US—Fiscal stimulus to support economic recovery

President Joe Biden proposed a US$1.9 trillion COVID-19 relief package in January (equal to about 10% of US GDP or 1.3 times the size of the Australian economy). The package includes US$1,400 direct payments to individuals (building on US$600 payments provided in the US$900 billion fiscal package enacted in December), funding to speed up vaccine distribution, help for state and local governments to plug budget shortfalls and increases in unemployment insurance payments. Small businesses will receive support from a new grant program, in addition to the existing Paycheck Protection Program. The proposal also includes a phased rise in the minimum wage to US$15 in 2025, from US$7.25 currently.

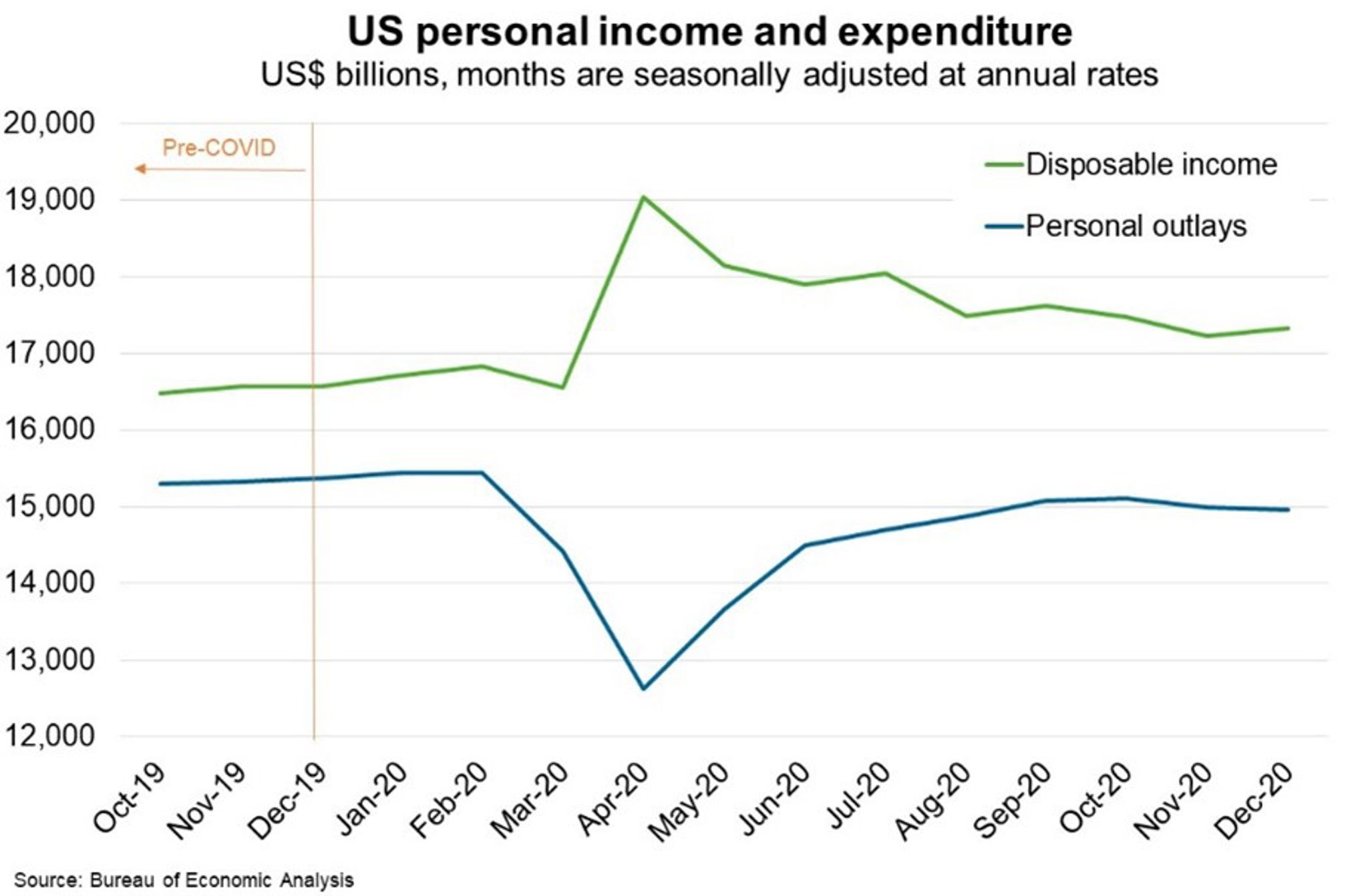

The Brookings Institution estimates the package would raise the level of real GDP by about 4% at the end of 2021 and 2% at the end of 2022, relative to a projection that assumes no additional fiscal support. Treasury Secretary Janet Yellen said the package would help the US return to full employment in 2022, rather than in 2025 under current CBO projections. However, the magnitude of the positive economic impact will depend on the actual size and content of the package that Congress ultimately passes. Prior stimulus helped to mitigate the effects of the COVID-19 shock. In aggregate, household income has been higher during the COVID period, even as employment and household spending temporarily plummeted (Chart).

Further, President Biden will soon announce details of the “Build Back Better Recovery Plan” that aims to boost jobs, increase infrastructure investment, combat climate change and advance racial equality. If passed, this package will support economic growth beyond the pandemic. Additional US stimulus that strengthens the US and world economic recoveries is ultimately positive for Australia. The US is Australia’s fourth largest export partner, taking more than A$27 billion of exports (6% of total exports) in 2019-20.