Australia—Wine exports to recover slowly after China lifts tariffs

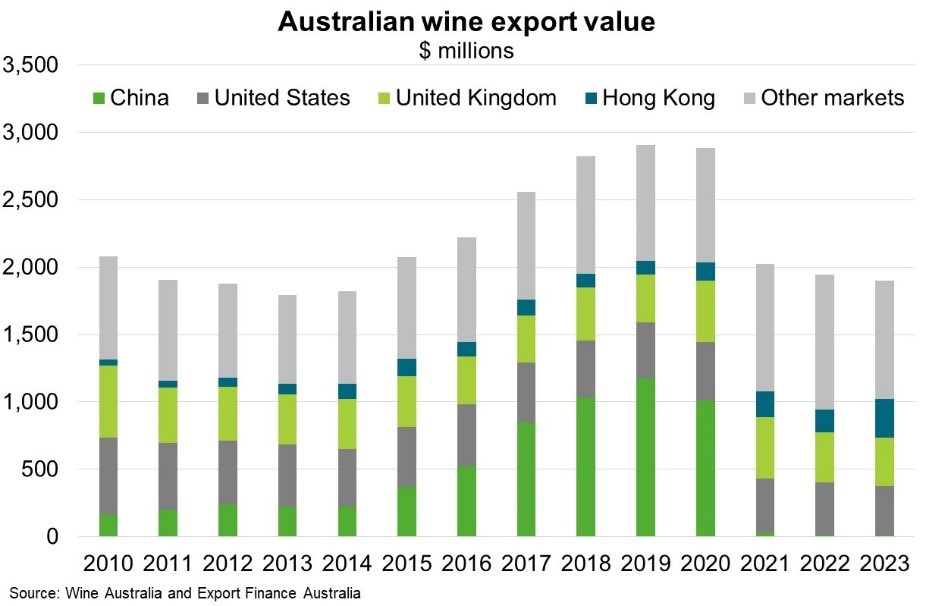

China has lifted anti-dumping and countervailing duties on Australian bottled wine, effective March 29. The duties, of between 116.2% and 218.4%, were imposed in March 2021 alongside multiple other trade barriers on Australian commodities. Previously, the phased removal of import tariffs under the 2015 China-Australia Free Trade Agreement coincided with strong Chinese demand for Australian wine. In 2019, the tariff on Australian wine fell to zero, giving Australian winemakers a 14% tariff advantage over competitors. Australia's share of China’s bottled wine imports subsequently increased from 28% in 2018 to 37% in 2019 in value terms. In 2019, China was Australia’s largest wine export market, at $1.1 billion (40% of the total). However, since 2021, Beijing’s duties on Australian wine effectively made China an unviable market, sharply reducing exports (Chart).

Despite the removal of duties, increasing Australia’s exports to China will take time and a return to pre-pandemic export levels is unlikely. Rabobank estimated last August that the Australian wine surplus would take at least two years to work through, with 2.8 billion bottles in storage (equivalent of 859 Olympic swimming pools). Further, China’s wine market is shrinking; in 2022, per capita wine consumption was one-third of its 2012 peak and import volumes have fallen 55% since 2017. Meanwhile, more domestic and global players have entered the Chinese market. Chinese consumers have embraced the high-end domestic spirit baijiu while France, Chile and Italy have become leading international wine suppliers. Last, Chinese consumer sentiment and domestic demand remain weak, underscored by deflationary pressures, despite Q1 2024 GDP growth beating market expectations. The ongoing property market downturn and high youth unemployment will continue to dampen discretionary spending in China.