Australia—Easing supply chain pressures support export confidence

A National Australia Bank survey reports supply chain pressures for small-to-medium businesses (SMEs) eased further in Q2, a trend that is likely to continue. Around 1 in 10 (11%) SMEs believe supply chain pressures will be a significant issue for their business in the next 12 months, compared to 31% of businesses at the same time last year. Supply conditions are improving for most industries, though at varying paces; while business services and accommodation and hospitality feel fewer supply challenges, pressures still exist in the manufacturing and retail sectors. Most states are also experiencing better functioning supply chains; but while SMEs in New South Wales and Queensland are the least concerned about supply chain issues in the coming year, Tasmania and South Australia see greater challenges.

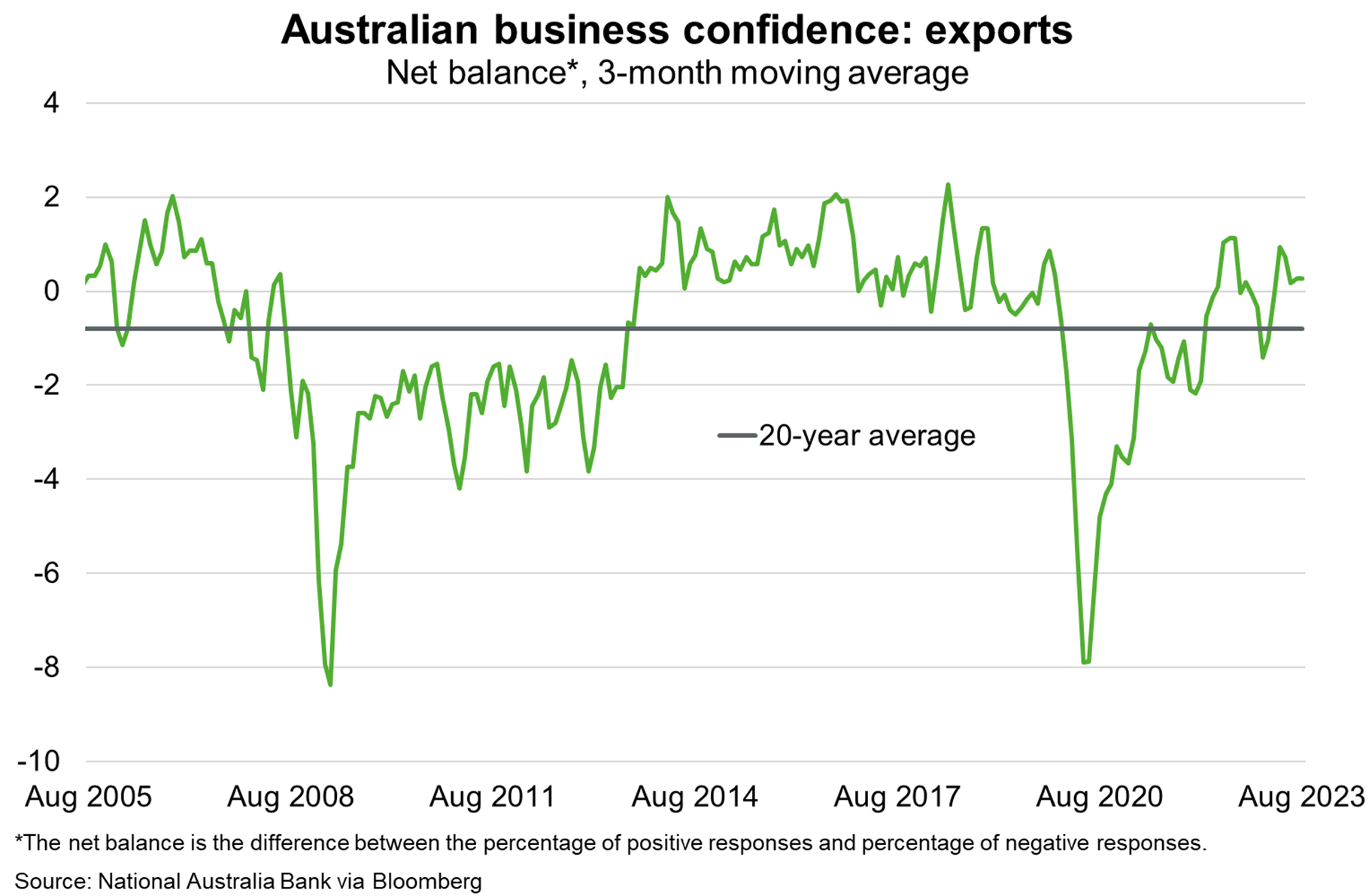

Supply chain pressures are easing at a time when shipping costs have fallen sharply. The Australian Bureau of Statistics notes that the cost of freight as a proportion of the total value of imported goods fell from a peak of 7% in February 2022 to 4.6% in March 2023, relative to a pre-COVID average range between 3 to 4%. Freight costs as a proportion of total import costs for cork and wood manufactures fell to 7.7% in March 2023, from as high 17.4% in April 2022. Continued falls in freight costs across many shipping routes in the past six months suggests freight costs as a proportion of total import costs will likely trend down further. Given Australia is a large importer of goods that are inputs into exports, fewer supply disruptions and lower freight costs (alongside the competitive AUD) are likely supporting the confidence of exporters (Chart), even as slowing global demand and labour constraints remain significant challenges for many businesses.