Exports outlook—Clean energy transition boosts resources, as services recovery accelerates

Despite a challenging global economic backdrop, businesses are confident about export opportunities in 2023. According to the DHL Export Barometer, 70% of Australian exporters anticipate an increase in orders over the next 12 months, up from a pandemic-induced record low of 47% in 2020. Prospects for resilient demand from Asian economies, the easing of supply disruptions, including for labour and materials, and a competitive Australian dollar lends support to this view.

Resources, energy and agriculture exports to hit record highs

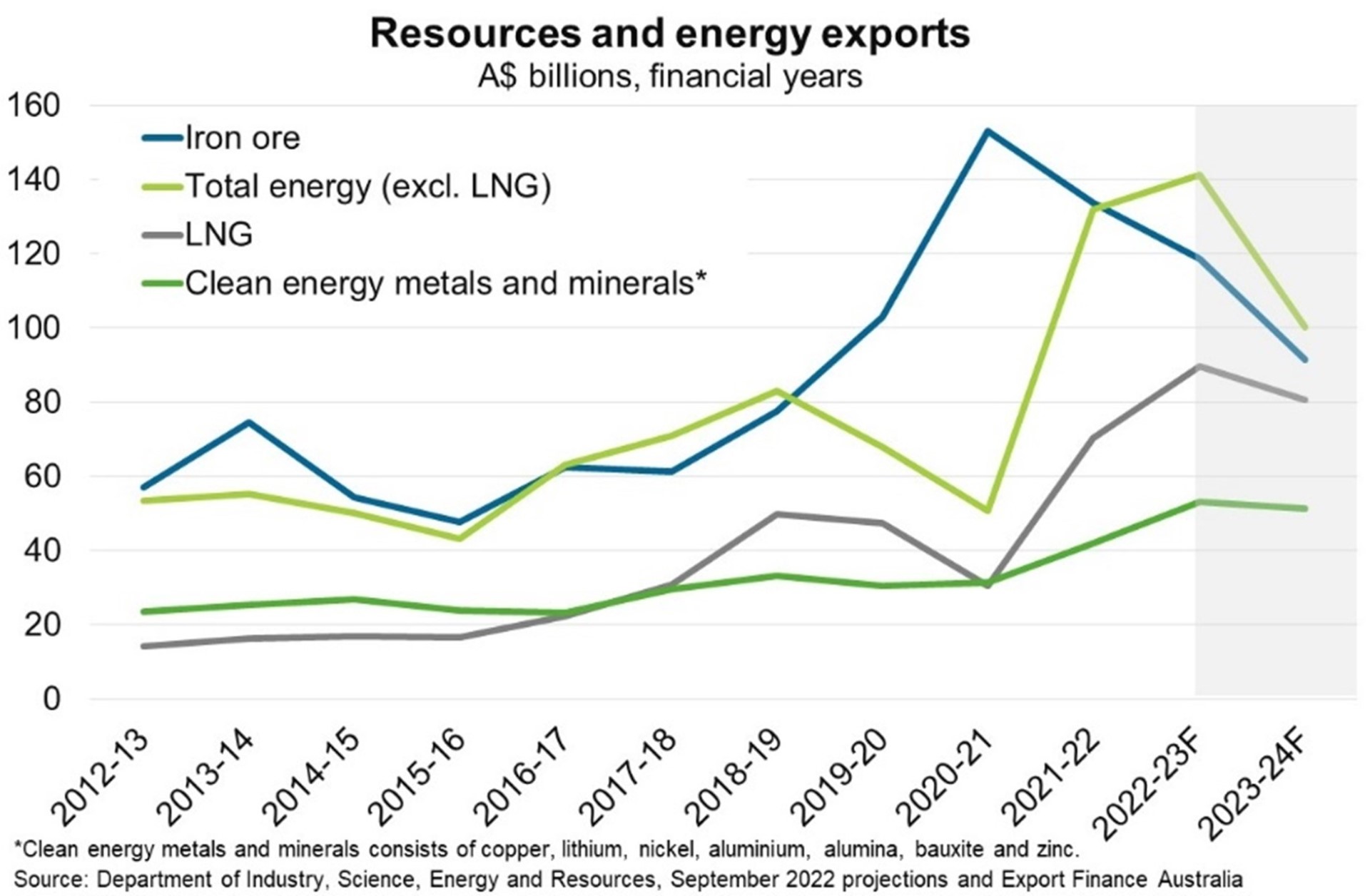

Australia’s resources and energy exports are forecast to reach $450 billion in 2022-23 according to the Department of Industry’s September 2022 projections, surpassing last year’s record of $422 billion. Australia will benefit from growing demand for metals and minerals used in low-emission technologies. Global manufacturing of electric vehicles and renewable power generation facilities requires metals and minerals as inputs. For instance, solar panels use large quantities of copper, silicon, silver and zinc, while wind turbines require iron ore, copper, and aluminium. Reflecting this, Australia’s exports of copper, nickel, lithium, zinc, alumina, aluminium and bauxite are set to hit more than $53 billion in 2022-23, 70% more than they earned in 2020-21 (Chart). Moreover, the outlook for LNG exports remains strong compared to other fossil fuels, bolstered by comparatively lower carbon emissions from production and combustion.

Stronger exports of LNG and metals and minerals will help offset declining iron ore export values. Iron ore exports are forecast to gradually ease from $134 billion in 2021-22 to $95 billion in 2023-24. This reflects more modest growth in blast-furnace steelmaking from major producers (EU, US and China), as the world transitions to lower emissions. Rising supply from Australia and Brazil will also face weaker demand related to a slowing global economy and China’s housing market downturn.

Fossil fuels exports are poised for another strong year in 2022-23, reflecting high prices for thermal and coking coal amid energy supply problems (largely related to Russia’s invasion of Ukraine). Thereafter, exports of oil, thermal and coking coal will fall as demand for, and prices of, carbon-intensive products weaken.

