Qatar

Qatar

Last updated: March 2023

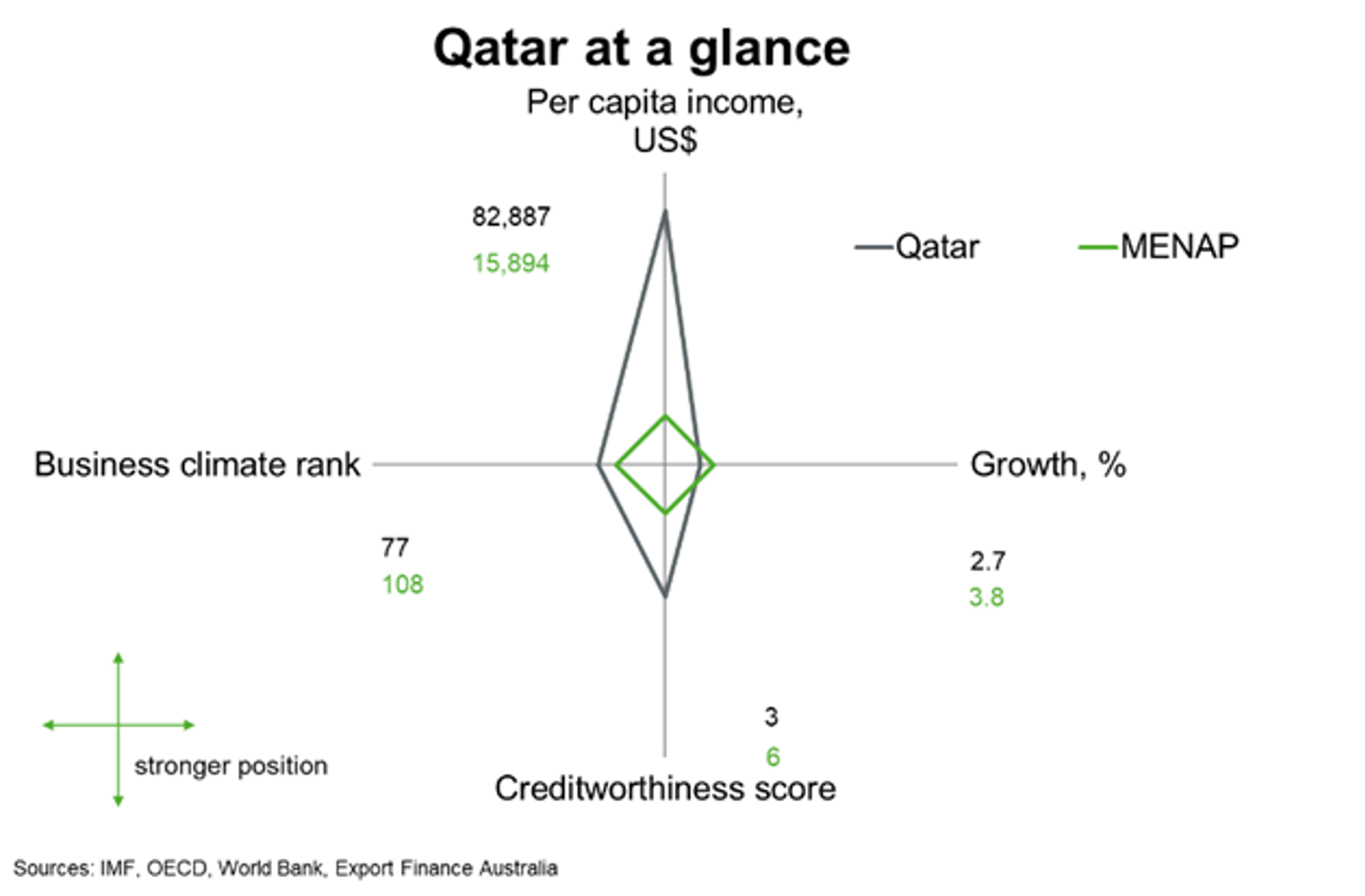

Qatar has the highest per capita incomes in the Middle East, North Africa and Pakistan (MENAP) region, and is the second largest global exporter of LNG. Qatar outperforms the MENAP region on measures of creditworthiness and the business climate while growth lags regional peers.

