Australia—Low AUD supports export competitiveness, lifts import costs

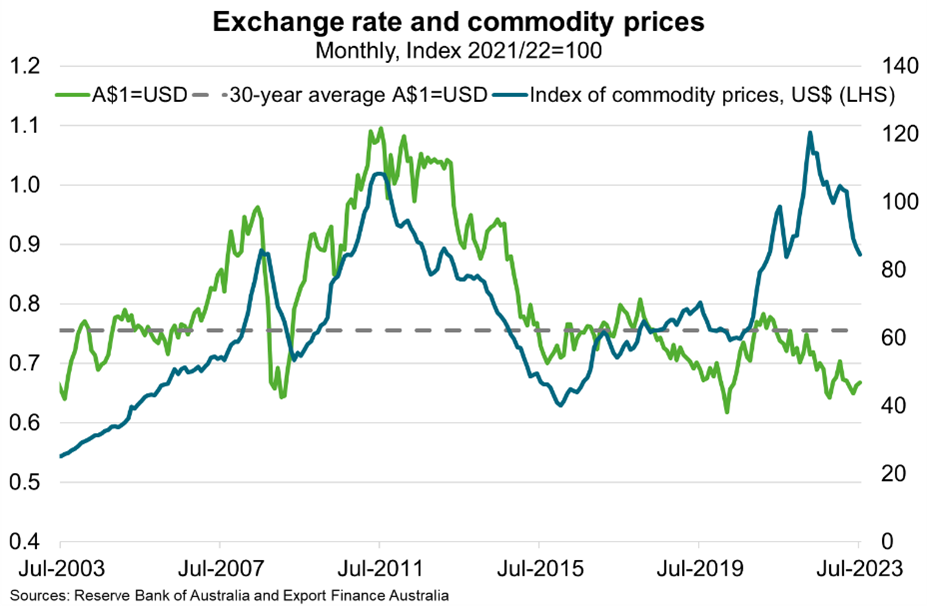

The Australian dollar (AUD) has fallen 18% since the recent peak in February 2021 to US0.64 cents—US11 cents below the historical average. Key AUD determinants include a) the ratio of export to import prices, b) differences between interest rates in Australia and major advanced economies, and c) changes in global risk sentiment. Thus, while the AUD appears undervalued relative to commodity prices (Chart), forecast lower prices for Australia’s key commodity exports, China’s fading economic momentum, and more aggressive rate hikes in the US relative to Australia will continue to weigh on the currency.

A lower AUD supports Australia’s international competitiveness but also increases the cost of imports. Australian business confidence is already weak amid elevated costs. According to the NAB Quarterly Business Survey, wage growth is the top concern. While the share of companies reporting materials availability as a constraint declined to 36% in Q2, from over 50% in 2022, the share reporting labour as a constraint barely moved, remaining over 80%. Inward migration has surged, but the labour market remains tight with measures of spare capacity around multi-decade lows. The Reserve Bank of Australia (RBA) forecasts the unemployment rate to rise only gradually—from 3.7% in July 2023 to 4½% in June 2024—and remain below pre-pandemic levels throughout the forecast period. More broadly, while inflation fell from a peak of 7.8% y/y in Q4 2022 to 6% in Q2 2023, the RBA forecasts inflation to return to the 2–3% target range only by late 2025. Financial markets meanwhile predict the RBA cash rate—up 400 bps since April 2022—to remain on hold until late 2024. As the global economy slows, the scope to pass on these costs to Australian export customers may fall, squeezing business profits.