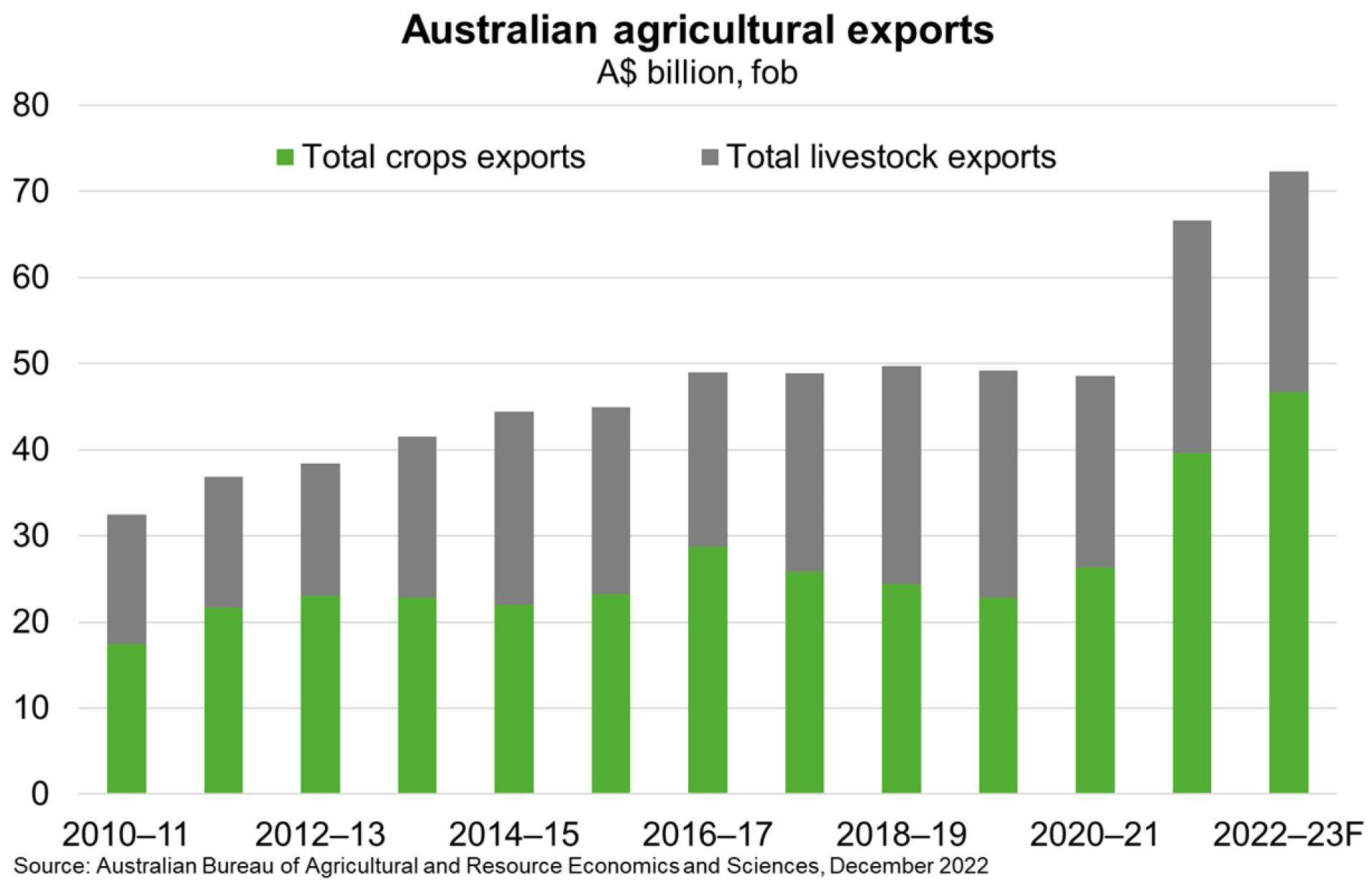

Meanwhile, agriculture exports are also forecast to reach a record high of $72 billion in 2022-23 (Chart). That reflects favourable growing conditions and world grain prices that are expected to remain elevated amid uncertain exports from the Black Sea region and persistent drought in the US, EU and Argentina. According to the Department of Agriculture, even when more neutral conditions return to overseas producers as La Niña conditions ease, it will take more than one season to replenish grain inventories.

