Global—Falling international prices would hurt commodity exporters

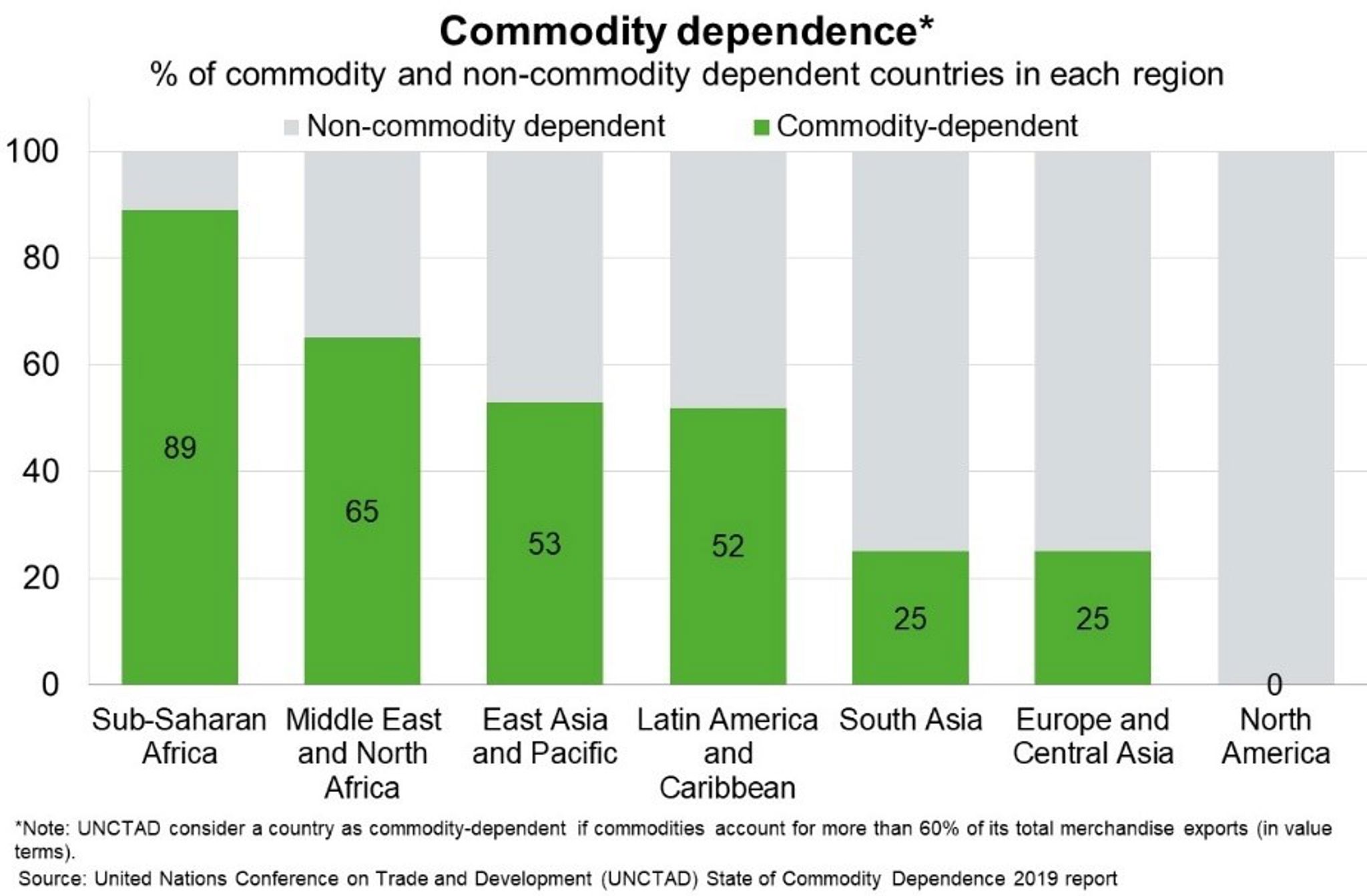

Surging commodity prices have boosted export receipts and foreign exchange inflows in commodity-dependent economies, most of which are concentrated in Africa and the Middle East (Chart). The run-up has been supported by growing Chinese demand, recovery in global manufacturing and increasing government spending, particularly on infrastructure, that has lifted demand for metals. Additionally, optimism about the global vaccine rollout, low interest rates and global fiscal stimulus have bolstered the economic outlook. Price rises have been broad-based amongst most commodities.

Price gains have not been as large as in previous commodity upswing cycles in the early 2000s and period from early-2002 to mid-2008. A key difference is that China is at a more advanced and less-commodity intensive stage of economic development; indeed, authorities reinforced their focus on investment in green technology and sustainable development in their five-year plan.

Still, downside risks to commodity prices are rising. Spot prices for many commodities are now well above 2021 average forecasts from market commentators. However, ongoing progress on vaccine rollout could revive growth in services and weigh on demand for goods, thereby weakening metals demand. The recent OPEC+ decision to continue limiting production is supporting oil prices; but Saudi Arabia has significant supply capacity while the potential re-entry of Iranian oil exports could send energy prices down again.

Lower commodity prices could deprive many major export markets of critical foreign exchange and growth momentum. For instance, UAE and Saudi Arabia (dependent on fuel exports), PNG (dependent on minerals and metal exports), and New Zealand and Brazil (dependent on agricultural exports).