© Export Finance Australia

The views expressed in World Risk Developments represent those of Export Finance Australia at the time of publication and are subject to change. They do not represent the views of the Australian Government. The information in this report is published for general information only and does not comprise advice or a recommendation of any kind. While Export Finance Australia endeavours to ensure this information is accurate and current at the time of publication, Export Finance Australia makes no representation or warranty as to its reliability, accuracy or completeness. To the maximum extent permitted by law, Export Finance Australia will not be liable to you or any other person for any loss or damage suffered or incurred by any person arising from any act, or failure to act, on the basis of any information or opinions contained in this report.

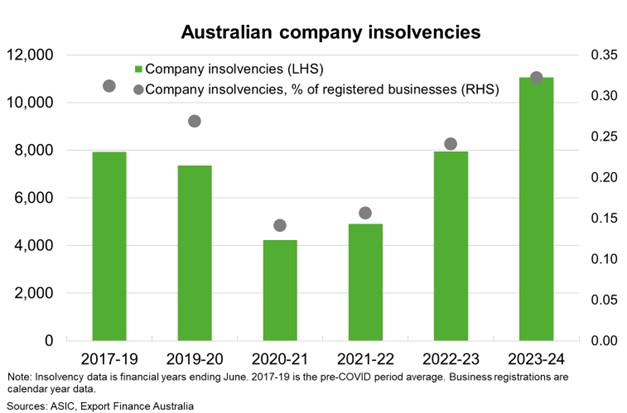

Australia—Weak demand, cost pressures raise business insolvencies

Weak demand and higher costs continue to create a challenging operating environment for Australian businesses. Particularly given the Australian Taxation Office has resumed enforcement actions on unpaid taxes. CreditorWatch indicates the failure rate for Australian businesses was 5% in August—the highest level since January 2021 amid the COVID-19 pandemic. Conditions are most challenging for small businesses exposed to soft consumer demand. Almost half of Australia’s 2.5 million small businesses are not breaking even, and one-quarter of business owners are using their personal savings to continue operating, according to the Council of Small Business Organisations Australia. Similarly, Australian Securities and Investments Commission data show a record 11,000-plus companies became insolvent in FY2024 (Chart). This trend appears to be accelerating; over 2,400 businesses become insolvent in July and August combined, up 36% on the same period last year.

But while insolvencies are at a record in absolute terms, they remain comparable to historical trends when calculated as a share of the total number of registered businesses (about 0.3%). Further, higher insolvencies partly reflect catch-up from the pandemic when they were unusually low, according to the Reserve Bank of Australia (RBA). Indeed, insolvencies remain below their pre-pandemic trend on a cumulative basis. Since 2020, about 6,900 fewer companies have gone bankrupt than would have otherwise been the case if the pandemic had not occurred and the government did not provide support measures, according to RBA estimates.

Looking ahead, Australian businesses are poised to benefit from lower inflation and interest rates. The assumed cash rate from market pricing is 3.5% in December 2025, down from 4.35% currently. If that outlook materialises, lower interest rates should bolster household budgets and consumer spending, reduce debt servicing expenses for businesses and lower borrowing costs, in turn supporting business profits.