2023—Global economic resilience amid persistent challenges

Global growth holds up

The global economy performed better than expected in 2023 amid unwinding supply chain disruptions, economic recovery in China following the removal of COVID-19 restrictions, and resilient labour markets, particularly in advanced economies, that supported household consumption. Declining energy and food prices from their Russia-Ukraine war-induced peaks eased global inflation pressures and allowed central banks to slow the pace of monetary tightening following a sharp rate hike cycle in 2022. The OECD’s November 2023 forecasts point to global GDP growth of 2.9% in 2023, up 0.7 percentage points from that predicted one year ago.

US and Asia drive global strength

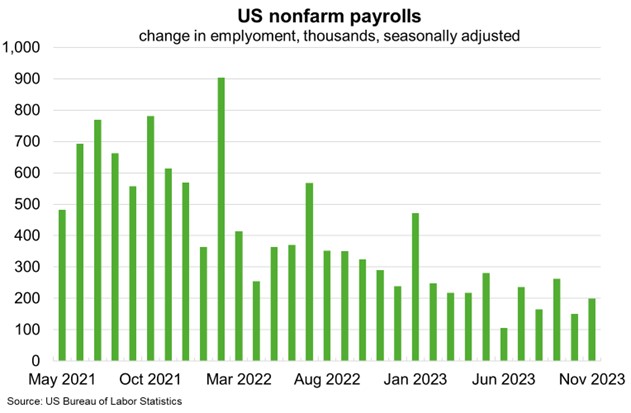

The world’s largest economy proved resilient in 2023. Robust economic growth and elevated inflation in the US prompted further interest rate hikes by the Federal Reserve, which manifested in financial instability in the US banking system in March. The collapse of Silicon Valley Bank and Signature Bank—the second and third largest bank failures in US history—triggered panic in financial markets, quickly engulfing Credit Suisse as investors fretted about the stability of the global financial system. Forceful action by US and Swiss authorities ensured the crisis remained contained to only a handful of banks. Indeed, the Federal Open Market Committee upgraded its full year forecast for 2023 to 2.1% in September, from 1% in June. That reflected resilient employment growth (Chart), rising wages and continued drawdown on excess savings that fuelled robust private consumption.

