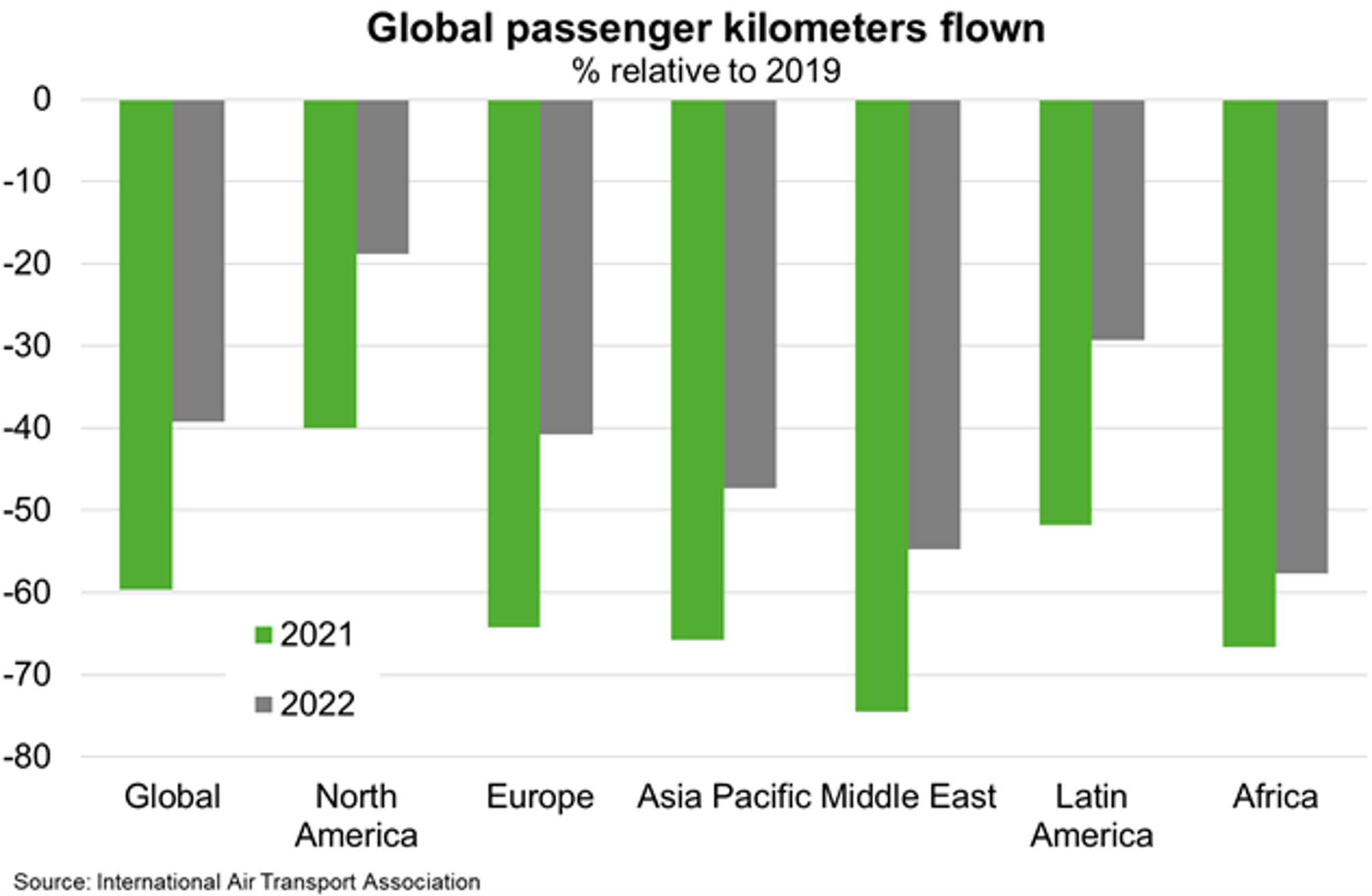

Prospects for continued recovery in global demand supports a robust outlook for goods exporters in 2022. In particular, resources, energy and agricultural exports are predicted to remain strong. The tentative reopening of international travel in late 2021 points to a pick-up in services exports in the coming year, but the tourism and education recovery will remain subdued, with the emergence of the Omicron variant reminding of vulnerability to setbacks. Businesses are confident about export opportunities next year. According to the DHL Export Barometer, 69% of Australian exporters anticipate an increase in orders over the next 12 months, up from 47% in 2020 as customer demand grows. Ongoing recovery in major export markets supports this view.

