US—Exceptional economic performance faces increasing headwinds

The United States has achieved the strongest recovery among major economies, with the level of GDP in 2023 forecast to exceed its pre-pandemic path. Meanwhile, advanced economies are expected to be 1.0% smaller this year than forecast prior to COVID-19, with the world economy faring even worse.

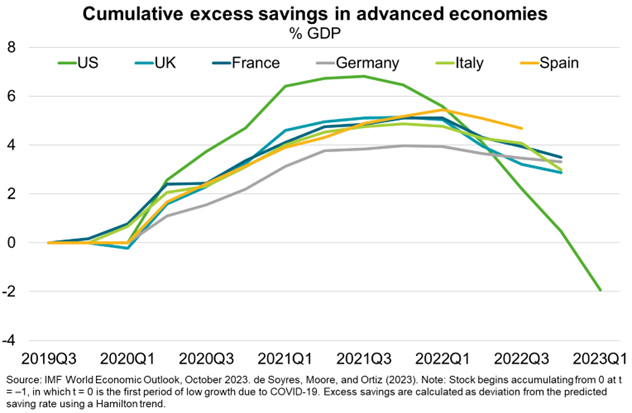

GDP growth forecasts for 2023 from the Federal Open Market Committee (FOMC) were upgraded to 2.1% in September, from 1.0% in June. Better than expected economic performance has been fuelled by strong private consumption, despite a manufacturing slowdown. This reflects a) large fiscal stimulus during the pandemic and households spending the associated savings faster (Chart), b) better insulation from higher energy prices following Russia’s invasion of Ukraine, and c) a historically tight labour market, which has supported household confidence and disposable incomes.

However, the FOMC forecasts GDP growth to slow to 1.5% in 2024, as still-high prices and higher interest rates (up 525 basis points since March 2022 to an upper limit of 5.5%) start to weigh more heavily on consumer spending. While the September median interest rate projection for 2023 was constant at 5.6%, the 2024 median rose to 5.1%, up from 4.6% in June, suggesting FOMC officials expect rates to remain higher for longer. In addition, slowing wages growth, declining savings, tighter credit conditions, waning fiscal support for families, and a resumption of student loan payments (which were frozen under a pandemic-era rule) will increasingly drag. Already, there has been an increasing reliance on credit to finance expenditures. Still, the IMF forecasts the US unemployment rate to peak at 4.0% in Q4 2024—lower than previously projected, consistent with updated expectations for a softer landing. This bodes well given the US accounted for 25% of the global economy and purchased over $30 billion of Australian exports last year.