Asian demand supports exports amid broader global economic weakness

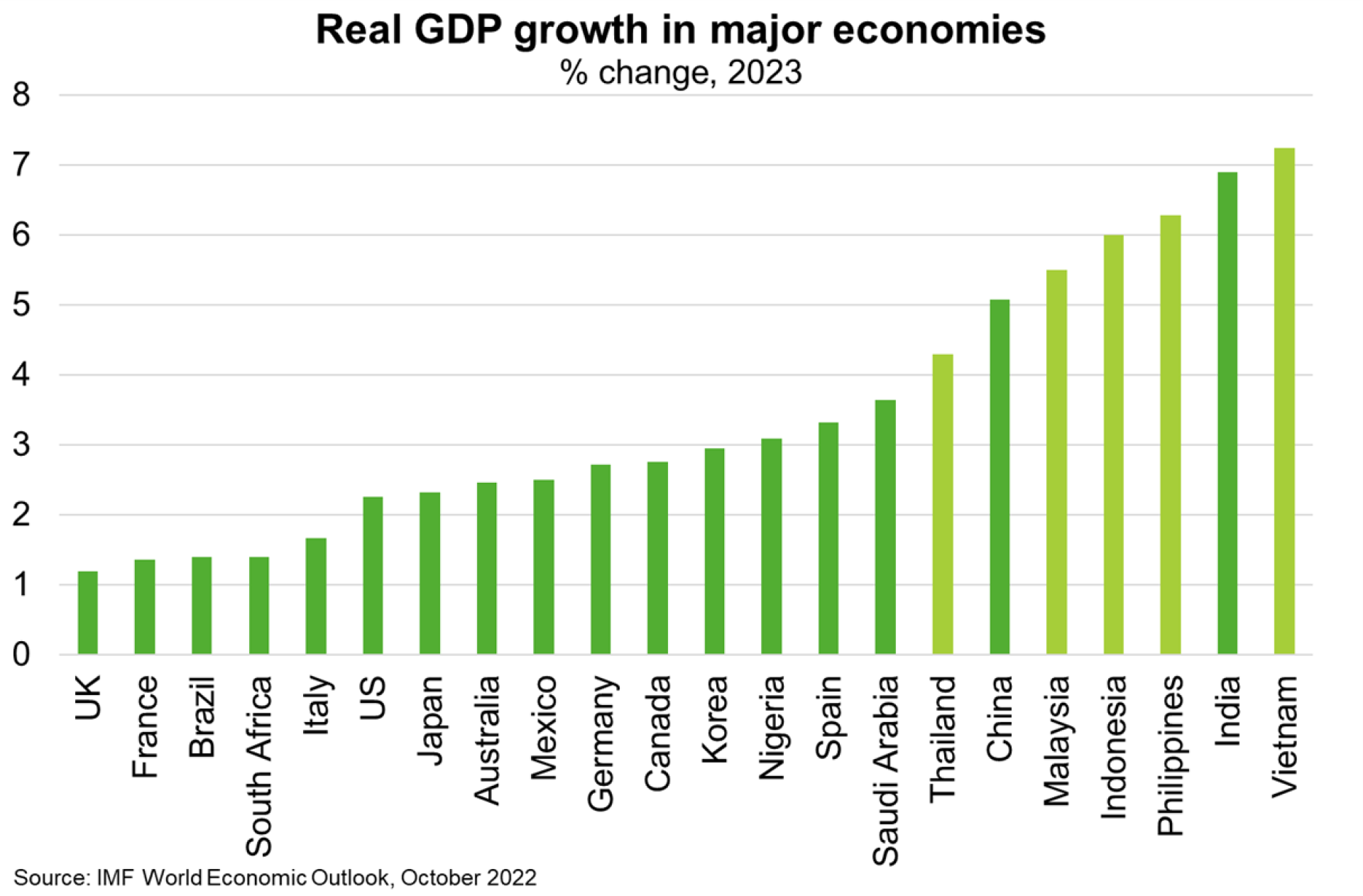

Exporters are on the front line of challenging global economic conditions. Encouragingly, though, the Asian region remains a pillar of strength. Economies of the ASEAN-5—Vietnam, Philippines, Indonesia, Malaysia and Thailand—all boast a relatively strong outlook in the coming year (Chart). Indeed, the ASEAN-5 as a group are expected to grow faster than China this year for first time since 1990. Moreover, India will remain one of the world’s fastest growing economies, and the step up in Australia’s bilateral trade relationship should foster stronger export growth. These countries have large populations, rising incomes, lower debt levels, improving governance and a focus on reforms to enhance their business environments and attract foreign investment. Although the global slowdown remains a risk to economic momentum in Asia’s export-oriented economies, continued growth in these markets is important because Australia sent more than 80% of its goods and services exports to Asia in 2021.