Stronger energy and base metals exports, as iron ore softens

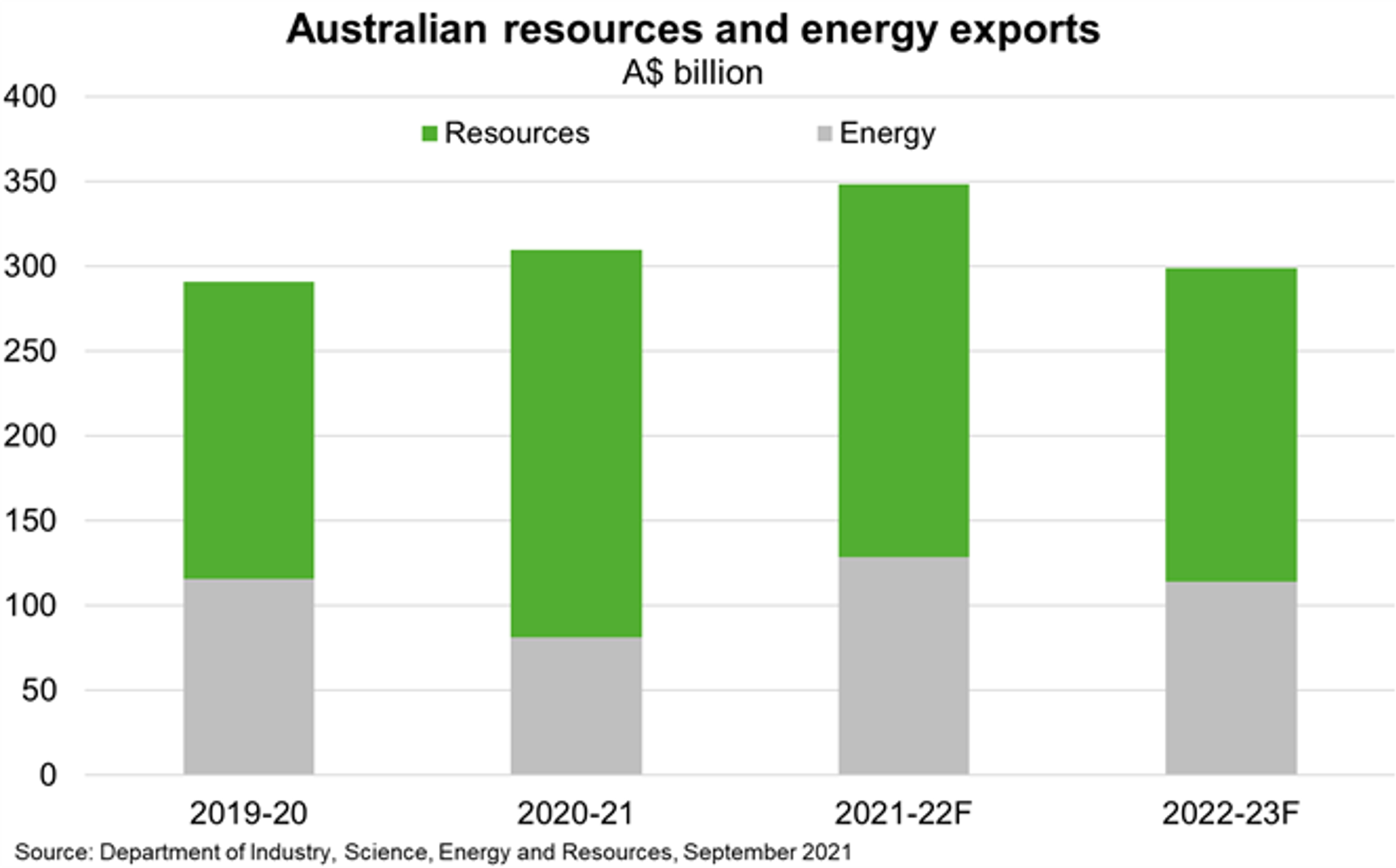

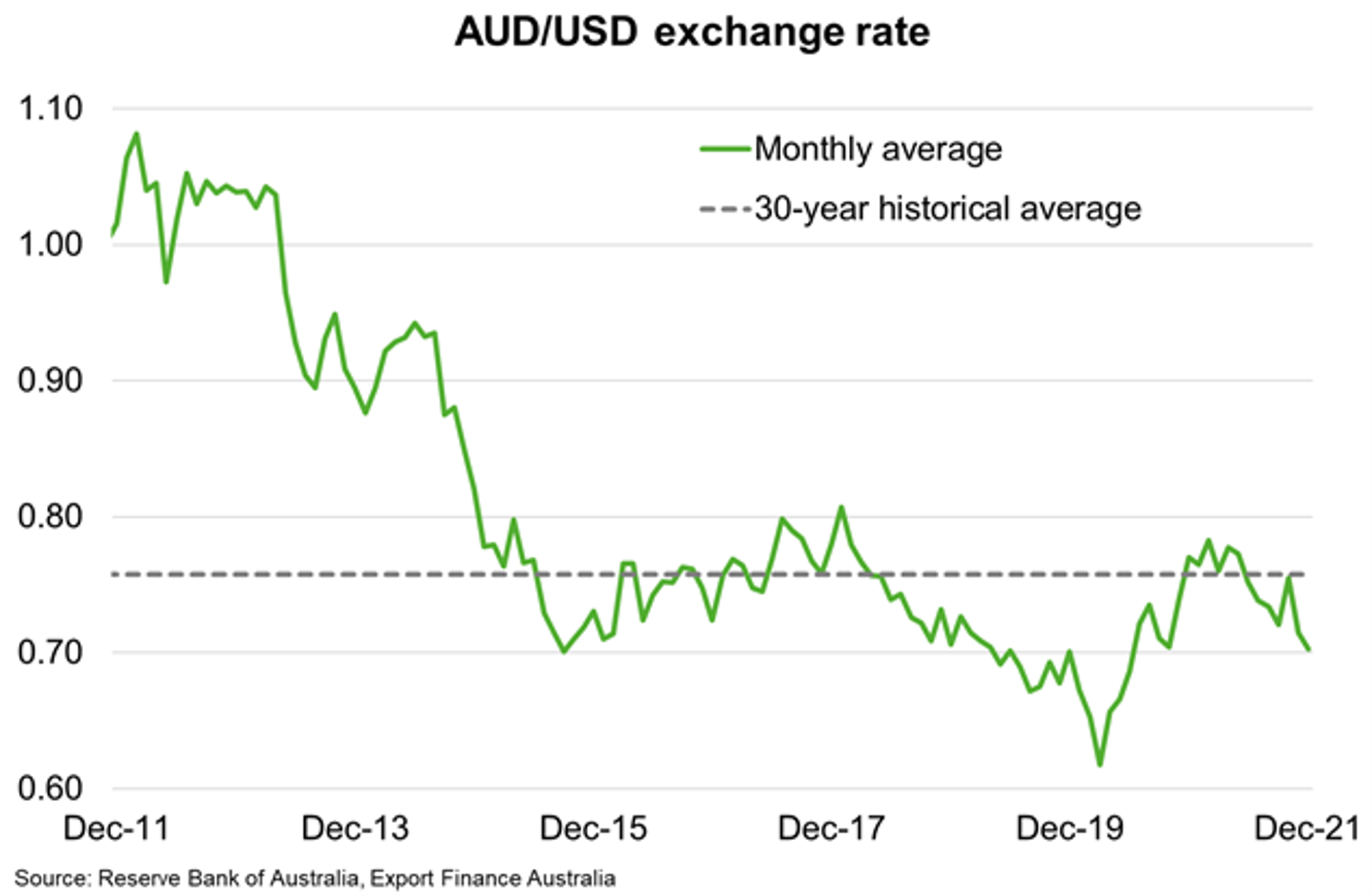

Australia’s resources and energy exports are forecast to rise 13% to a record $349 billion in 2021-22, driven by a stronger outlook for coal, LNG and base metals and a weaker Australian dollar. Some moderation in prices is likely in 2022, as supply rises and demand growth moderates, leading to lower but still high export receipts of around $300 billion in 2022-23 (Chart).