Global—Trade slowdown hits Asia’s electronics exporters

Global goods trade is slowing as consumers curb their post-pandemic demand for electronics and consumer products and shift consumption to domestic services, such as restaurants and travel. Higher interest rates and cost of living pressures are also dampening consumer spending and business investment in the US and Europe. Given most products are priced in US dollars, US dollar strength is further crimping global demand. The IMF forecasts global trade growth to slow to 2% in 2023, from 5.2% in 2022, before rising to 3.7% in 2024, well below the 2000-19 average of 4.9%.

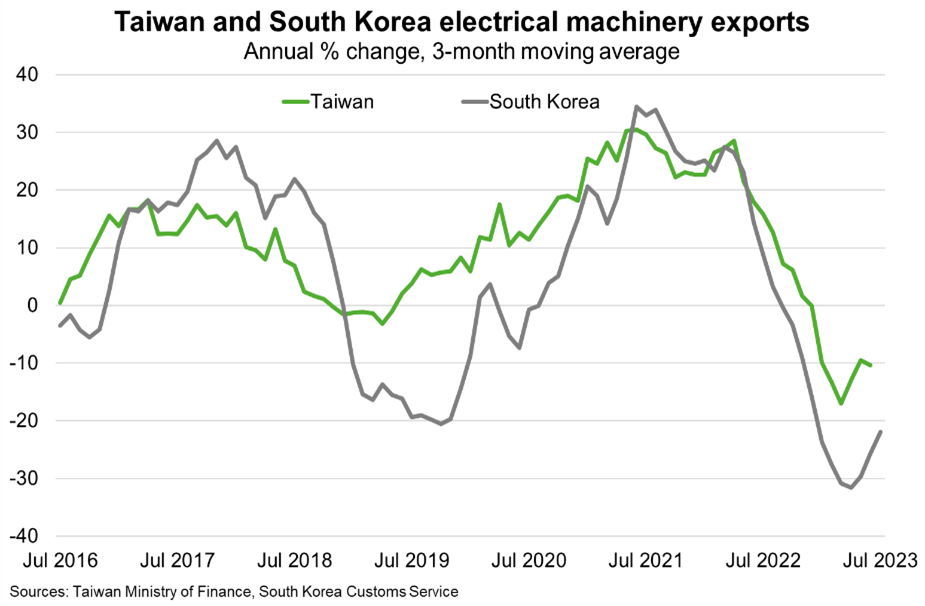

The slowdown in global trade and downturn in electronics demand is hitting Asian exporters particularly hard (Chart). In July, Chinese exports fell at their steepest annual pace since the onset of the pandemic. China’s declining imports and sluggish economic recovery are taking a toll on demand elsewhere. For instance, Taiwan’s exports fell 10% in July from a year earlier, while Vietnamese exports of smartphones—the country’s largest export earner—fell 18% in the January-July period compared to a year earlier. Vietnam’s electronics manufacturing slump will dent demand for critical South Korean inputs. Indeed, South Korean exports tumbled 16.5% through the first 20 days of August from a year earlier.

Declining semiconductor inventories and recovering demand for new personal computers and smartphones could revive the electronics cycle later this year and next, supporting Asian exports. Further ahead, rising incomes and growing consumer markets in India and across Southeast Asia will boost trade within the Asian region and beyond. The longer term outlook for electronics demand is also favourable, underpinned by major technological developments, including 5G mobiles and Artificial Intelligence computing.