© Export Finance Australia

The views expressed in World Risk Developments represent those of Export Finance Australia at the time of publication and are subject to change. They do not represent the views of the Australian Government. The information in this report is published for general information only and does not comprise advice or a recommendation of any kind. While Export Finance Australia endeavours to ensure this information is accurate and current at the time of publication, Export Finance Australia makes no representation or warranty as to its reliability, accuracy or completeness. To the maximum extent permitted by law, Export Finance Australia will not be liable to you or any other person for any loss or damage suffered or incurred by any person arising from any act, or failure to act, on the basis of any information or opinions contained in this report.

China—On track to achieve growth target despite slowing economy

China’s economic performance is weakening in Q4 2025 amid subdued investment growth, a still weak property market, and lower exports as frontloading rebalances. However, strong growth of 5.2% in the first three quarters of 2025, exchange rate depreciation and some fiscal expansion should help China achieve its target of ‘around 5% growth’ in 2025.

China’s next Five Year Plan aims to recalibrate economic policy to address persistent vulnerabilities, improve economic resilience in a more geostrategically complex world, and shift to a more innovative and consumption driven economy. Central to achieving these goals is addressing persistent deflation, which reveals a structural mismatch between supply and demand, and the waning effectiveness of subsidies. China is focused on ‘anti-involution’ supply-side measures to rein in excess capacity and stabilise corporate profitability. Measures include lifting and enforcing standards, encouraging consolidation of unprofitable firms, and supporting and commercialising innovation. Anti-involution efforts have focused on EVs, solar and batteries so far, with coverage expected to expand to other sectors throughout 2026. That said, China will remain a major manufacturing power in traditional industries, while new ‘extraordinary’ policy measures were promised to pursue breakthroughs in key technologies. Meanwhile, boosting the share of consumption in the economy became a development goal, with employment, income and expectations identified as key bottlenecks. This may induce increased spending on public services, expanding the services market, and improving access to affordable housing.

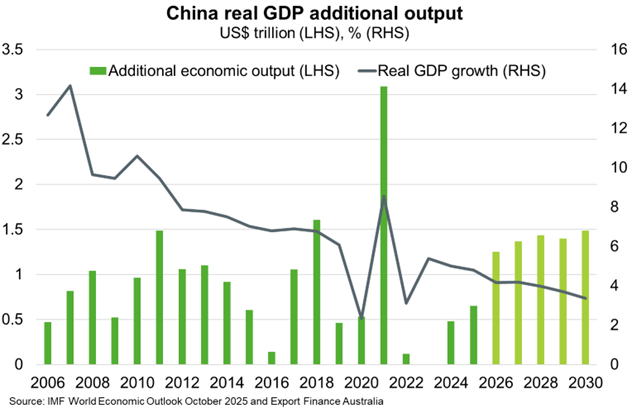

The outlook remains weaker than recent years, with the IMF forecasting growth of 4.8% in 2025 and 4.2% in 2026. Despite headwinds, China’s economy is set to expand by US$1.3 trillion in 2026 (Chart), roughly equivalent to the size of Saudi Arabia’s economy. This outlook is supported by the 12-month trade truce with the US, measured fiscal support and widening profit margins as anti-involution measures take effect.