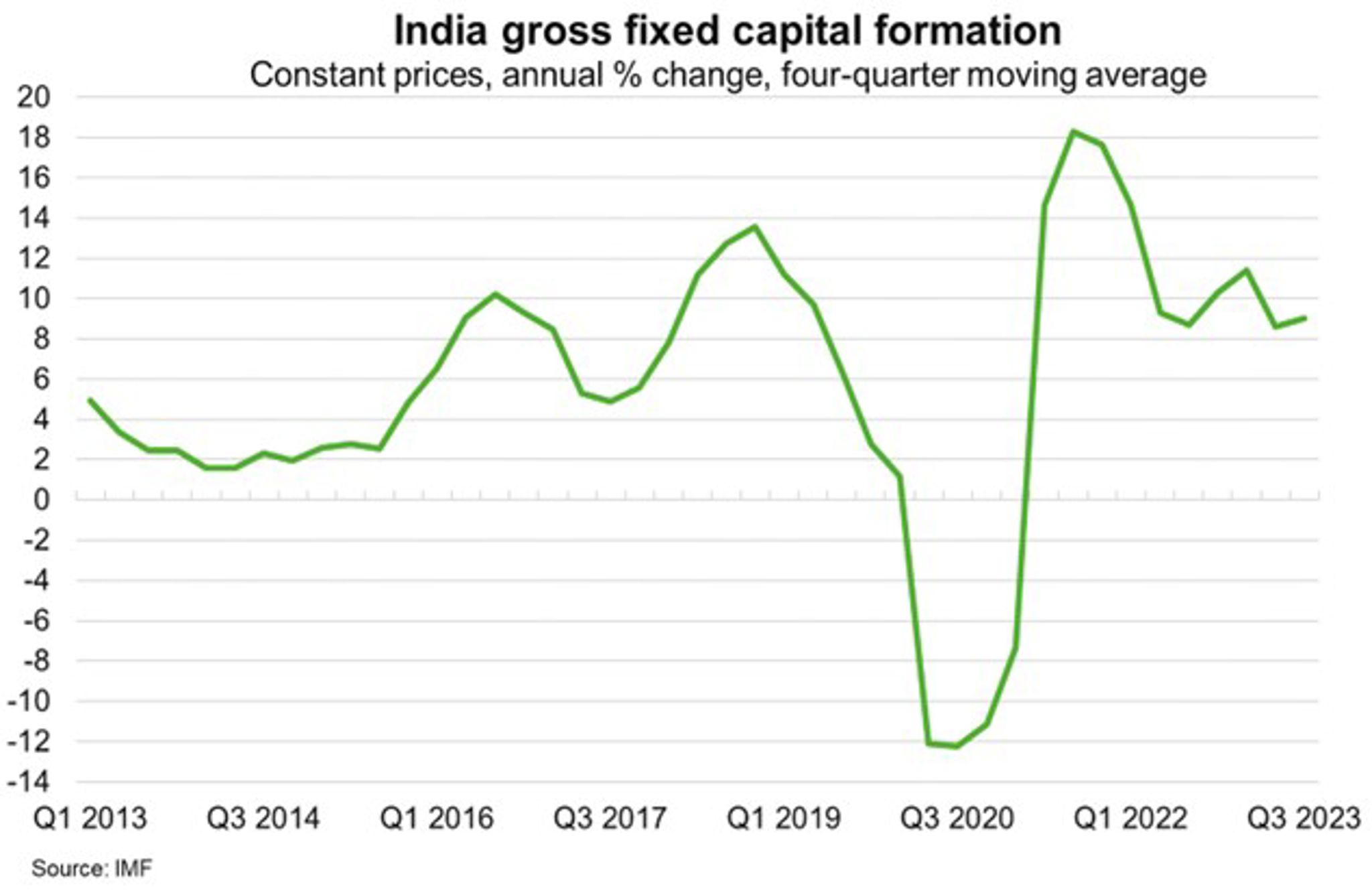

Emerging Asia generated about 60% of global growth in 2023, supported by China’s economic reopening and the Indian government’s ongoing investment in infrastructure (Chart). Strong private consumption and infrastructure investment boosted growth in domestic-led economies such as Indonesia and the Philippines. Another year of open international borders supported an acceleration in international tourism arrivals, lifting growth in service-oriented countries such as Thailand and the Pacific Islands.

