Asia—World trade slowdown will weigh on export-reliant economies

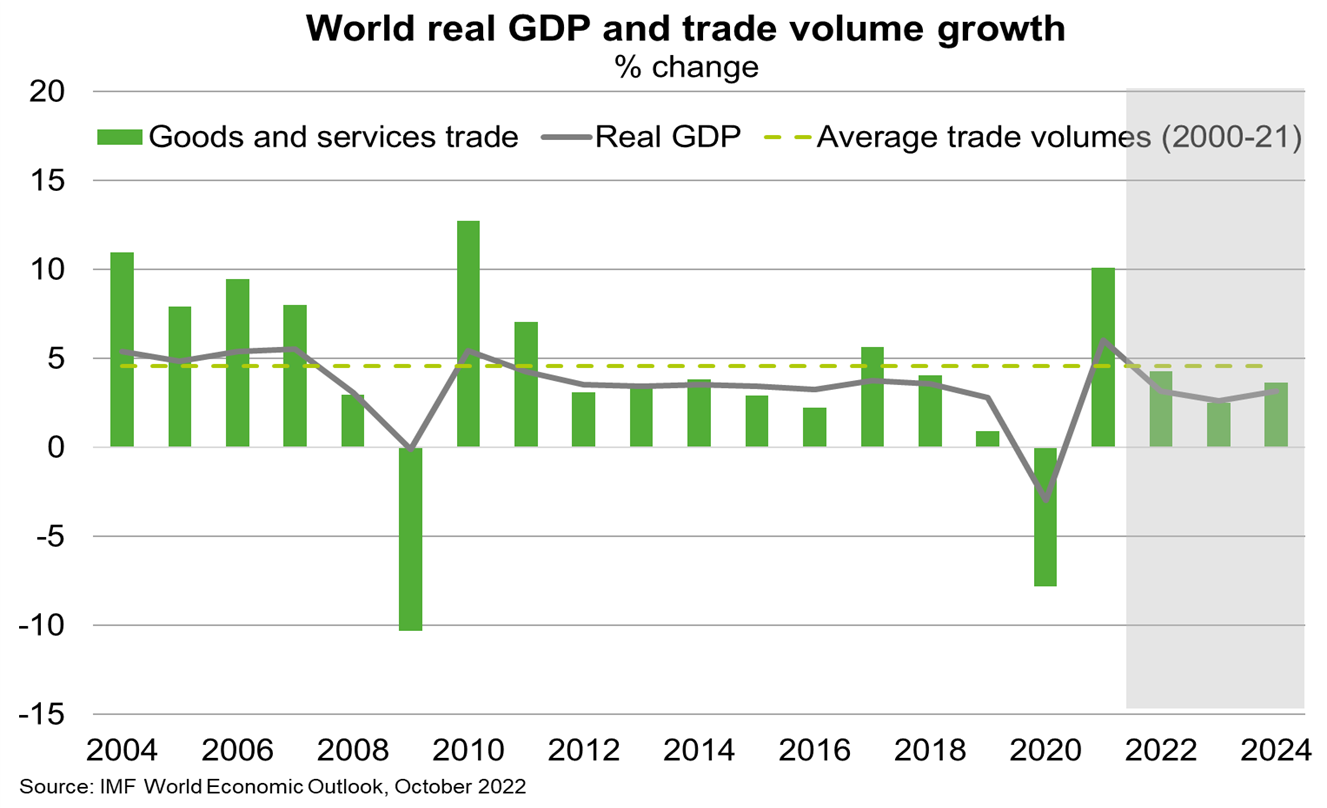

World trade rebounded strongly following the pandemic-induced downturn in 2020, despite multiple supply disruptions. But momentum is now waning. The IMF forecasts trade growth to slow sharply to 2.5% in 2023, revised down from its previous forecast in April of 4.4% and well below the historical average (Chart). If downside risks materialise, world trade could contract next year according to the WTO—for the first time, pandemic aside, since the GFC. Indeed, Chinese exports fell in October from a year ago.

The global trade slowdown is cyclical. Trade generally tracks the GDP cycle, but with bigger swings, and the IMF expects countries accounting for one-third of the global economy to contract this year or next. To this end, cooling US consumer prices provide some relief. However, structural impediments to global trade from geopolitical and environmental risks are rising. Recent economic policies will impact trade and investment in critical minerals and technology; for instance, the US recently announced export controls on advanced semiconductors. Further, consumers, governments and investors increasingly expect companies to take responsibility for the environmental footprint of their supply chains. This is likely to incentivise smaller and shorter supply chains and increased technology uptake that weighs on trade.

Rising trade restrictions and uncertainty are particularly costly for Asia, given its role as a global production hub. About half of all imports in the US and a third in Europe come from Asia.