| The above chart is a cobweb diagram showing how a country measures up on four important dimensions of economic performance—per capita income, annual GDP growth, business climate rank and creditworthiness. Per capita income is in current US dollars. Annual GDP growth is the five-year average forecast between 2023 and 2027. Business climate is measured by the World Bank’s 2019 Ease of Doing Business ranking of 190 countries. Creditworthiness attempts to measure a country's ability to honour its external debt obligations and is measured by its OECD country credit risk rating. The chart shows not only how a country performs on the four dimensions, but how it measures up against other countries in the region. |

Economic outlook

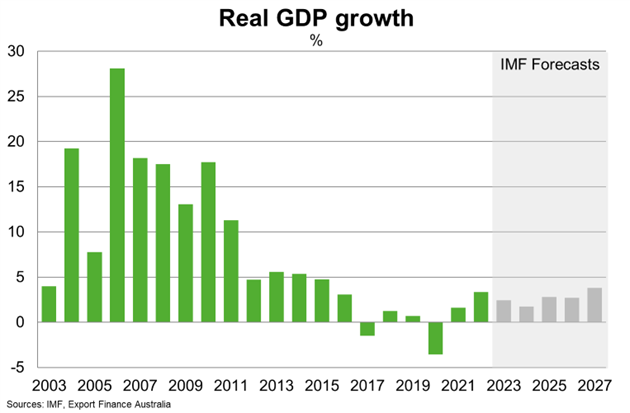

A revival in domestic demand, buoyant private credit growth, higher oil and gas prices and rising tourism inflows as Qatar hosted the 2022 FIFA World Cup event helped real GDP growth accelerate to 3.4% in 2022, from 1.6% in 2021.

The IMF expects growth to moderate to 2.4% in 2023, driven by lower growth in hydrocarbon exports as global energy prices ease; LNG accounts for around 90% of Qatar’s total exports. The decision by OPEC+ to limit oil production in 2023 will also weigh on export growth. The outlook for tourism remains bright as Qatar will host the 2023 Asian Cup football tournament and the recent extension of the Haaya Card will allow visa-free entry until 2024.

Risks are balanced; potentially stronger energy demand from China, following the easing of its zero-COVID policy, could push up global energy prices and support stronger demand for Qatar’s LNG. On the downside, even higher inflation and interest rates would weigh on household spending and broader economic growth.

The IMF expects growth to average 2.8% per annum between 2024 to 2027. The Qatari government expects the North Field Expansion (NFE) to increase LNG production capacity from 77 million tonnes to 126 million tonnes per annum by 2027; at which point Qatar will produce nearly one-third of global LNG supply. The expansion of North Field will boost employment and raise government revenues that can help the government fund non-oil projects, particularly in the tourism and culture space.

Qatar’s long-term outlook is strong. Public construction activity related to National Vision 2030 development projects and robust prospects for tourism will support growth in the non-oil sector and help authorities diversify the economy. Qatar should benefit from greater foreign investment as it strengthens the regulatory regime, reform administrative processes and digitise trade and investment operations.

