Emerging markets—Australia’s major export markets recovering, but risks remain high

The IMF expects economic activity will return to pre-pandemic levels for many emerging markets (EMs) in 2022, supported by progress in COVID-19 vaccination. But growth will decelerate next year, and the recovery will remain uneven. High commodity prices will support some EMs, but those reliant on tourism and functioning global supply chains will take longer to recover. The global recovery is also highly vulnerable to future shocks, including from new variants of COVID-19. The pace of vaccine rollouts, vaccine efficacy against future strains, the ability of countries to increase vaccine coverage and maintain fiscal support will be important in determining the pace and timing of the recovery.

Debt repayment risks will remain high as external financing conditions tighten, particularly for governments reliant on foreign currency borrowing. Although the IMF expects inflation to moderate in 2022 as current supply disruptions ease, sticky food and energy costs could lead to more aggressive monetary tightening that undermines growth and debt sustainability. The COVID-induced deterioration in public finances leaves limited space to further stimulate many economies. Muted economic momentum and adverse financial conditions may also lead to the risk of political tensions and social unrest in some countries.

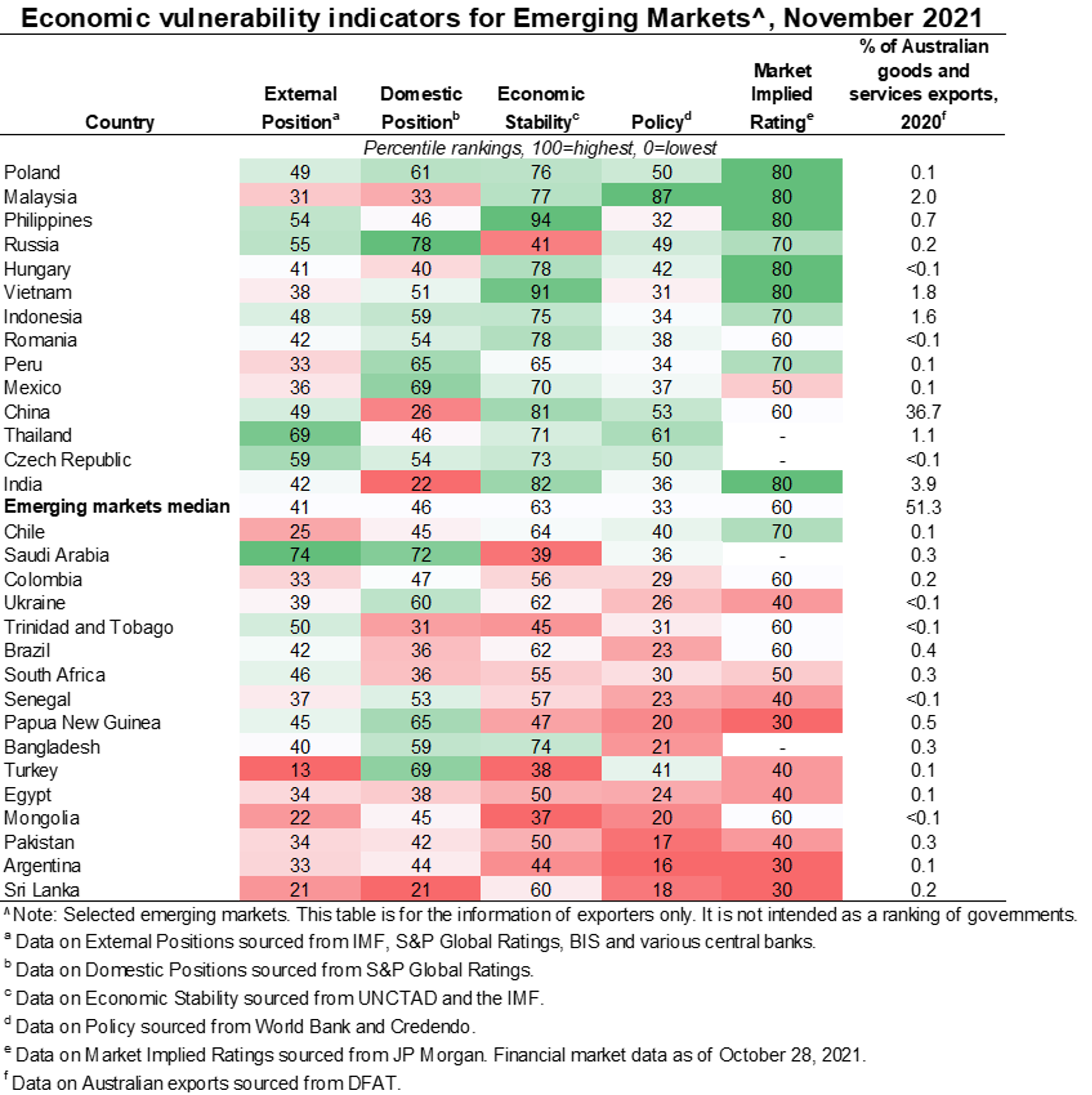

International institutions and financial market analysts, including the IMF, World Bank and S&P Global Ratings, use a range of indicators to assess the EMs most exposed to these risks, as shown in the table. Using data from external sources:

- External position—what is the external debt and reserves position? Is the current account in deficit and how far has the currency deviated from its long term average?

- Domestic position—how leveraged is the private and public sector?

- Economic stability—what is the growth and inflation outlook? How reliant is the country on commodity exports, given the volatility in global commodity prices?

- Policy effectiveness—how effective is the regulatory environment and how severe are political risks?

- Market implied ratings—market risk premiums on foreign currency denominated bonds are used to give an indication of market risk appetite.

Based on these indicators, many EMs—including major Asia Pacific export markets such as Malaysia, Philippines and Indonesia—are less exposed. This reflects relatively robust external buffers, lower sovereign risk, effective macroeconomic policymaking and stronger growth prospects beyond the pandemic. Vietnam’s diverse economy, numerous free trade agreements, integration in global supply chains, competitiveness in production and stable political environment supports a robust economic outlook. China, Thailand and India have some capacity to withstand further global economic and financial volatility. But there are pockets of vulnerability in each country. For example, Thailand’s reliance on struggling tourism, China’s highly leveraged property sector, and India’s high public debt.

By contrast, more exposed countries start from a relatively weaker position to handle downside risks related to a resurgence of the COVID-19 pandemic, renewed global economic weakness, tighter global financing conditions and, in a few countries, political and social tensions.