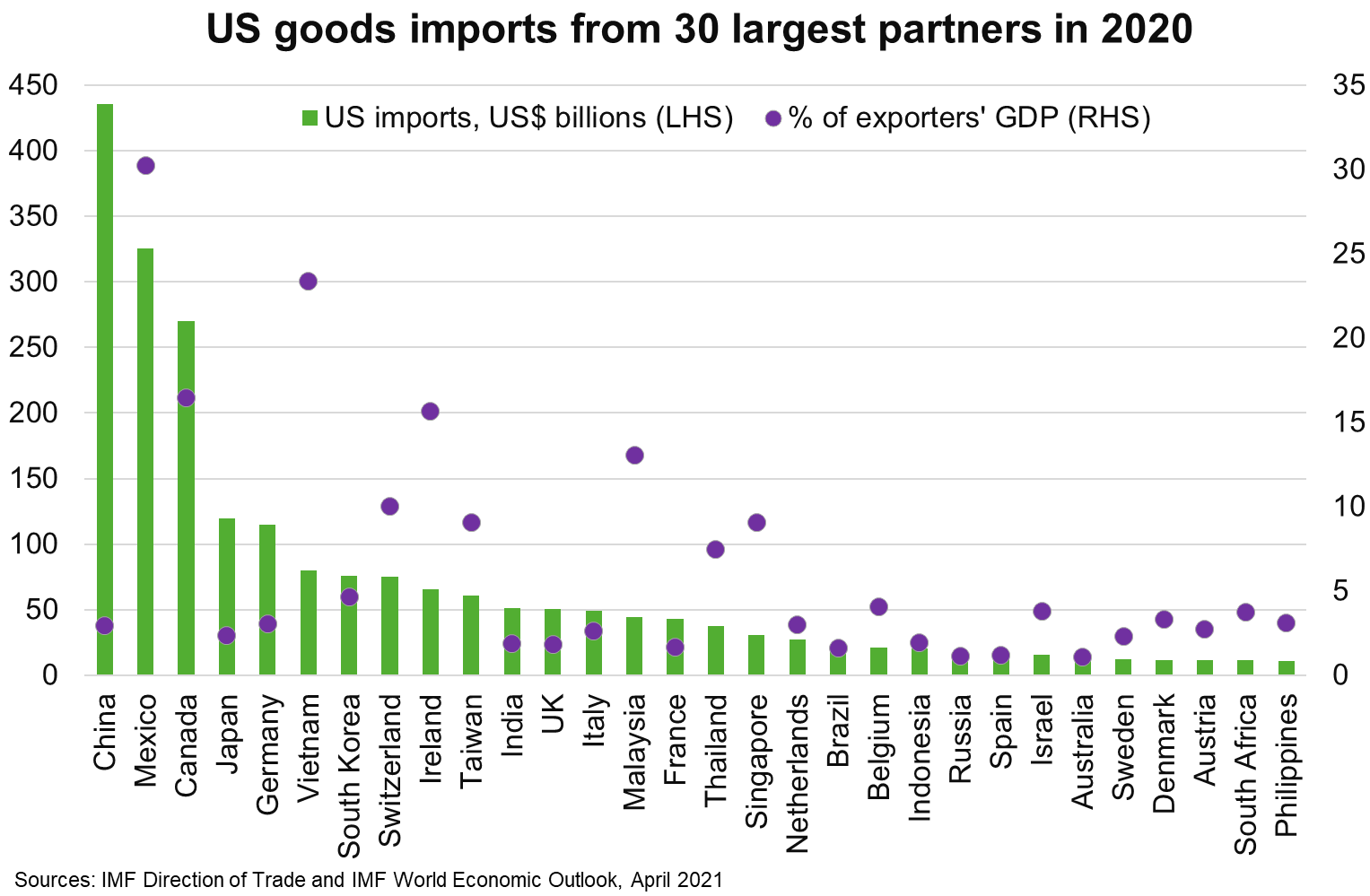

Rapid vaccine rollout, accommodative monetary policy and the passage of several large fiscal stimulus packages bolster the US economic outlook. President Biden’s US$1.9 trillion relief package passed in March provides US$1,400 stimulus cheques and increases unemployment insurance, among other measures. The newly announced US$2.3 trillion infrastructure plan, subject to Congress approval, would support producers of autos, semiconductors, fiber-optics, renewable-energy, pharmaceuticals and construction firms. Export-oriented emerging markets, particularly in Asia and Latin America, and some advanced economies, should benefit from stronger US import demand (Chart). Firms entrenched in US supply chains also stand to gain.

The boost to US incomes and consumption should further lift demand for Chinese electronics, telecommunications, household equipment and textiles; Chinese exports to the US rose 61% year-on-year in yuan terms in the first quarter of 2021. Exports of electronics and machinery from Japan, Korea, Germany and Taiwan are also likely to grow. Vietnamese exporters of textiles and computers and telecommunications equipment are likely to benefit, along with electronics exporters in Malaysia. Stronger US investment in infrastructure bolsters prospects for auto exports from Japan, while higher demand for commodities should lift exports from Brazil, Indonesia, Canada and Australia. Large US stimulus that strengthens the US recovery and also lifts emerging markets (that take the bulk of Australian exports) is broadly positive for Australian exporters.

That said, the overall boost to emerging markets could be limited by US efforts to increase purchases of American made products, something which President Biden shows an intention to pursue. Moreover, if stronger US growth prompts US interest rates to rise faster than markets expect, emerging markets could experience sharp capital outflows. As seen during the 2013 taper tantrum, that could challenge financial stability in external debt-ladened economies, such as Brazil and Indonesia, and damage economic prospects in emerging markets. That said, continued clear messaging from the US Federal Reserve on its intention not to raise interest rates before 2023 should help to dampen this risk.