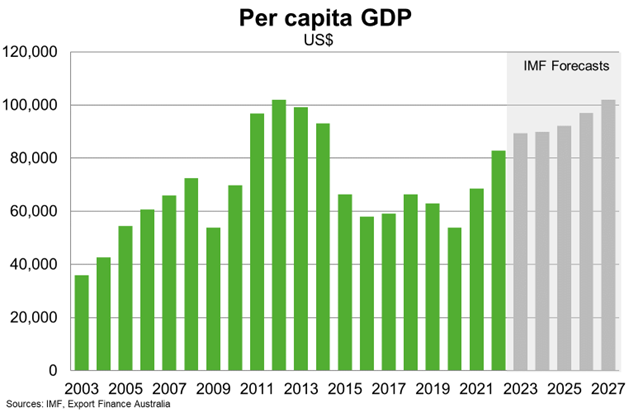

Qatar has the highest per capita income (US$83,000) in the MENAP region, followed by the United Arab Emirates. The IMF expects incomes to rise above US$100,000 by 2027. Household incomes have been volatile due to the country’s dependence on energy to drive output and jobs. But that volatility should dissipate as Qatar increasingly diversifies its economy over time. Income inequality remains an issue—according to data from the World Inequality Database—the top 10% of adult income earners in Qatar earn around 55% of the country’s total income.

Country risk

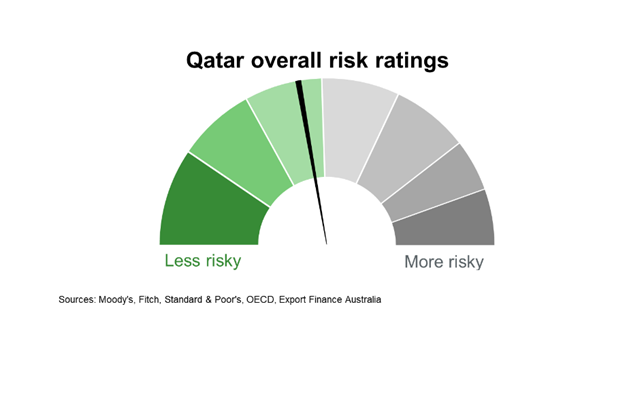

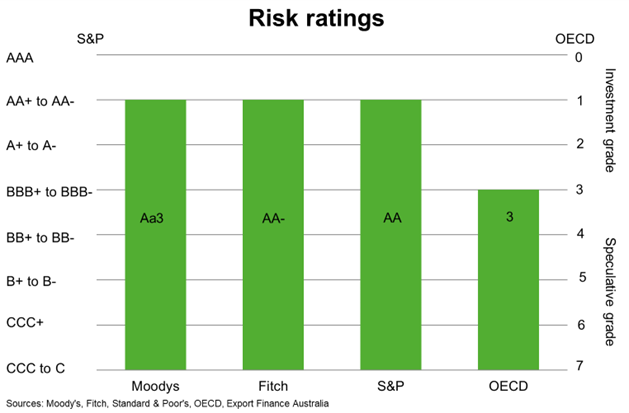

Country risk in Qatar is moderate. The OECD country risk rating is 3 and the country has investment grade ratings from all three major private rating agencies. This suggests that there is a low likelihood of the country being unable/unwilling to meet its external debt obligations.

