Pakistan—Economic stability key challenge for new government

Following February national elections, a coalition government formed by the Pakistan Muslim League-Nawaz (PMLN) and the Pakistan People’s Party (PPP) is being led by Shehbaz Sharif. Sharif previously served as prime minister from April 2022, when Imran Khan (now incarcerated) was ousted from the premiership after a no-confidence vote, to August 2023, when a caretaker government was put in place pending the election outcome. Independent candidates, most of whom were affiliated with Khan’s Pakistan Tehreek-e-Insaf (PTI) party won the most parliamentary seats but were unable to secure a parliamentary majority.

With Pakistan’s 24th IMF arrangement due to expire this month, securing another, and adhering to its reform conditionality, is critical to Pakistan navigating out of an economic crisis. Pakistan’s external position has improved in recent months; the central bank reported foreign reserves of US$7.9 billion in early March, up from a low of US$3.1 billion in January 2023. But reserves remain low relative to external funding needs, estimated by the IMF to average US$26 billion p.a. over the next five years. Interest payments alone will cost over 60% of government revenues this FY and next, according to IMF estimates. The sovereign’s vulnerable external position means any delays in securing new IMF financing will increase external liquidity stress and default risk.

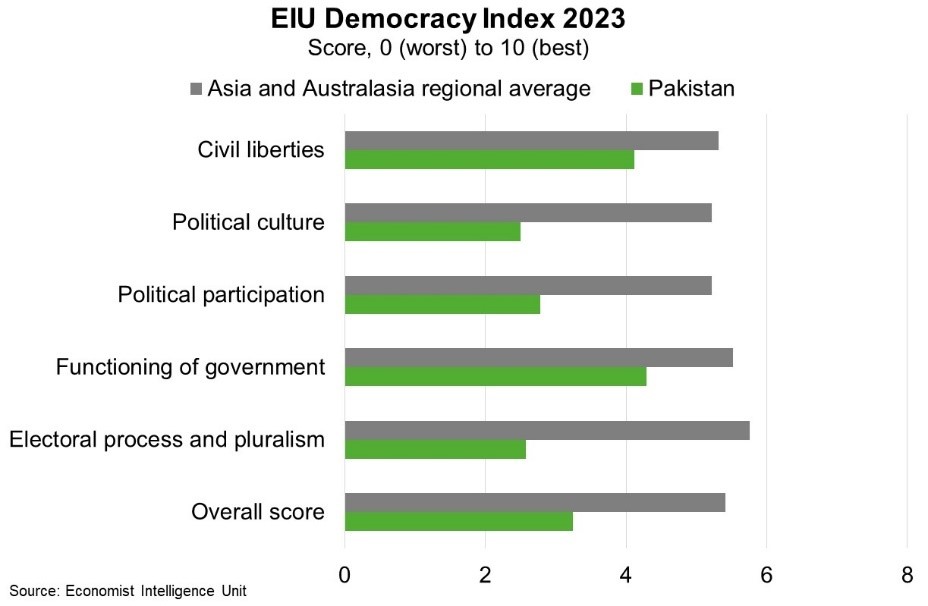

Pakistan registered the greatest deterioration of any country in the Asia and Australasia region in the Economist Intelligence Unit’s (EIU’s) 2023 Democracy Index (Chart) and was reclassified from a ‘hybrid’ to an ‘authoritarian’ regime. The Pakistan administration faces widespread perceptions that the electoral process was not free, fair and inclusive and polarisation over the results raises the risks of ongoing political instability. Amid the difficult political context, tougher IMF-mandated reforms may increase public discontent and resistance from entrenched vested interests. Australian exports worth $2.6 billion last FY—concentrated in education—made Pakistan our 26th largest export market. Heightened risks of political and economic instability in Pakistan will continue to present challenging conditions for Australian businesses.