Australia—Travel recovery drives services exports to pre-COVID levels

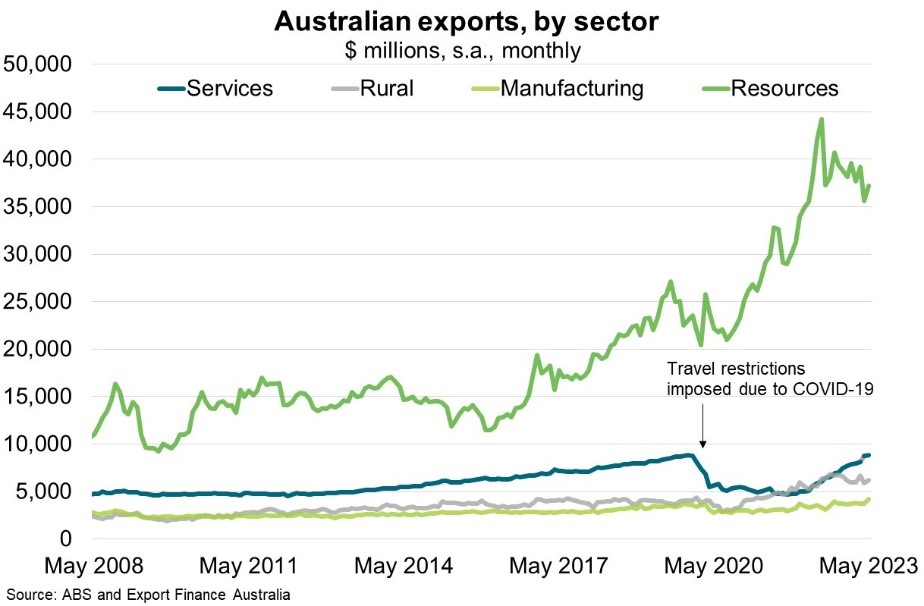

While Australia removed border restrictions for vaccinated persons in February 2022, services have since underperformed other exports sectors. However, recent data suggests services exports exceeded pre-pandemic levels to hit a record $8.9 billion in May (Chart), driven by the recovery of international travel (to $5.5 billion).

Short term overseas visitor arrivals were still just 77% of pre-pandemic levels in May, suggesting each visitor spent more. Indeed, the recovery has been particularly strong for travellers coming for work, and thus likely stay longer, in Australia. Almost 120,000 short term visitors arrived for work in the first five months of 2023, compared to 96,000 in the same period in 2019. Outperformance of short term visitors seeking employment should help to ease labour shortages plaguing Australian exporters. Meanwhile, short term visits to family and friends were 96% of pre-pandemic levels, while holidaymakers and international students lagged at 61% and 69% respectively. The recovery has also been uneven across markets. In particular, just 5% of short term visitors were from China in the three months to May, compared to 15% during the same period in 2019, despite Beijing easing travel restrictions at end-2022.

During the pandemic, from March 2020 to May 2023, an estimated $99 billion in Australian travel exports (roughly 4.4% of GDP) have been lost. However, despite economic headwinds in China and the still fragile global economic upturn, the travel export outlook is supported by buoyant pent-up demand, tight labour markets and a global stock of excess savings. Indeed, the International Air Transport Association (IATA) forecasts global ‘revenue passenger kilometres’ to reach 88% of the 2019 level in 2023. IATA’s May passenger polling data supports this optimistic outlook; 41% of travellers said they expect to travel more in the next 12 months and a further 49% expect to maintain the same level of travel.