India — Elections imply policy continuity with added reform challenges

The Bharatiya Janata Party (BJP) won 240 of 543 seats in India’s general elections, 32 seats short of a single-party parliamentary majority and 63 seats fewer than in the 2019 elections. In early June, Prime Minister Narendra Modi announced he will return for a third term as leader under a coalition government formed between the BJP and the National Democratic Alliance (NDA). The BJP’s weakened mandate will require dependence on alliance partners and negotiations with smaller regional parties to pass legislation over the next five years.

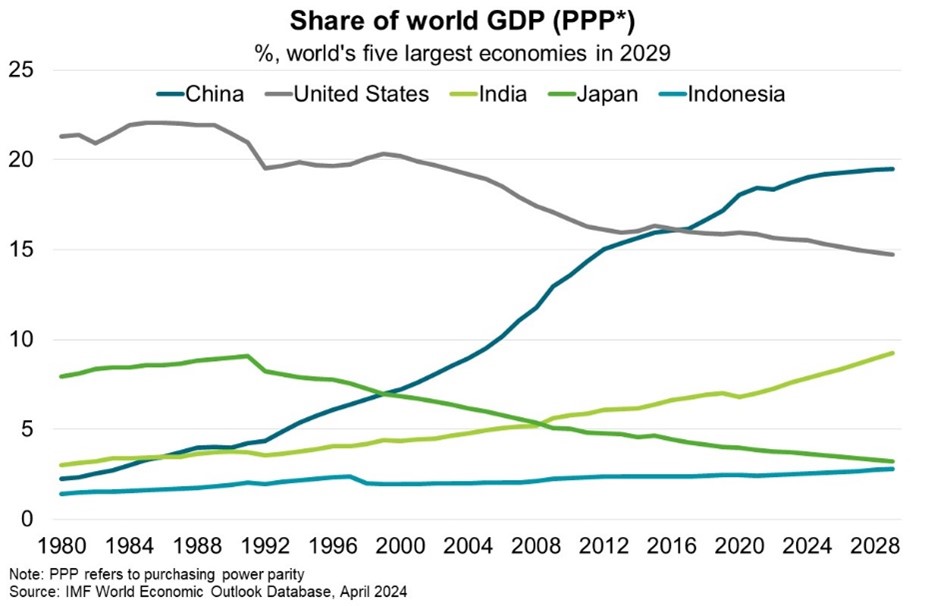

The outcome should bring broad policy continuity—including enormous infrastructure spending and efforts to expand the digital economy that have spurred rapid economic growth (Chart). Indeed, real GDP growth outperformed expectations to hit 7.8% year-over-year in the March quarter. The IMF forecasts India to remain the fastest growing major economy; expanding by 6.8% in 2024 and 6.5% in 2025, supported by strong domestic demand and a growing working-age population. India’s anticipated policy continuity and macroeconomic resilience will continue to offer Australian exporters a vast consumer market and opportunities to diversify risk.

However, India’s benchmark share index fell 6% following the election result. This reflects concerns that the government’s efforts to win greater support from the disenfranchised low-income rural population will impede critical progress on fiscal consolidation. India’s public debt reached 82% of GDP in 2023, compared to 70% five years prior, and interest payments consume over a quarter of public revenues. Coalition politics may also increase policy unpredictability and delay ambitious economic reforms needed to boost the manufacturing industry, lower youth unemployment and improve the business climate, particularly for foreign investment. Indeed, despite US-China tensions that have created a favourable geopolitical backdrop for India, inward FDI flows have fallen, from a peak of US$64 billion in 2020 to US$28 billion in 2023.