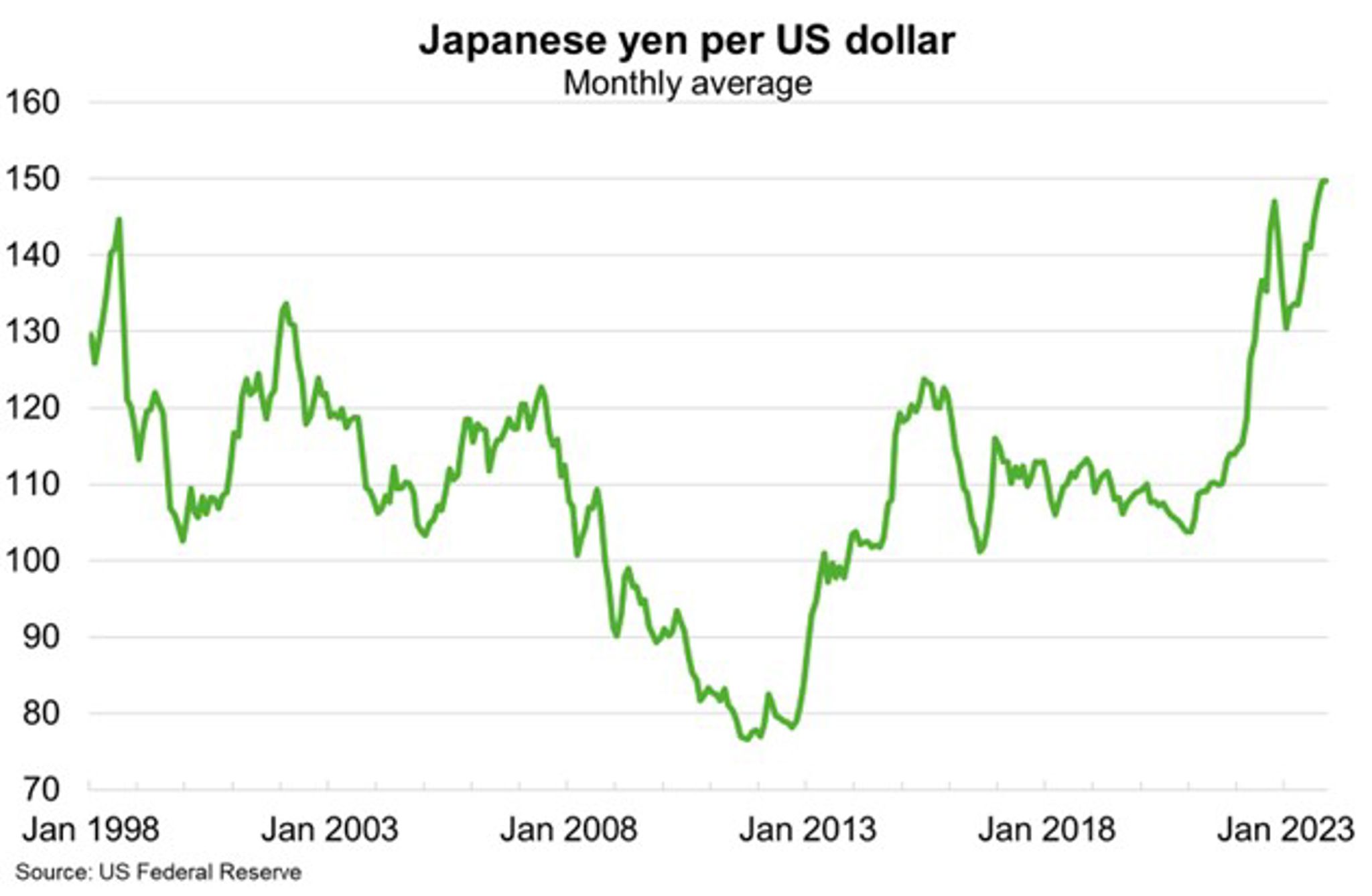

Japan, the world’s fourth largest economy, enjoyed an export boom in 2023 on the back of the weakest yen/US dollar exchange rate in more than two decades (Chart), the resumption of international tourism and resolution of supply chain issues. The largest wage hikes in more than 25 years supported household spending, helping to offset the squeeze to household budgets from higher inflation.

But growth moderated overall…

The global economy faced several challenges this year that resulted in growth moderating to 2.9%, from 3.5% in 2022, and well below the historical (2000–19) average of 3.8%.