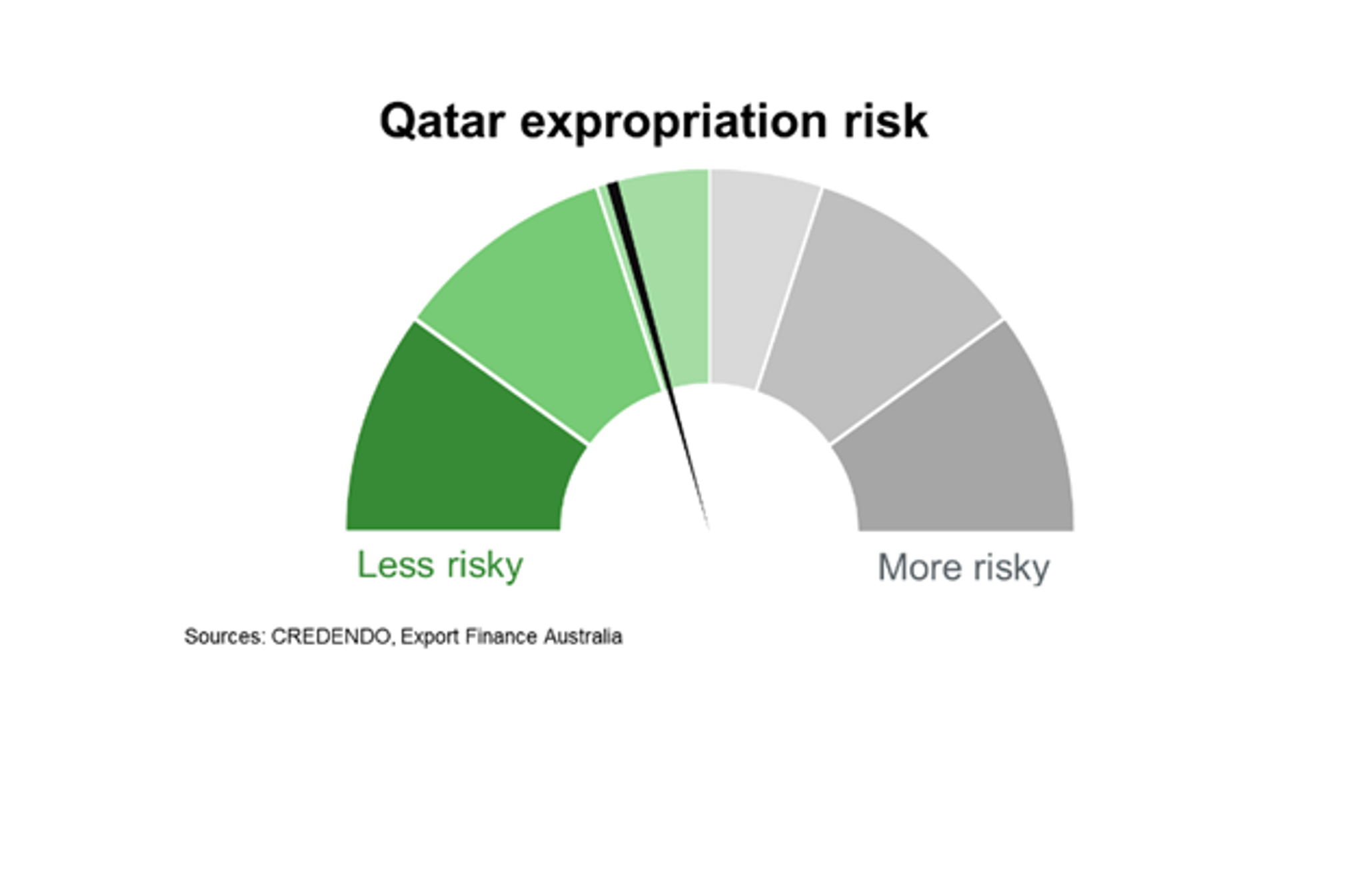

The risk of expropriation in Qatar is moderate. The US investment climate statements note that the government protects foreign investment and property from direct or indirect expropriation, unless for public benefit and after providing adequate compensation.

