Emerging Markets—Higher borrowing costs worsen debt vulnerabilities

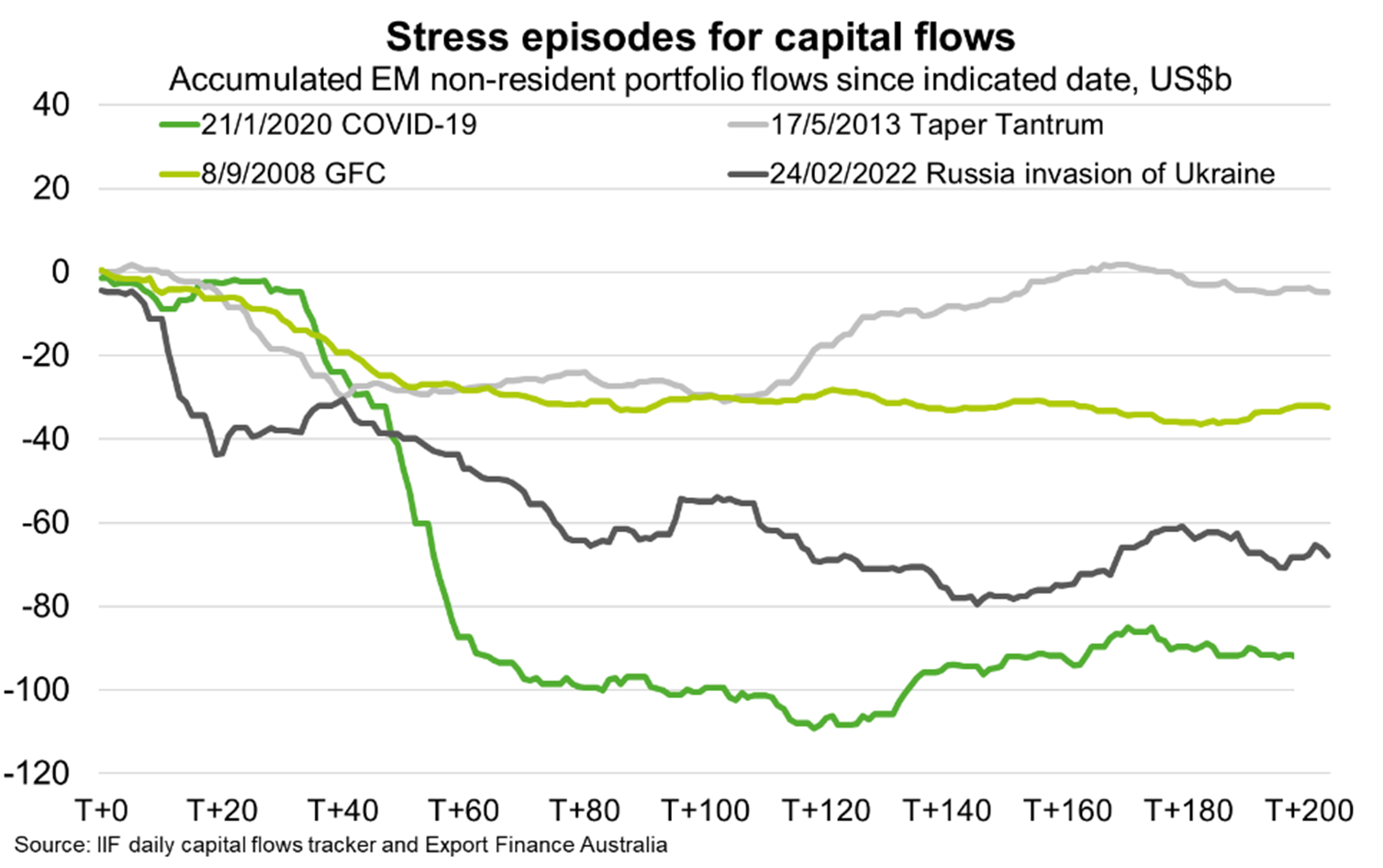

Debt levels in many emerging markets rose sharply during the pandemic, as governments unleashed support measures to protect households and businesses. Emerging markets as a group recorded US$99 billion of debt in June 2022, up almost 30% from end-2019. Accelerated US monetary tightening and geopolitical tensions have since raised concerns of a global recession, while rising US interest rates have made emerging markets less attractive for investors given the US yields on offer. Foreign investors have responded by withdrawing US$68 billion of capital from emerging markets since Russia invaded Ukraine—more than following the 2013 ‘taper tantrum’ and the 2008 global financial crisis (Chart). Higher borrowing costs have been exacerbated by depreciating emerging market currencies. Many emerging markets in Asia, the Middle East and Africa, are running down foreign reserves to defend their currencies and cover surging energy and food import costs. However, when foreign reserves run low, central banks may need to hike interest rates to stem currency depreciation, dragging on economic activity.

Amid these difficult external conditions, in the last month alone in Asia, the IMF has announced a staff level agreement on a US$2.9 billion package for Sri Lanka and approved the disbursement of US$1.1 billion to Pakistan, while the ADB has granted US$100 million in emergency support to Mongolia. The IMF is also considering a request from Bangladesh for balance of payments and budget assistance. Financing support from multilateral development partners will be complemented by fiscal consolidation to ensure debt sustainability. This entails a difficult balancing act for policymakers—while austerity will help safeguard economic prospects in the long term, it may also stoke social unrest in the short term. For instance, the Bangladeshi government’s withdrawal of subsidies saw fuel prices spike 50% in August. Ensuing street protests echoed those seen recently in Indonesia and many other countries already struggling with soaring inflation.