China—Deflation risks highlight weakening economic recovery

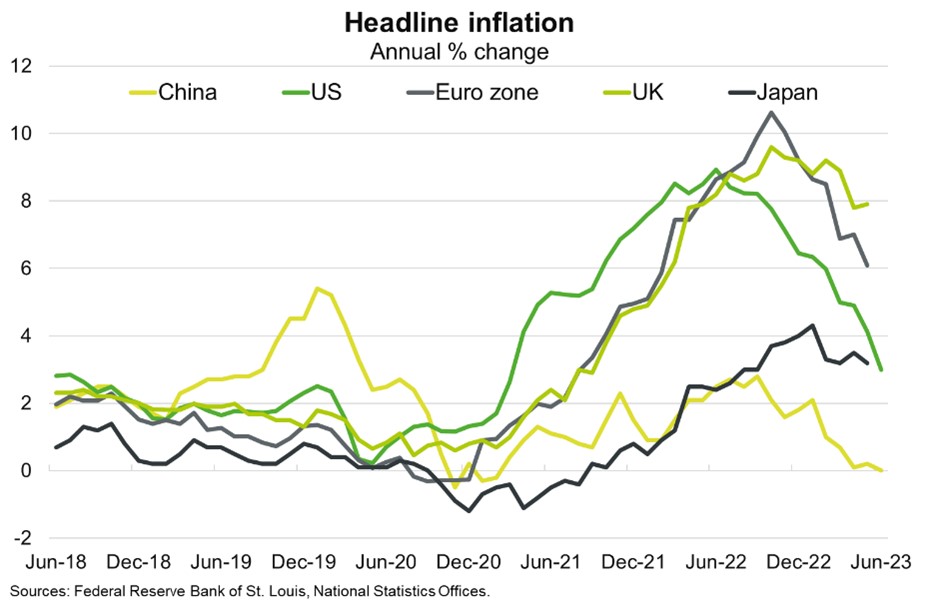

China’s headline consumer price index was flat year on year in June, underscoring weakness in domestic demand, while producer prices fell at the fastest pace in seven years (-5.4%) dampening revenues for manufacturers and potentially curbing investment intentions. In addition to low domestic inflation, China’s export prices fell almost 10% year on year in May, the most in nearly a decade, reducing export receipts. As China teeters on the brink of deflation from weak consumer expenditure and private investment, inflation in other major economies remains well above central bank targets (Chart). China’s continued exports of lower priced goods and RMB deflation could further tame global inflation.

China’s economy grew 0.8% in Q2 compared to the previous three months, much softer than the 2.2% expansion in Q1 following the end of COVID-19 lockdowns. Declining exports (down 12.4% year on year in June), falling property prices, rising unemployment and high corporate debt are challenging Beijing’s 5% GDP growth target for 2023. The threat of deflation adds to calls for additional stimulus measures beyond recent cuts in interest rates, bank liquidity injections, extended tax breaks (for electric vehicle purchases) and increased infrastructure spending. Indeed, at its July Politburo meeting, Chinese authorities pledged to introduce targeted policy measures to support the property sector, consumption and the wider economy.

Chinese growth will slow toward 4% in the coming years, according to IMF forecasts, because of a declining working-age population, falling returns from investment and slowing productivity growth. Slowing momentum in the world’s second-largest economy will further pressure global growth. In particular, weakness in Chinese manufacturing production, exports, investment and consumption are key risks to the prices of Australian commodity exports to China. But even with slower growth, given the size of China’s economy, increasing economic output will create additional opportunities for Australian exporters.