© Export Finance Australia

The views expressed in World Risk Developments represent those of Export Finance Australia at the time of publication and are subject to change. They do not represent the views of the Australian Government. The information in this report is published for general information only and does not comprise advice or a recommendation of any kind. While Export Finance Australia endeavours to ensure this information is accurate and current at the time of publication, Export Finance Australia makes no representation or warranty as to its reliability, accuracy or completeness. To the maximum extent permitted by law, Export Finance Australia will not be liable to you or any other person for any loss or damage suffered or incurred by any person arising from any act, or failure to act, on the basis of any information or opinions contained in this report.

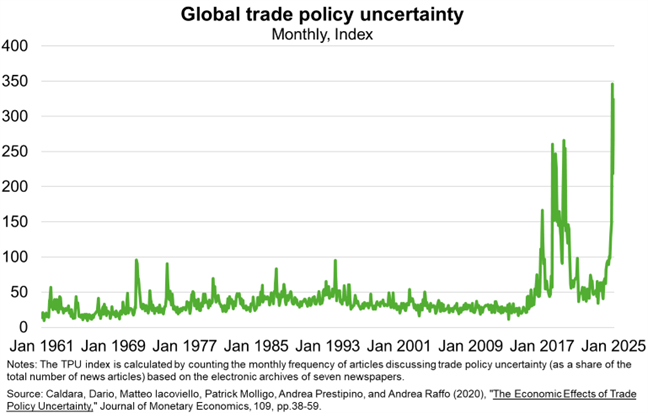

Australia—US trade policy uncertainty an indirect headwind to exports

Global trade policy uncertainty is at its highest level since 1960 (Chart). On February 1, President Trump announced tariffs of 10-25% on imports from Canada, Mexico and China (which collectively accounted for US$1.3 trillion or 43% of US imports and 5% of GDP in 2023). While the implementation of tariffs on Canada and Mexico was postponed for 30 days, additional reciprocal and sectoral tariffs on US trading partners have since been announced. With respect to tariffs on Canada, Mexico and China, President Trump said the tariffs are a response to the fentanyl crisis and illegal immigration. More broadly, the Administration has said tariffs also aim to reduce the US trade deficit, protect US manufacturing, and raise revenue to finance future tax cuts. Some trading partners have responded by signalling both retaliatory measures and negotiation strategies.

The nature of our trade relationship, including that the US has a long-standing trade surplus with Australia, may shield Australian exporters from direct US trade penalties. However, several of President Trump’s announcements on tariffs, including on reciprocal tariffs and tariffs on steel and aluminium, have not yet come into force and specific details of their application are still subject to review by US officials. In any case, Australian exporters would be indirectly impacted by any tariffs imposed on other trading partners through the following.

1. Lower demand. US tariffs will weigh on growth in China and the US, which purchased 32% (A$213 billion) and 6% (A$38 billion) of Australia’s FY2024 exports respectively. More generally, unpredictable trade policies are likely to sap global investment and economic activity.

2. Weaker Australian dollar (AUD), to the extent that US tariffs exacerbate sticky US inflation and delay monetary easing. The average US tariff on imports is forecast to rise from 2.4% to 10.5% (levels not seen since the 1940s). Already, year-ahead inflation expectations among Americans jumped to 4.3% in January, from 3.3% a month earlier. Weaker commodity prices—that derive from a tariff-induced slowdown in China—and global uncertainty would also weigh on the AUD. While a lower currency supports Australia’s international competitiveness, it also increases import costs, potentially exacerbating cost pressures currently weighing on business confidence.