India—Capital-intensive budget boosts Australia’s export opportunities

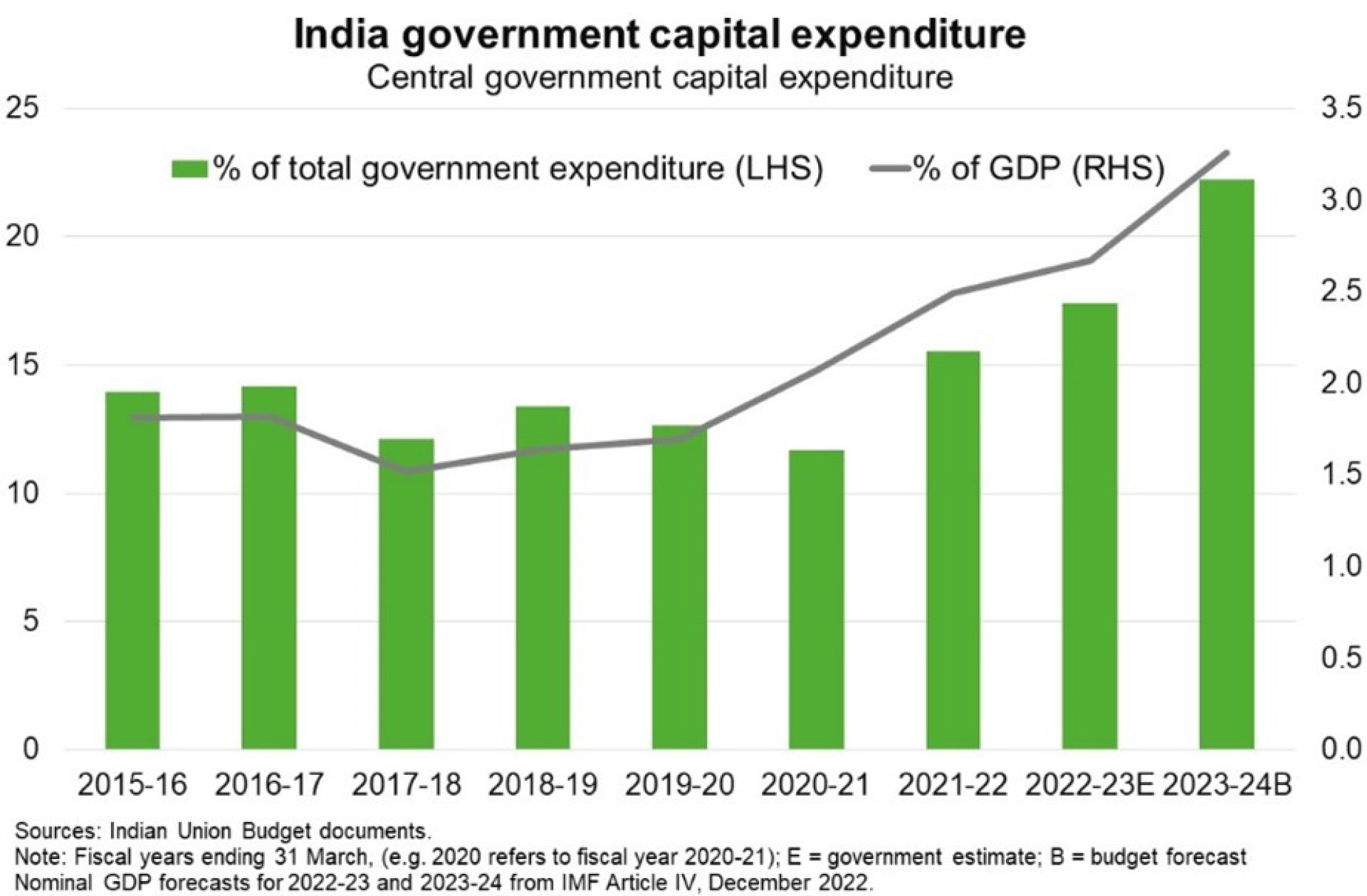

India’s capital spending will rise 37% to a record INR10 trillion (US$125 billion) in fiscal 2023-24 (year-ending March 2024), reinforcing the government’s commitment to infrastructure development. Capital spending will account for 22% of total government spending (3% of GDP) in 2023-24, up from 12% in fiscal 2020 (Chart). Increasing infrastructure spending alongside the budget’s plans to cut personal income taxes and raise investment in green energy further supports India’s robust growth outlook. The IMF expects India to remain the world’s fastest growing major economy, with real GDP growth of 6.1% in 2023 and 6.8% in 2024. The government’s focus on lifting growth and rationalising inefficient government subsidies will also help consolidate public finances and stabilise the debt burden, a positive for creditworthiness, government effectiveness and the broader investment climate.

Capital spending is targeted toward physical infrastructure—such as highways and railways, housing, roads and bridges, telecommunications and airports—thereby boosting prospects for Australia’s resources and energy exports, particularly thermal and coking coal, copper, iron ore and building and construction materials. India’s transition toward cleaner energy sources, including through the National Hydrogen Mission, is also positive for Australian metals and minerals exports. In support of executing India’s infrastructure plans, Australian service-oriented industries, such as design and engineering and education and training, are also likely to benefit.

These export opportunities build on an already-strong bilateral trade relationship. India’s strong growth and import demand helped it overtake the US as Australia’s fourth largest export market in FY2022. Indeed, compared to FY2021, Australia’s exports of goods and services to India jumped over 70% to $33 billion. The Australia-India Economic Cooperation and Trade Agreement, which entered into force in December 2022, will enable Australian exporters to take further advantage of India’s growing import demands.