Papua New Guinea—Progress on gas projects, but election risks loom

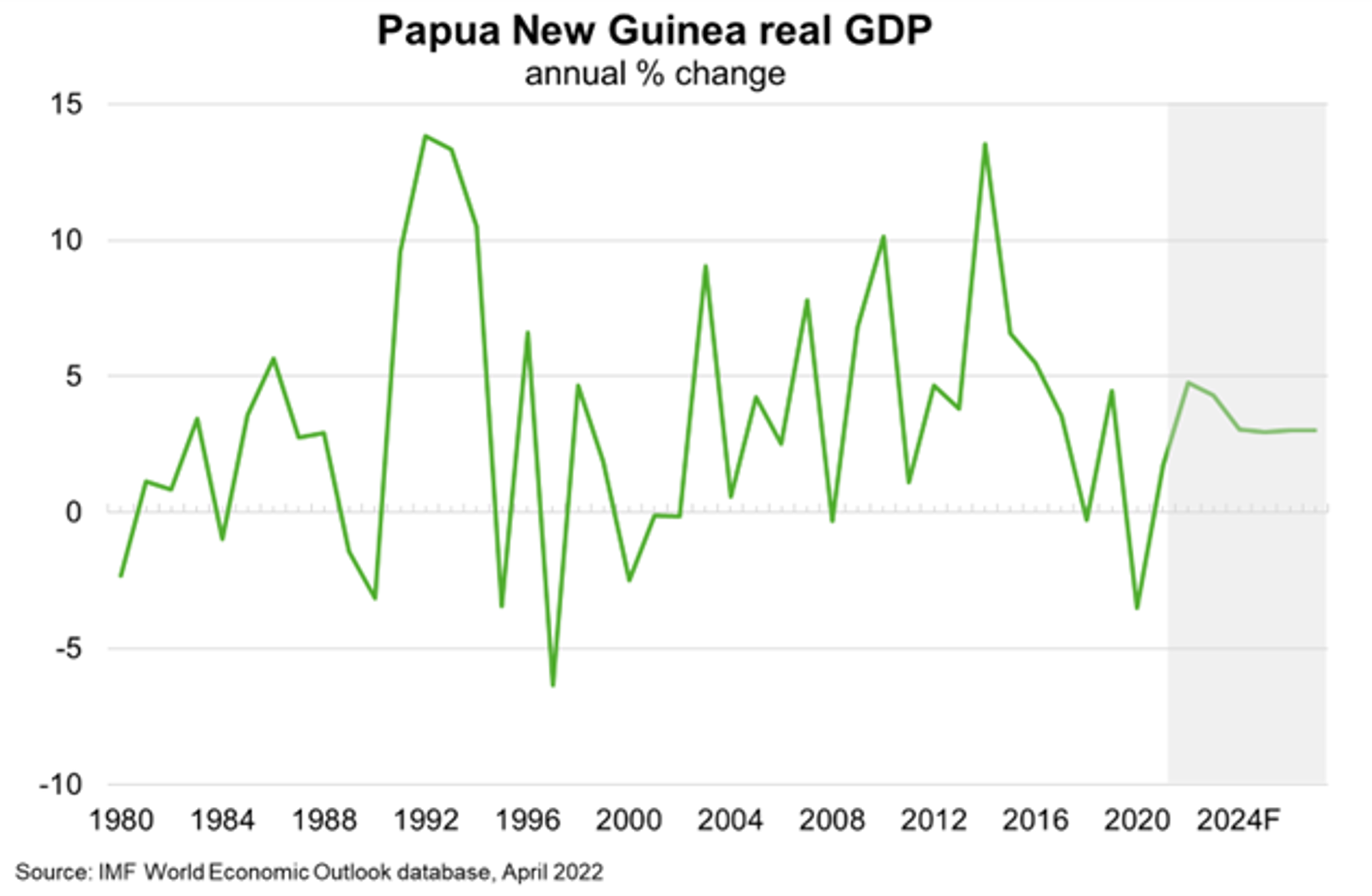

Momentum on gas projects and higher global LNG prices are brightening PNG’s economic prospects. The Total-led US$12 billion Papua LNG project (about 60% of PNG’s GDP) is progressing technical and commercial, regulatory, social, and environmental activities, and is expected to move to the front-end engineering and design phase by the end of 2022. A final investment decision is expected in the second half of 2023, with construction to commence soon thereafter. ExxonMobil’s P’nyang gas agreement, signed in February 2022, is poised to commence construction once the Papua LNG plant is operational. Should these gas projects proceed sequentially as planned, growth could be sustained for longer than previous boom-bust cycles in the 1990s (construction of Porgera and Lihir gold mines) and during 2010-2014 (PNG LNG) (Chart). The start-up of these gas projects adds upside potential to the IMF’s PNG average GDP growth forecast of 3.2% per year from 2023-27, and offers significant export and investment opportunities for Australian businesses. PNG was Australia’s 23rd largest export market in 2020.

PNG heads to the polls next month. The general election is facing difficulties amid concerns about violence and electoral irregularities in some areas. PNG’s authorities are strongly focused on preventing violence that plagued the 2017 election. Still, under-resourced police and widespread availability of illegal firearms present violence risks before and after the vote, although foreign investors are generally not the target of election-related violence.