2023—Global growth to slow further with inflation moderating gradually

The global economic outlook will present multiple challenges for Australian exporters. While recent OECD forecasts do not imply a global recession, economic growth is expected to fall sharply to 2.2% in 2023—reflecting high interest rates, elevated energy prices, weak household income growth and worsening confidence—before recovering to a relatively modest 2.7% in 2024. This growth profile makes ambitious assumptions, including the absence of further waves of COVID-19 infections, no escalation or broadening of the war in Ukraine, and the gradual dissipation of the energy market pressures in Europe. Decelerating growth and tighter monetary policy will see inflation moderate, but remain high, forecast at 6.5% in 2023 and 5.1% in 2024 (from 9.4% in 2022) in OECD economies. Weakening demand will alleviate logistics bottlenecks and ease shipping costs, but shortages of raw materials, parts and labour will keep business costs historically high.

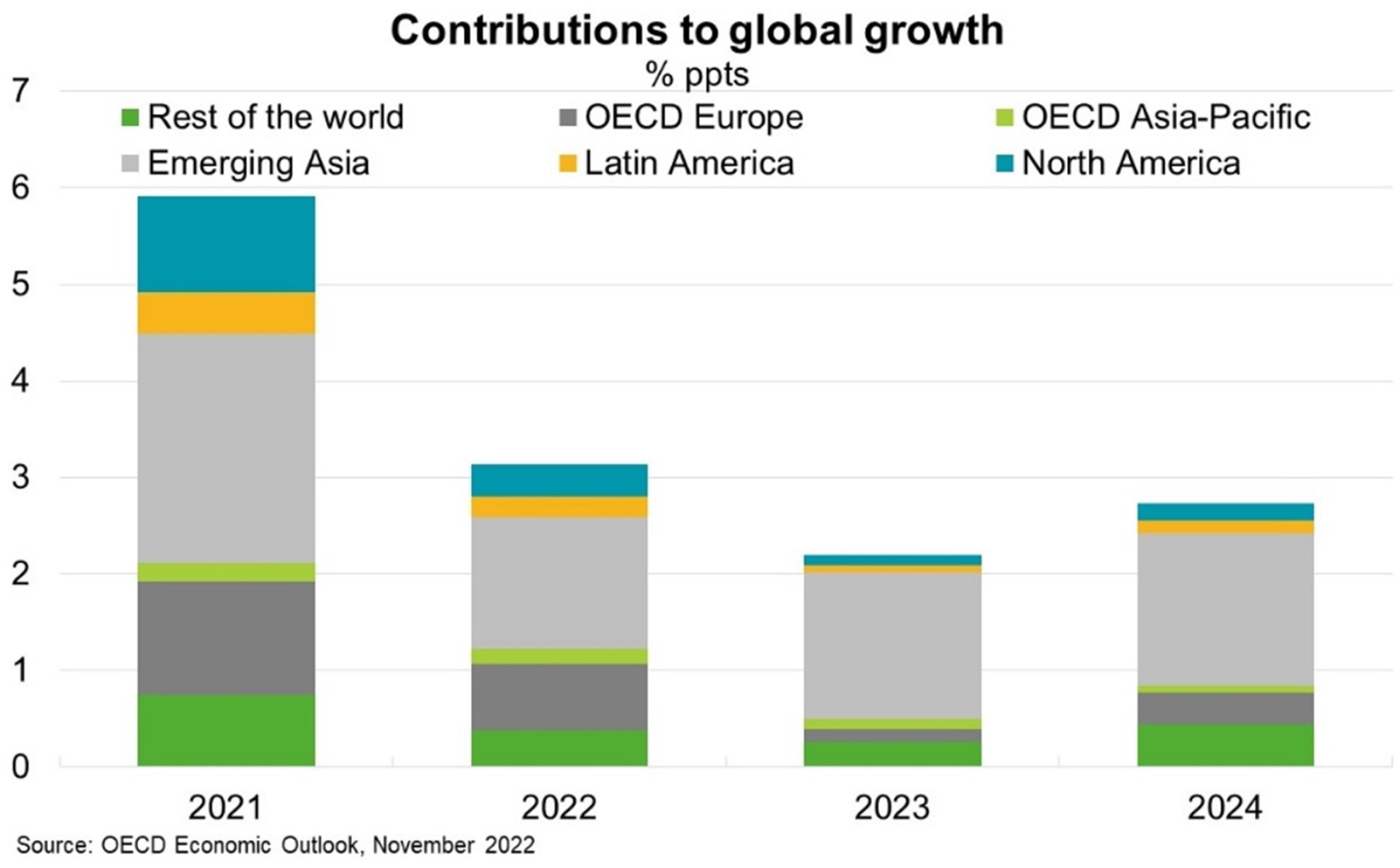

The further deterioration in global demand and ongoing inflationary pressures amid elevated geopolitical uncertainty will weigh on the export outlook and business confidence. That said, slowing global growth will be increasingly imbalanced across regions, with Australia’s largest regional export markets faring relatively well. China will likely contribute the most to global growth, as COVID-19 restrictions ease into 2023. More broadly, emerging markets in Asia will be the main growth engine—accounting for nearly 75% of global GDP growth in 2023—whereas Europe, North America and South America will see very low growth (Chart).