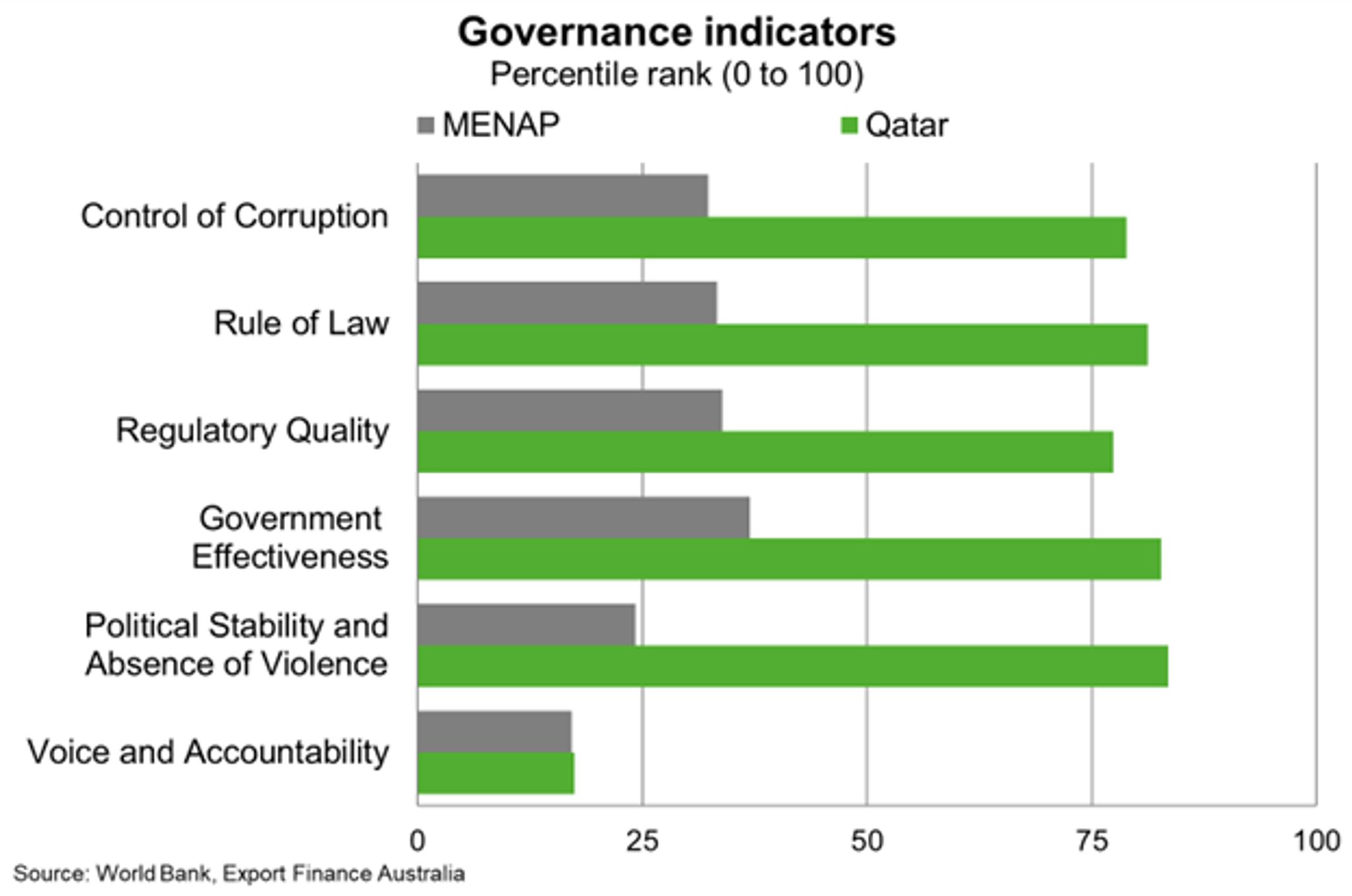

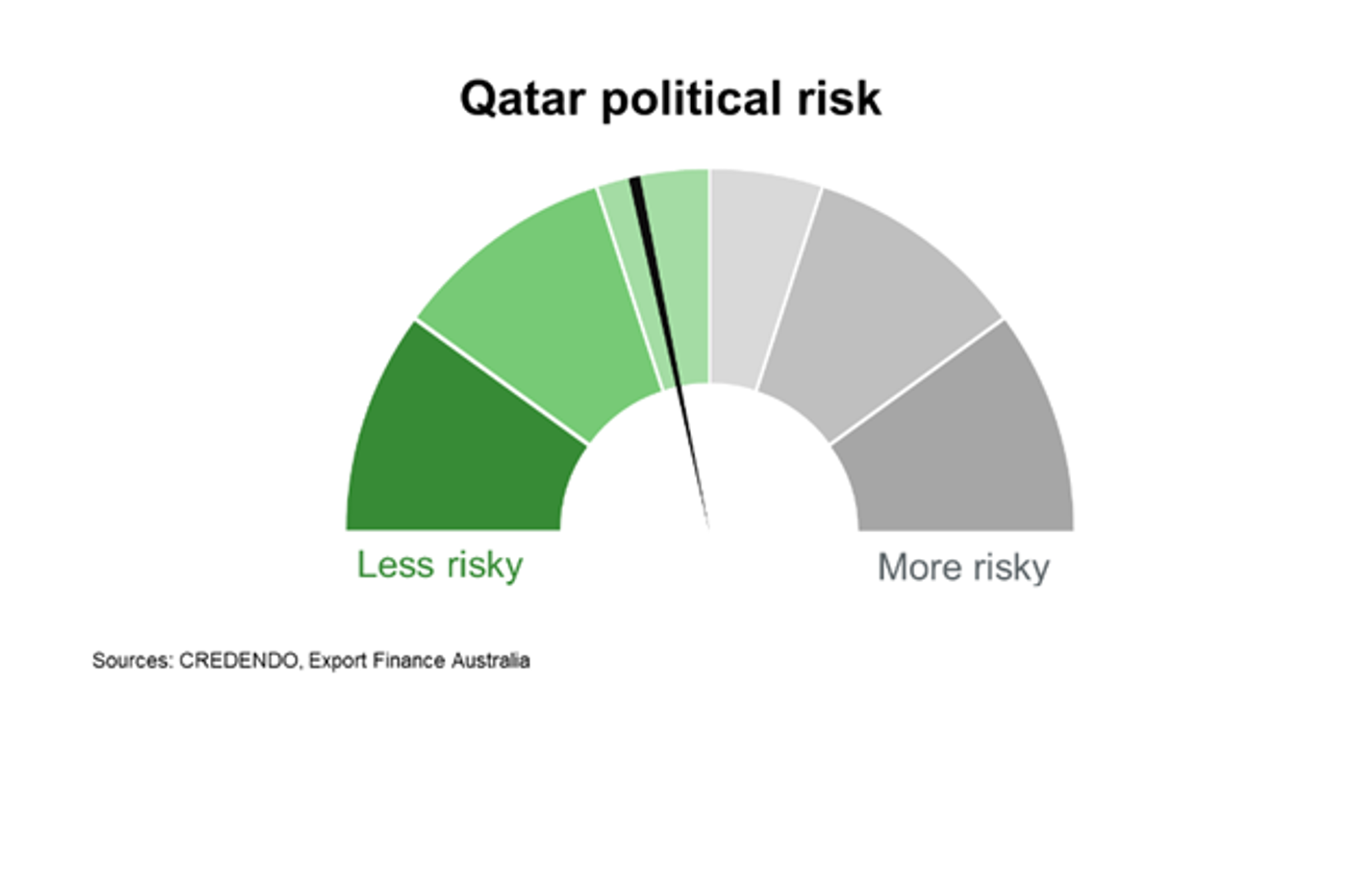

Qatar scores in the top quartile on most governance indicators and has a track record of solid fiscal and economic management. That said, Qatar scores lowly on measures of voice and accountability. Political risk in Qatar is low to moderate and includes risks related to the escalation of regional geopolitical tensions that can hinder oil production and trade.

Bilateral relations

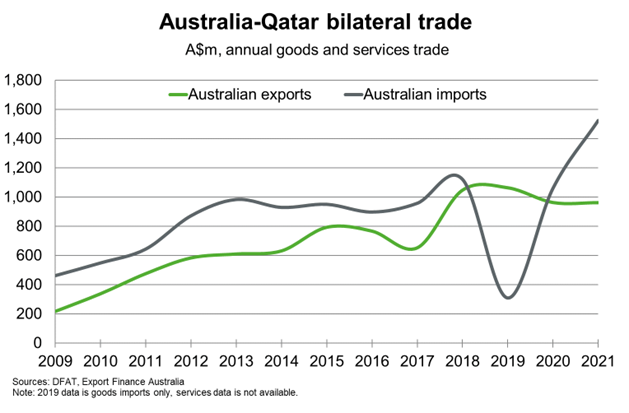

Qatar was Australia’s 35th largest trading partner in 2021. Total goods and services trade amounted to $2.4 billion in 2021. Australia’s major exports to Qatar in 2021 included barley, wheat, meat and live animal, aluminium and engineering services. Australia’s major imports from Qatar included fertilisers, aluminium, sulphur and iron pyrites, hydrocarbons, primary ethylene polymers and aviation services.

