UK—Bleakest outlook among G7 countries reflects structural problems

The IMF expects the UK will be the only major advanced economy to shrink (-0.6%) this year. The 0.9 percentage point downward revision from forecasts made in October suggest even Russia will outperform the UK in 2023. The Bank of England also expects a prolonged recession to begin in the current quarter and last until the first quarter of 2024. UK output is forecast to be smaller in early 2026 than its pre-pandemic level.

The bleak outlook reflects tighter fiscal policy and financial conditions, but also structural problems. First, still-high retail energy prices are weighing on household budgets given the UK’s dependence on natural gas and higher pass through of costs to final consumers. Second, a high share of variable rate mortgages makes households particularly sensitive to interest rates, which have increased from 0.1% to 4% since December 2021, amid very high inflation (10.5% y/y in December). Third, labour market inactivity remains materially higher than prior to the pandemic, reflecting early retirement and the health impacts of COVID-19. Indeed, half a million workers have left the workforce since the onset of the pandemic due to long term sickness.

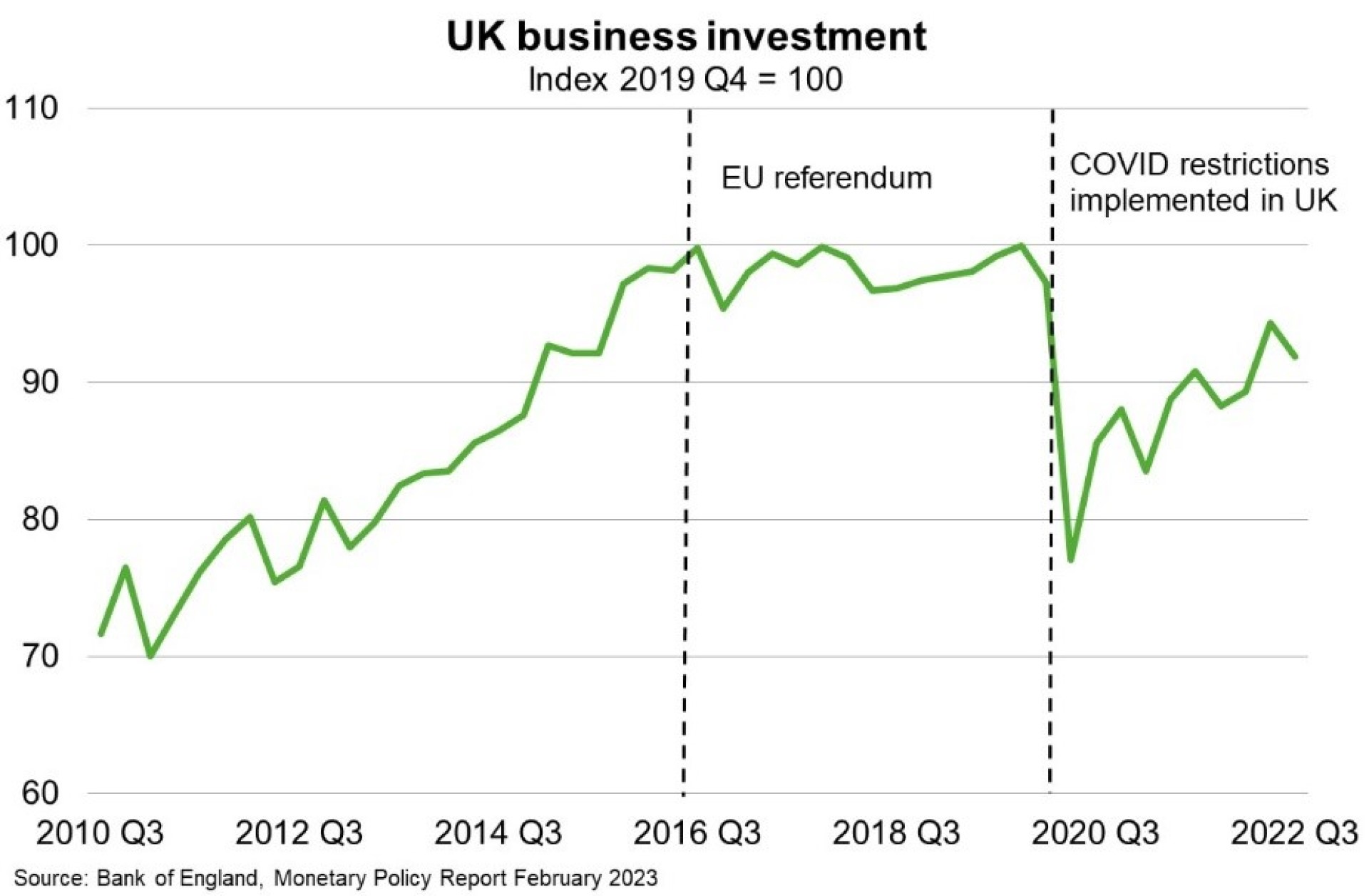

Last, by-products of Brexit—increased barriers to trade with the EU and subdued business investment— weigh on productivity. According to the UK Office for Budget Responsibility, Brexit will result in the UK’s ‘trade intensity’ (i.e. integration with the world economy) being 15% lower in the long run, and saw the UK miss out on much of the recovery in global trade that followed the lifting of COVID-19 restrictions. Moreover, capital spending growth stalled after the 2016 referendum, with economic uncertainty associated with the pandemic and the energy crisis also weighing on business investment more recently (Chart).