Weaker Australian dollar to support export competitiveness

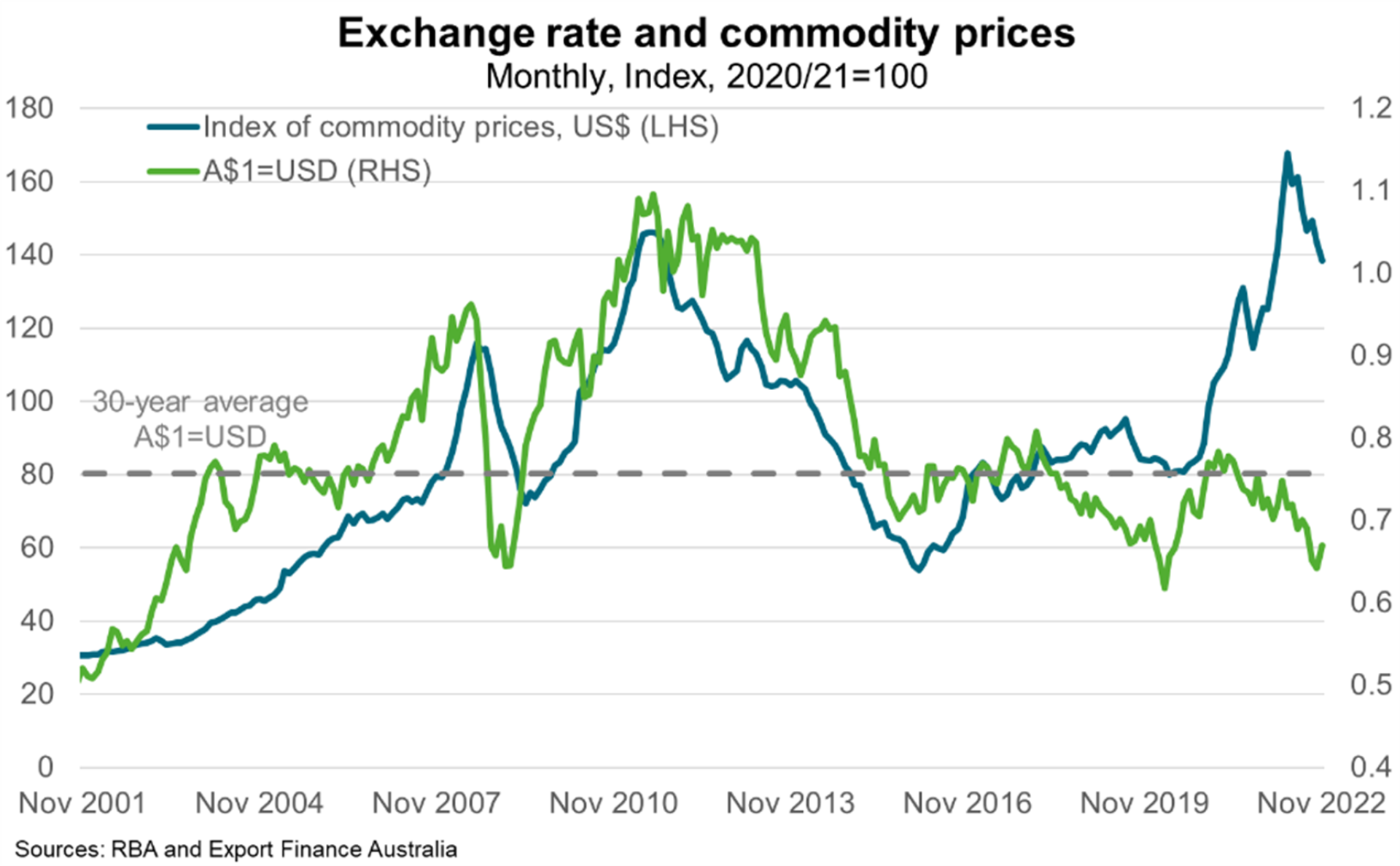

The weak Australian dollar will provide a tailwind for exporters in 2023. The Australian dollar now sits at about US$0.68 cents—well below the 30-year average (Chart). Although this increases the costs of imports, it also supports export competitiveness. Futures markets pricing as of early December suggests the AUD will remain steady at around US$0.68-US$0.69 cents over the next two years. That said, the AUD faces downward pressure from a more aggressive rate hike path in the US relative to Australia, falling key commodity prices and fears of a global recession.

The weaker Australian dollar and another year of open international borders should support a faster recovery in tourism and education exports in 2023. A strong return of Indian and Nepalese students to Australia is boosting inbound arrivals, a trend that is likely to continue. This is helping to offset lower arrivals from China, Australia’s largest and biggest-spending market, where ongoing COVID-zero policies are constraining Chinese travel demand. On balance, services exports are expected to reach pre-pandemic levels late next year.