Advanced economies—Inflation converging to target, but risks remain

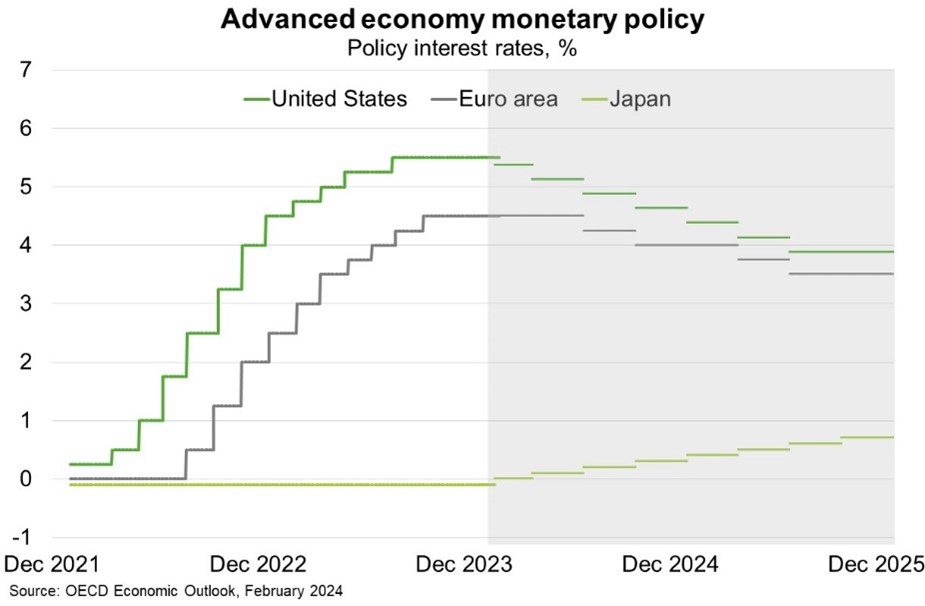

The IMF forecast inflation in advanced economies to fall by 2 percentage points to 2.6% in 2024. The drivers of slowing inflation differ by country but generally reflect lower energy prices, declining core inflation amid still-tight monetary policies and a related softening in labour markets. Disinflation is expected to see major central banks lower interest rates this year (Chart)—boosting economic growth prospects, as real incomes recover. In particular, euro area GDP growth is expected to recover from 0.5% in 2023, to 0.9% in 2024 and 1.7% in 2025. Similarly, following a mild recession in late 2023, UK GDP growth is expected to improve to 0.6% in 2024 and 1.6% in 2025. Although underlying US economic resilience implies less rush to cut interest rates, US Federal Reserve Board members forecast a federal funds rate of 4.6% in 2024, down from 5.4% in 2024. Still, US GDP growth is expected to ease from 2.5% in 2023 to 1.7% in 2025, amid a rundown of household savings and moderating government spending.

The evolution of inflation could disrupt financial stability via two channels. First, new upside inflation surprises could see central banks keep interest rates high for longer. Persistent labour market tightness and wage demands, amid weak productivity, could keep upward pressure on services inflation. Indeed, stronger-than-expected recent US labour market and inflation data have sparked concerns that the last mile of disinflation may prove the hardest. Negative supply shocks—from geopolitics or extreme weather—could also drive renewed inflation. Second, the future drag from past rate hikes could prove stronger than anticipated. Particularly given monetary tightening has been of a scale and speed rarely seen in the past and the pass-through to household and corporate debt service burdens is still only partial.