About 80 Australian companies are operating in Qatar, with the majority working in engineering and infrastructure sectors. Qatar’s LNG expansion projects and infrastructure development under the National Vision 2030 presents opportunities for Australian engineering services exports.

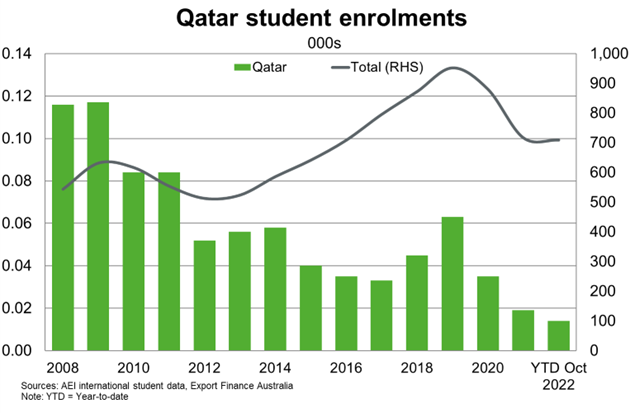

Qatari student enrolments in Australian institutions are modest and have fallen almost 85%, from 117 to 19 students, between 2009 to 2021. This trend has been largely due to substantial improvements in the quality of education in Qatar, in line with its National Vision 2030 plan.

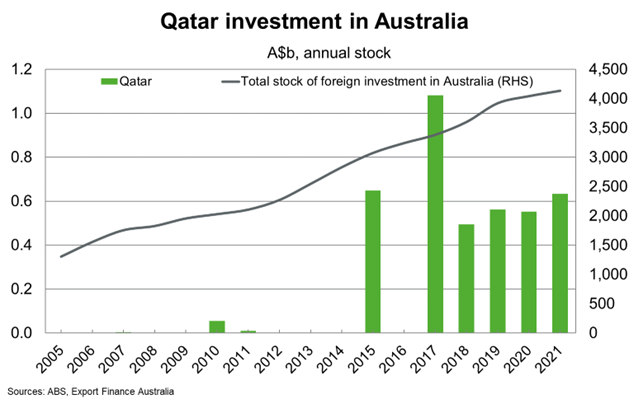

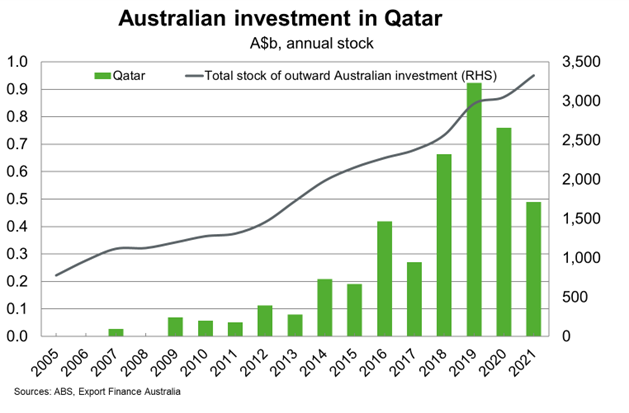

Bilateral investment between Qatar and Australia is small. Qatar’s sovereign wealth fund—the Qatar Investment Authority—is the tenth largest in the world and looking to grow its investment portfolio in Australia. This includes through its subsidiaries Hassad Food and Nebras Power, which have invested about $3 billion over recent years in Australian property, logistics, energy and agriculture sectors.