Low-income countries—IMF support boosts recovery prospects

In late August, the International Monetary Fund (IMF) approved a US$650 billion allocation of Special Drawing Rights (SDRs) to member countries, its largest-ever distribution of monetary reserves. SDRs are international reserve assets that have been created to supplement IMF member countries’ official foreign exchange reserves without adding to debt burdens. This is the first allocation of SDRs since the US$250 billion issued after the 2008-09 global financial crisis.

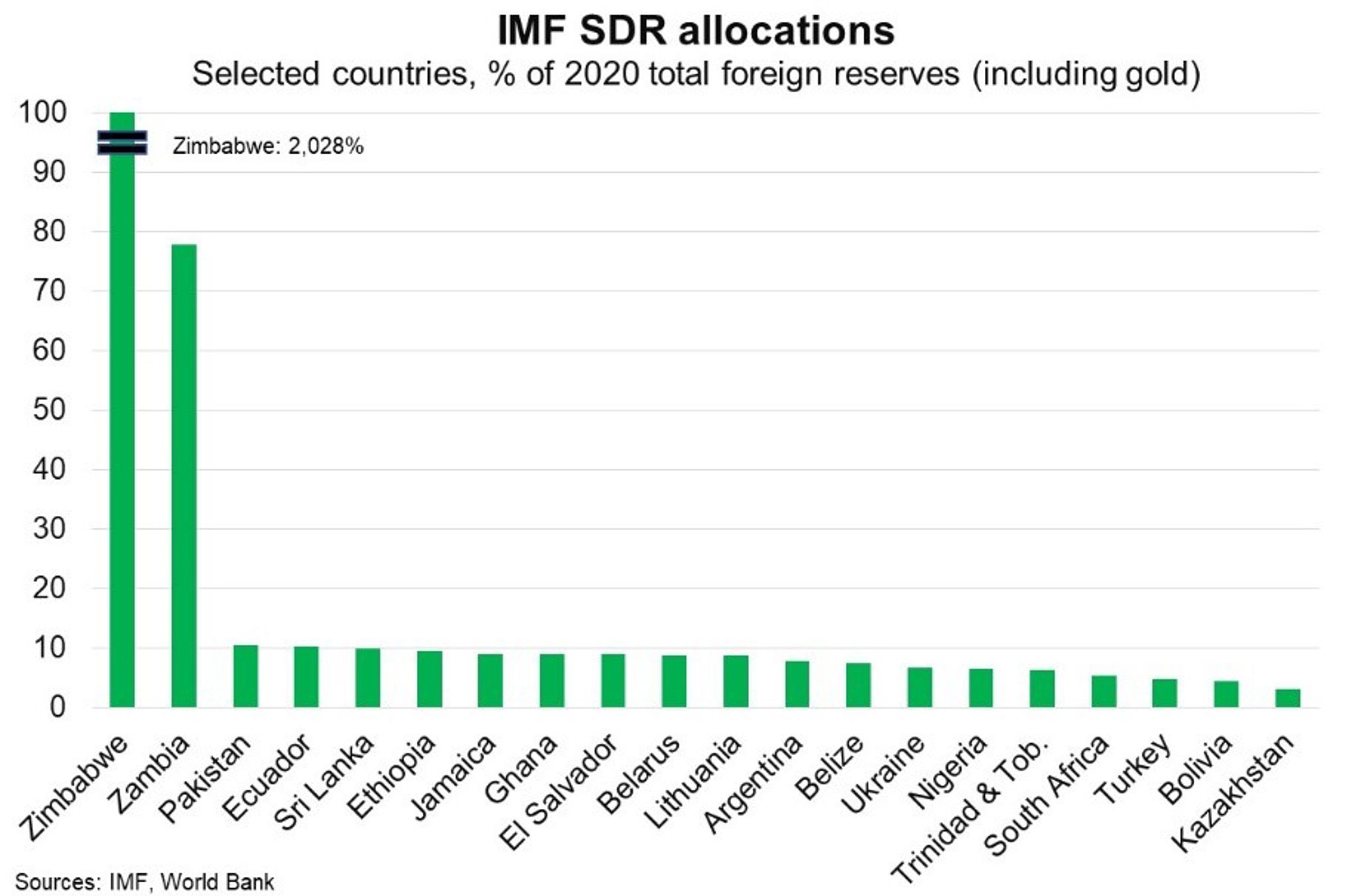

Countries can exchange SDR assets for hard currencies with other IMF members to help meet mounting external debt servicing and pay for imports, including much-needed vaccines to combat COVID-19. Emerging market and developing countries will receive US$274 billion, while low-income countries will receive about US$21 billion (double the amount of assistance these countries got from international institutions in 2020). The direct liquidity boost will particularly benefit Zimbabwe, which could see a twenty-fold increase in foreign reserves, while Zambia’s reserves could roughly double and reserves could rise by about 10% in Pakistan, Ecuador, Sri Lanka and Ethiopia (Chart).

Because the SDR allocation is distributed based on existing capital contributions to the IMF, advanced economies receive the bulk of the funds. For those countries that don’t need the additional financial support, SDRs may be on-lent, reallocated or donated to low-income countries, as part of broader multilateral efforts to address the pandemic. France, for example, has committed to reallocating part of its SDRs to African countries.

In general, rising foreign exchange reserves in all countries—and particularly low-income countries—should provide further support to the global recovery, a positive for Australian exporters.