China’s ongoing property downturn

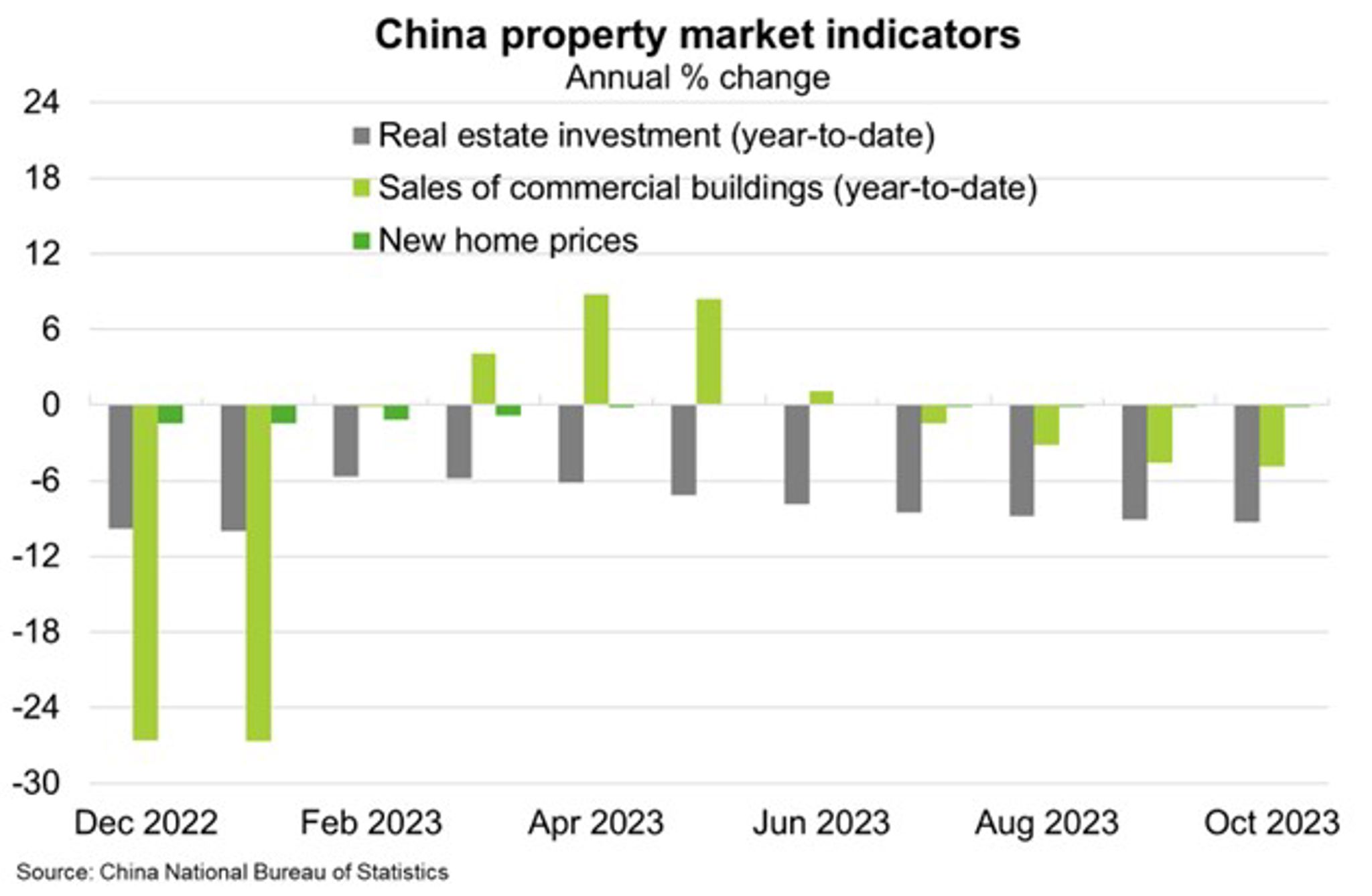

China’s economy is estimated to have grown 5.2% in 2023 according to the OECD, up from a COVID-19 induced 3% in 2022. However, a mid-year soft patch reflected a fading boost from reopening and slowing external demand for Chinese wares, while the downturn in property investment and construction remained a persistent drag on consumption (Chart). Geopolitical tensions with the US also weighed on foreign trade and investment. Despite modest stimulus measures from Chinese authorities, structural impediments remain a cap on growth.

