Advanced economies—High interest rates increase public debt risks

High interest rates increase public debt risks

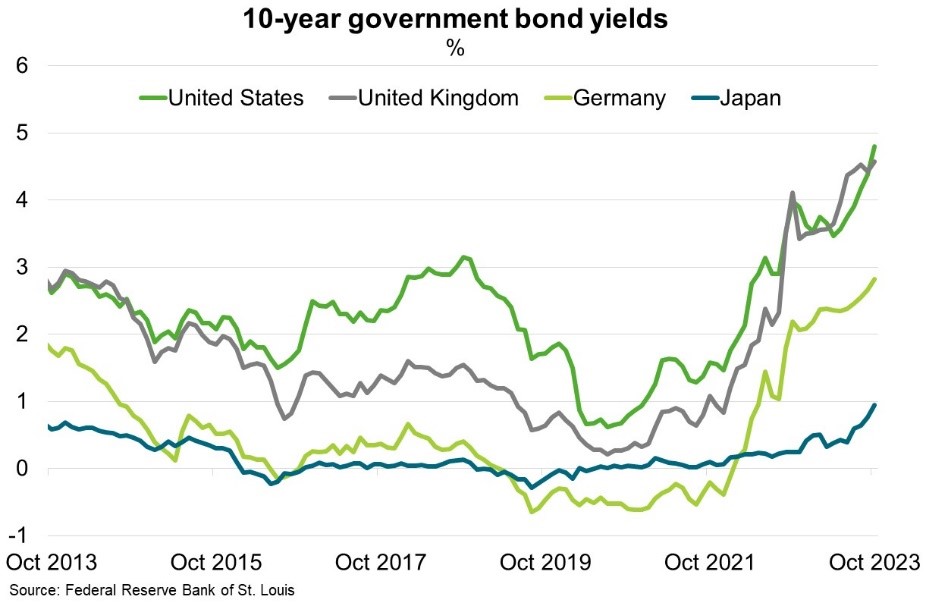

Fiscal pressures are rising amid record public debt, higher for longer interest rates and slowing economic growth. The global debt stock surpassed US$307 trillion in Q3 2023—up US$60 trillion since 2018. The rise in government debt—which hit a peak of US$88 trillion in Q3 2023 (95% of GDP)—has been most evident. Meanwhile, interest rates have jumped on long term government debt. For instance, yields on 10-year US government bonds approached 5% in October, from below 1% in 2021. Germany had to pay nearly 3% to borrow for a decade in October, following negative interest rates in 2021 (Chart).

Debt sustainability depends on interest rate and economic growth dynamics. Because governments issued long term debt when rates were low, the IMF forecasts average GDP growth in advanced economies to continue to exceed interest rates on public debt until 2028. But governments must refinance eventually. While the interest rate outlook is highly contested, 10-year yields now appear above plausible estimates of long run economic growth in most advanced economies.

Public spending cuts may therefore be required to avoid higher debt. Budget deficits remain large in many advanced economies. Indeed, Moody’s recently lowered the outlook on its US AAA credit rating to ‘negative’, citing large deficits and rising debt service costs, following Fitch’s downgrade of the US sovereign in August. More broadly, S&P estimates the annual interest bill for G7 countries will rise to US$1.5 trillion by 2026, from US$905 billion in 2018. Other demands on government budgets are also mounting—amid ageing populations and the need to finance the green transition, defence capabilities and industrial resilience. The IMF warns that in a shock-prone world, few countries will have the fiscal space to support their economies.