World—Easing supply problems and commodity prices could reduce high inflation pressures

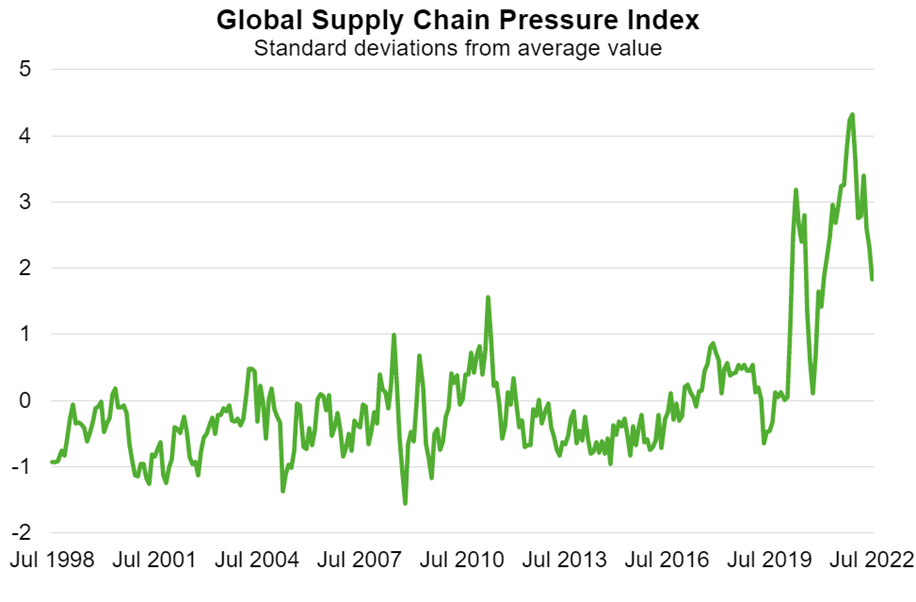

Global supply constraints have eased over recent months, though they remain elevated (Chart). Global goods demand has plateaued while the supply of goods from China has recovered from COVID‑19 disruptions and east Asian production has expanded following capacity-enhancing investments. Shipping contract rates remain high amid elevated fuel prices and ongoing shortages of vessels. However, supplier delivery times, order backlogs and queues at ports have eased. Moreover, some commodity prices are falling amid concerns about the outlook for global growth and China’s property sector. Despite the Northern Hemisphere drought, agricultural prices are falling given better weather in some countries and the restarting of some Ukrainian grain exports. The July reading of the RBA US$ commodity price index was down 17% from a record high in April. If sustained, easing commodity prices and supply constraints could reduce significant inflation pressures.

But the risk of setbacks to supply remains high. Beijing’s commitment to eliminating COVID-19 may see periodic shortfalls of Chinese exports. Energy rationing in Europe could disrupt industrial supply chains, while tensions between China and Taiwan could disrupt semiconductor manufacturing.

Inflation is at multi-decade highs in most economies. Despite rapid interest rate hikes in recent months, core inflation—the gauge of underlying inflation pressure excluding volatile energy and food prices—is yet to ease. Persistent high core inflation reflects rising services inflation, underpinned by rebounding services demand, faster wage growth and high prices for commodities used as inputs. Most central banks have signalled further policy tightening to prevent high inflation becoming entrenched in longer-term inflation expectations. Tighter financial conditions, as a result, mean many forecasters are now predicting a mild recession in the US economy. Inflation pressures among many of Australia’s major Asian export markets are relatively moderate, implying less monetary tightening will be required.

Source: New York Federal Reserve