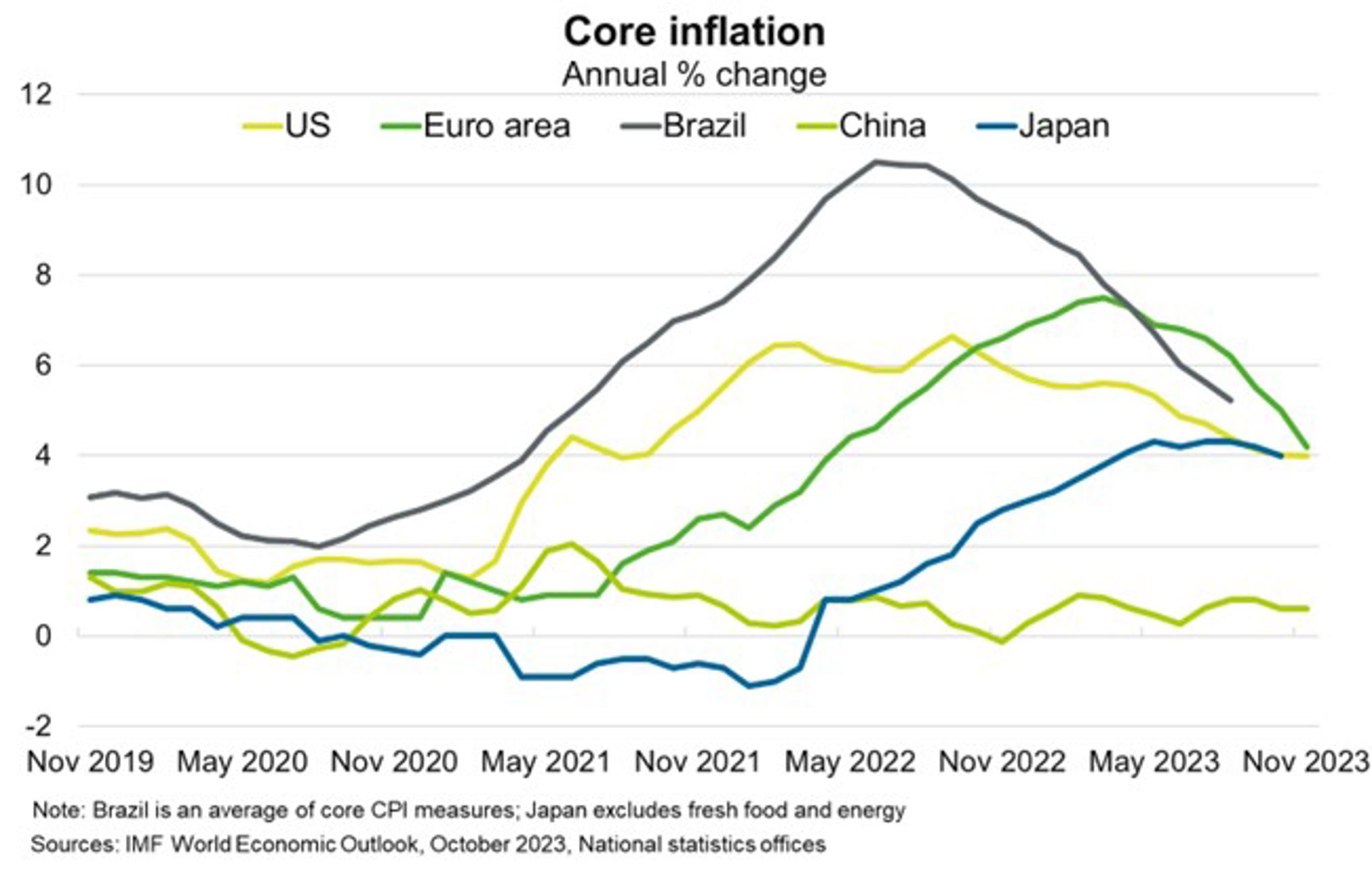

Elevated inflation and tighter financial conditions

Lower energy prices and easing supply bottlenecks reduced headline inflation in most economies this year. US inflation stabilised late this year at well below last year's highs, even though it remains above pre-pandemic levels. The US Federal Reserve’s rising interest rates are having their desired inflation-curbing effect, but the US still faces cost of living pressures as in many economies. Indeed, core inflation—excluding food and energy—remained high in 2023 (Chart). This reflected higher business profits in some sectors, elevated labour costs, and rebounding services demand as spending patterns normalised post-pandemic. Bad weather also started to hit crop yields and raise domestic prices in India and across Latin America, keeping inflation elevated and raising food insecurity in some countries. That said, recent conflict in the Middle East has not materially impacted oil supplies or energy prices thus far.

Even though central banks neared the end of their tightening cycle, higher interest rates exacerbated fiscal and debt vulnerabilities in some advanced economies and emerging markets. Rising borrowing costs and a strong US dollar increased debt-servicing burdens and debt default risks for governments and corporates. Financing constraints limited the ability of many governments in developing economies to invest in much-needed infrastructure and services for economic development. Some countries, like Sri Lanka, Pakistan and Papua New Guinea made progress on IMF-led reforms, though economic and fiscal pressures remain significant.

