Global—Policy shifts to curb demand for carbon-intensive commodities

A landmark report from the Intergovernmental Panel on Climate Change (IPCC) reinforces the need for deep cuts in greenhouse gas emissions to limit global warming to 1.5 degrees celsius over the next two decades. Several major economies, including the US, Europe, China, Japan and South Korea, have committed to cutting their carbon emissions, promising to reach "net zero" emissions in 2050 or 2060.

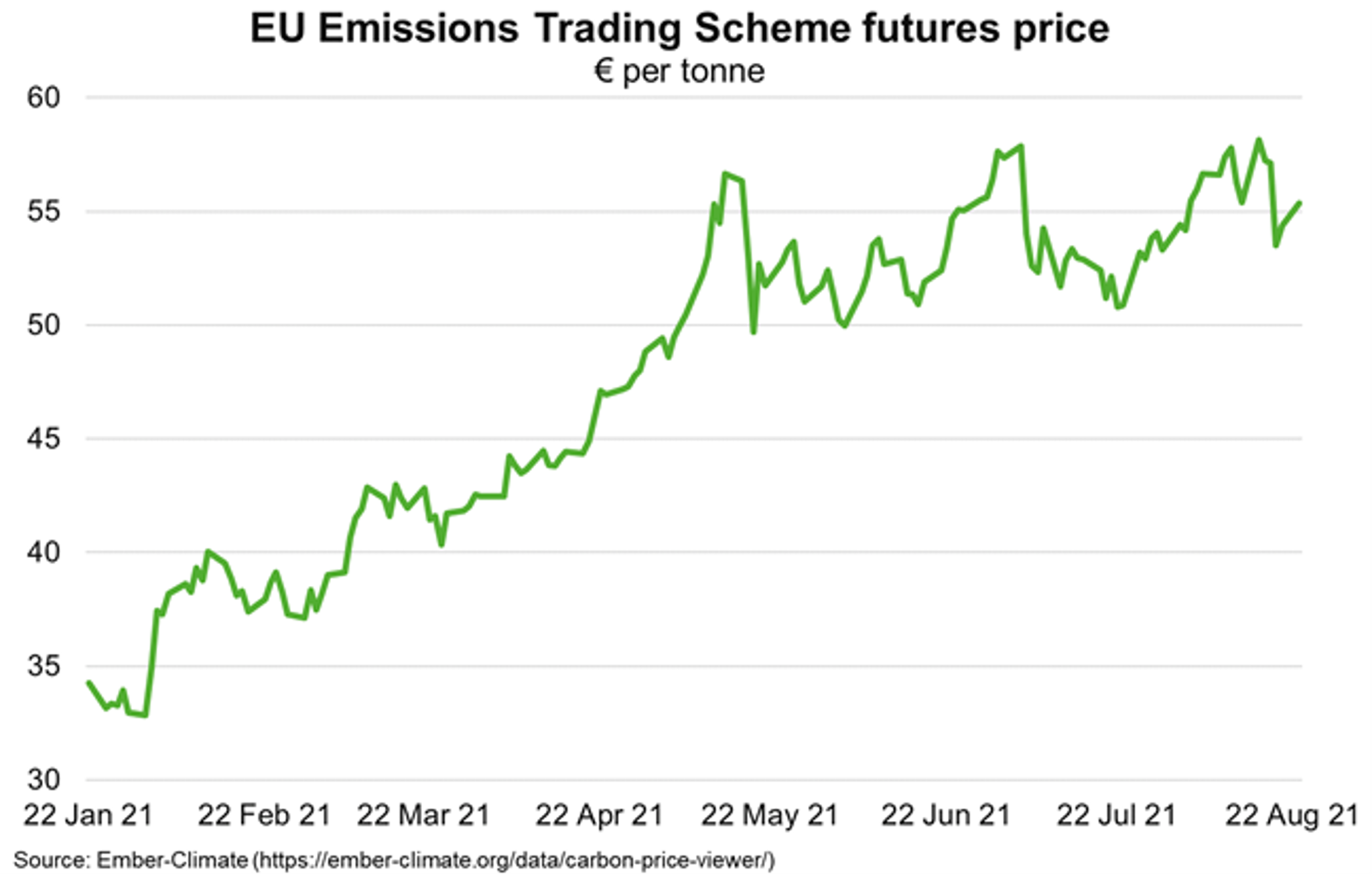

One way European Union (EU) policymakers propose to step up their climate abatement effort, meet their 2030 Paris target and ultimately achieve net zero emissions is to place a charge on embedded carbon for some imports, and extend the application of the EU Emissions Trading Scheme (EU ETS) to equivalent areas of domestic production. The proposed policy—a Carbon Border Adjustment Mechanism (CBAM)—is justified by the EU as being needed to maintain a level playing field between imports and equivalent EU production that pays a carbon price under the EU ETS. The initial CBAM proposal covers European imports on selected goods from five sectors, including cement, electricity, fertilisers, iron and steel and aluminium. Charges will be based on the carbon emissions produced in the production processes of covered products. A discount will be applied to those imports subject to a domestic carbon price, although the cost to producers in source countries of other climate policies will not be recognised. The CBAM scheme is scheduled to be phased in gradually over coming years, with affected importers to report emissions from 2023, levied from 2026 and applied fully by 2035. Currently, carbon trades for roughly €55 per tonne (A$90) in Europe, having risen sharply through 2021 as efforts to reduce carbon emissions intensify (Chart).

Carbon border pricing means carbon-emitting businesses around the world face the prospect of paying higher costs to export, potentially reducing profitability. Businesses that export lower-carbon products and whose exports are subject to their own domestic carbon price are likely to face fewer financial effects. Higher carbon prices could reduce demand for exports that have lower-emission substitutes (for example, in electricity generation). However, higher carbon prices could also encourage greater investments in renewable technologies, such as wind, solar or hydrogen, that could, over time, contribute to lower carbon-intensity of exports and curb global emissions.