Pakistan—Political uncertainty raises economic and financial risks

Parliament selected opposition leader Shehbaz Sharif of the Pakistan Muslim League-Nawaz (PML-N) to become Pakistan’s next prime minister (PM) on April 11, 2022, after former PM Imran Khan lost a vote of no confidence. The new government faces a surging current account deficit and high inflation. The PML-N leads a coalition of many parties, which will challenge governability and raise the risk of political instability. The PML-N‑led coalition will also face challenges passing legislation, given its slim majority in parliament.

The new government will now face talks with the International Monetary Fund (IMF) over its existing IMF program. Pakistan is not currently meeting its current account deficit and budget deficit targets for the program. This is partly due to heightened international energy prices, but Pakistan also faces challenging IMF‑led reforms to raise government revenue and liberalise prices. Progress on reforms is important for Pakistan to secure external financing to meet large forthcoming external debt obligations. Pakistan’s stock of foreign reserves, which stood at US$23 billion in February 2022, remains low relative to estimated external debt repayments of about US$13-US$14 billion every year through to FY2026. Parallel to engagement with the IMF, PM Shehbaz Sharif is reportedly planning to visit China and Saudi Arabia—two key creditors—to seek a rollover of its debt.

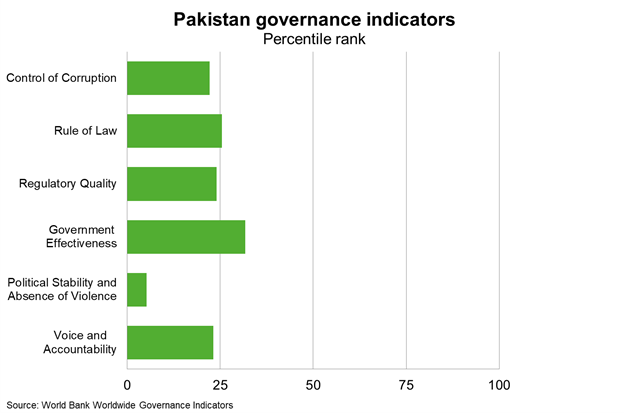

The risk of further violence and civil unrest is high, which could result in sustained disruption to major infrastructure that weighs on economic activity. Pakistan remains a challenging place for exporters to do business, due in part to low rankings on various measures of governance and political stability (Chart). Pakistan was Australia’s 29th largest export partner in 2020, taking $1.3 billion in goods and services exports, chiefly education, vegetables, coal and ferrous waste and scrap.