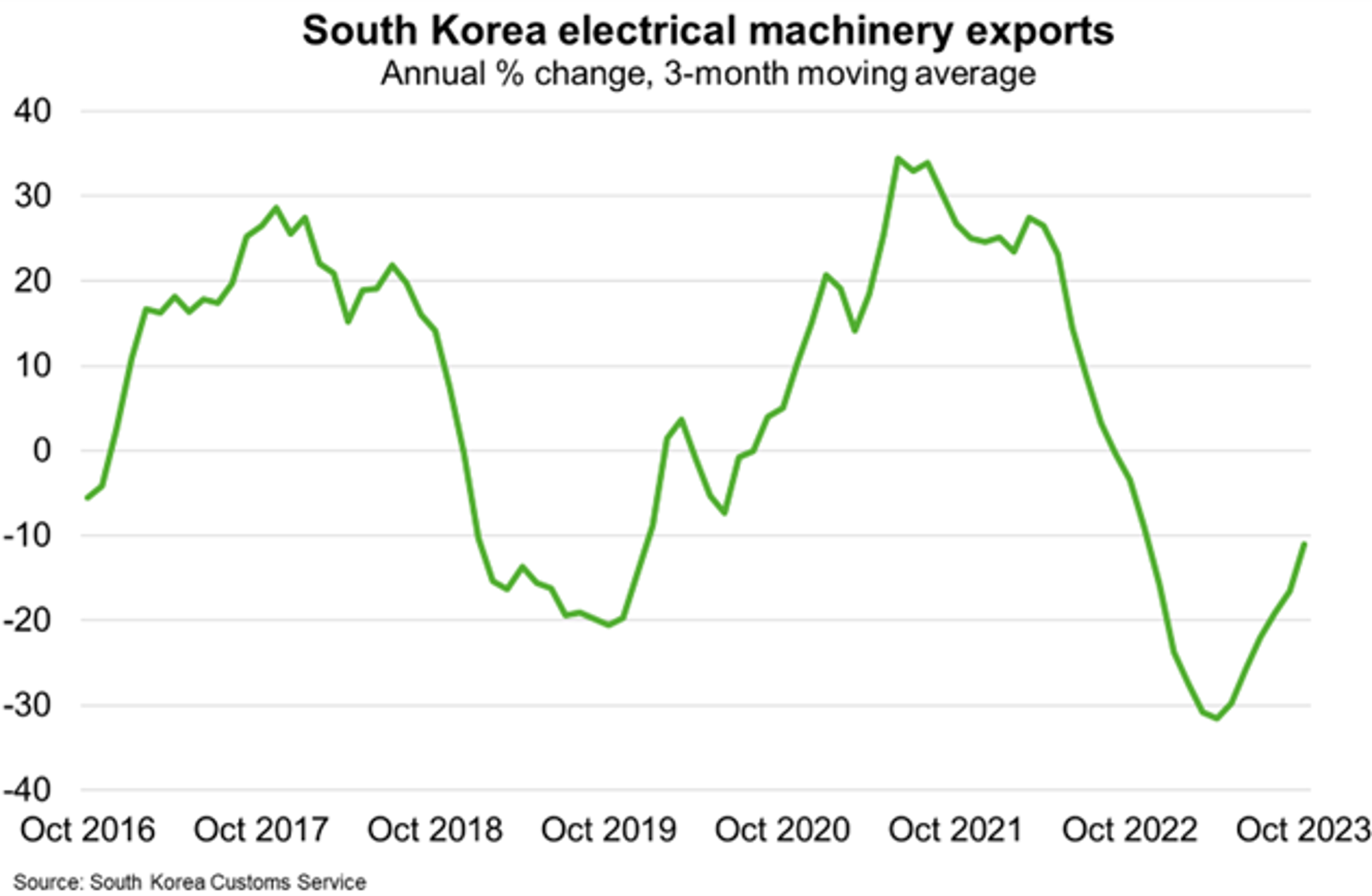

Goods trade slowdown hit Asia’s electronics exports

World trade growth declined to an estimated 1.1% in 2023 according to the OECD, from 5.2% in 2022 and well below the historical average of 4.9%. Global goods trade slowed as consumers shifted their post-pandemic demand from electronics and consumer products to domestic services, such as restaurants and travel. This took a significant toll on Asia’s large electronics exporters, including South Korea (Chart), Taiwan, China, Hong Kong and Vietnam.

Rising domestic and geopolitical tensions

Heightened geopolitical tensions and rising trade barriers weighed on global trade and prompted more companies to diversify and enhance the resilience of their supply chains. The relocation of manufacturing out of China and shift in supplier bases benefited Vietnam and India in particular.

Domestic political tensions also remained prominent in 2023, including a three-month political impasse in Thailand following a leadership transition mid-year and protests and violence in Bangladesh ahead of the general election scheduled in January 2024. Latin America faced growing social discontent and diminished trust in public institutions, adding to challenges from slower growth and high inflation. Ailing power infrastructure in South Africa hindered the government’s ability to deliver public services and contributed to social unrest.