© Export Finance Australia

The views expressed in World Risk Developments represent those of Export Finance Australia at the time of publication and are subject to change. They do not represent the views of the Australian Government. The information in this report is published for general information only and does not comprise advice or a recommendation of any kind. While Export Finance Australia endeavours to ensure this information is accurate and current at the time of publication, Export Finance Australia makes no representation or warranty as to its reliability, accuracy or completeness. To the maximum extent permitted by law, Export Finance Australia will not be liable to you or any other person for any loss or damage suffered or incurred by any person arising from any act, or failure to act, on the basis of any information or opinions contained in this report.

PNG—Strong IMF reform progress but FX and economic issues persist

PNG is making strong progress on reforms half-way through its US$918 million IMF program. Foreign exchange (FX) shortages have eased, fiscal deficits have fallen, excess liquidity in the banking system has been reduced and anti-corruption institutions are being strengthened. PNG is on track to receive a further US$127 million from the IMF following its third program review this month and has requested access to a new 24-month US$265 million Resilience and Sustainability Facility, which will help enhance resilience to weather-related risks. Against this backdrop, economic growth and FX inflows are picking up as PNG benefits from higher prices for key exports, such as cocoa. The Asian Development Bank forecasts real GDP growth to accelerate to 3.2% in 2024 and 4.5% in 2025.

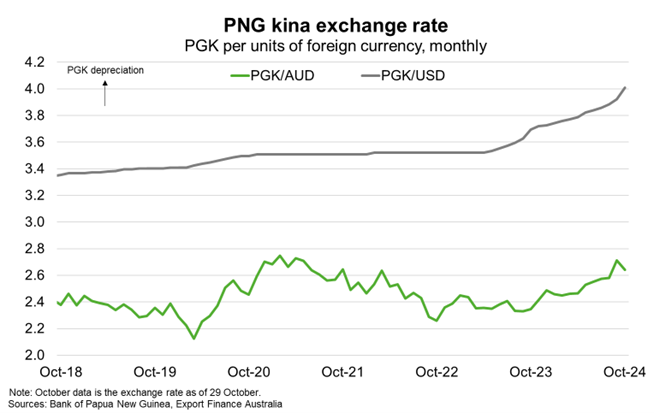

But significant hurdles to stronger economic activity in Australia’s 24th largest export market remain prominent. First, the FX backlog remains above PGK1 billion (about US$250 million) according to ANZ Bank. BSP Financial Group reports waiting times on essential FX orders remain at two-to-four weeks (down from a peak of six-to-eight weeks). IMF-mandated reforms to foster depreciation of the PNG kina, which is down more than 11% against the US and Australian dollars since May 2023 (Chart), has helped ease but not eliminate the FX market imbalance. Second, Final Investment Decision on the Total-led US$12 billion Papua LNG project (about 40% of PNG’s GDP) has been delayed until late 2025. Other notable risks to the outlook include increasing tribal fighting in the Highlands, law and order issues, fuel supply restrictions and disaster and weather-related events.