Chile—Draft constitution may erode investment climate

The government agreed to redraft Chile’s neoliberal and market-friendly Pinochet-era constitution to quell mass protests that erupted in 2019. An elected 154-member constitutional convention charged with drafting a new constitution released the final text on 4 July after a year of negotiations. If approved in a nationwide mandatory referendum on September 4, Chile’s new constitution would shift Australia’s third largest Latin American export market to a welfare state model with greater protections for environmental, cultural, social and indigenous rights.

The final draft omits more extreme articles which would have challenged the investment climate, such as nationalisation of mining operations. However, the document will increase policy uncertainty by leaving key questions to be determined by legislation due within three years. It is also less business- and growth-friendly than the current constitution. For instance, trade unions are guaranteed a say in corporate decision-making and permitted to strike for any reason. Meanwhile, ‘all forms of job precariousness are prohibited’, suggesting less labour market flexibility. Changes to the judicial system could render judges vulnerable to increased factionalism. Proposed universal public pensions and healthcare systems will increase social spending and may erode fiscal sustainability.

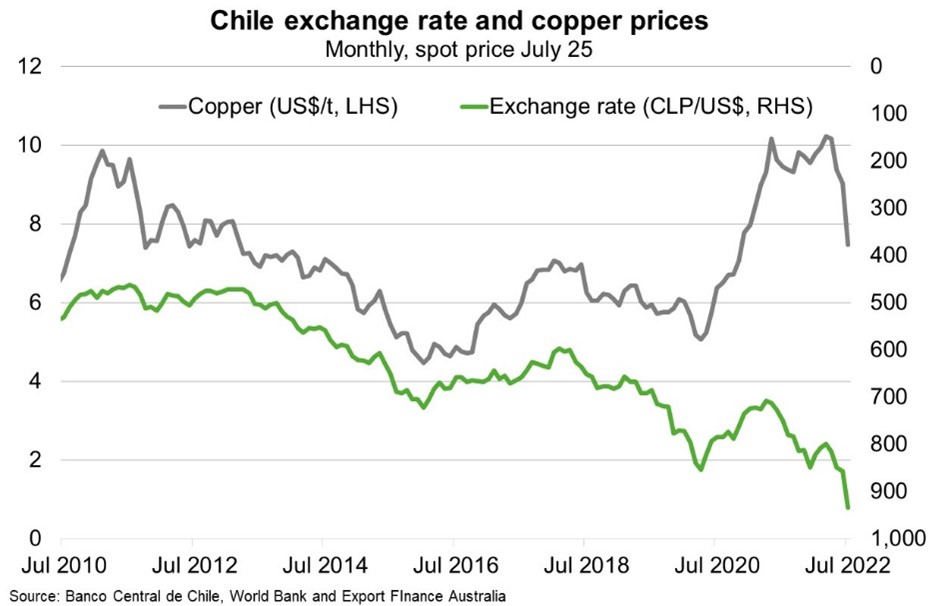

Polls suggest the draft is likely to be rejected, meaning the current constitution will remain in force. This would undermine President Boric’s policy agenda, which hinges on significant changes to the role of the state. However, if approved, the new constitution is likely to impact investor sentiment, particularly given Chile’s economic woes. Growth is rapidly slowing as policy stimulus is reversed and global headwinds mount. The Chilean peso fell to a record low against the US dollar earlier this month amid a pronounced slump in copper prices (Chart), fuelling inflation. The Central Bank intends to sell up to US$25 billion of international reserves before September 30 to support the currency, potentially eroding buffers to future shocks. While the peso has strengthened since the announcement, volatility is expected to continue in coming months.