Vietnam—Economic fundamentals sound, despite recent slowdown

The IMF expects Vietnam’s export-driven economy to expand 4.7% in 2023, down from 8% in 2022. The deceleration reflects weaker global demand for consumer goods and fading economic momentum in China. Vietnamese exports fell 12% and imports fell 18% in H1 2023. Domestic challenges include an ongoing property market downturn and balance sheet weaknesses in the corporate, banking and household sectors. Rolling blackouts to cope with record temperatures and a severe drought are also weighing on productivity and consumption. Hanoi and Haiphong, encompassing large industrial zones with many foreign-invested manufacturing operations, have been most affected. Authorities have responded with stimulus measures; the central bank has cut interest rates four times this year and lawmakers have reduced value added tax until end-2023. Indeed, GDP grew 4.1% from a year earlier in Q2, up from 3.3% in Q1. This month Prime Minister Pham Minh Chinh flagged even stronger measures to stimulate demand.

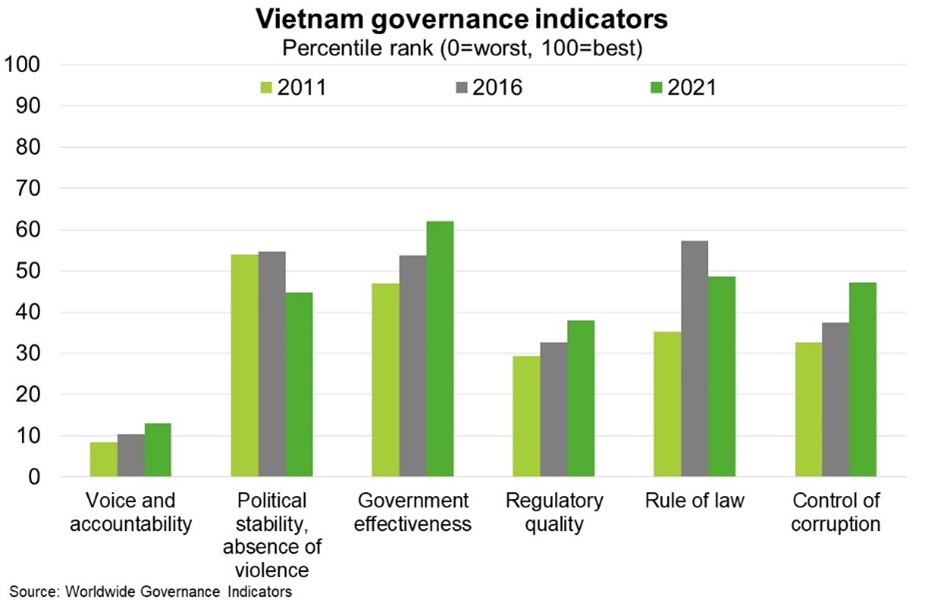

Despite the immediate stresses, Vietnam’s longer term economic prospects remain robust. Foreign direct investment (FDI) increased 13.5% to a record US$22 billion in 2022. While FDI is slightly down in H1 2023, Vietnam will continue to benefit from a growing “China plus one” strategy—whereby geopolitical tensions see manufacturers supplement Chinese production with expansion to other countries. This has been facilitated by a young and increasingly educated and competitive workforce along with improved government effectiveness, regulatory quality and control of corruption (Chart). That said, Vietnam aims to become an upper middle-income country by 2030, which will require accelerated reforms to upgrade critical infrastructure (including power) and ease cumbersome bureaucracy. Structural reforms would support continued strong Australian export growth to Vietnam; already up an annual average 17% over the five years FY2022 (to $13.7 billion, Australia’s ninth largest export market).