India—Rising capital spending offers Australian export opportunities

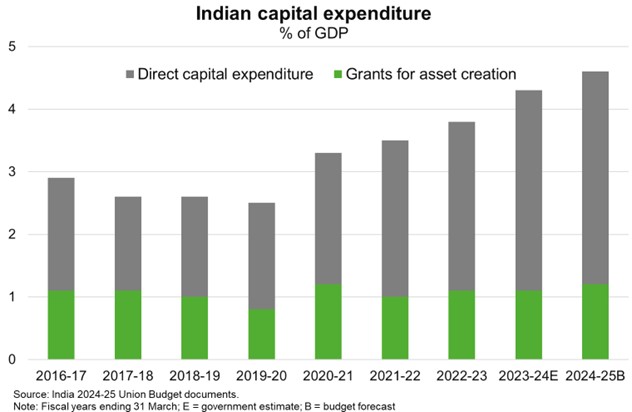

India’s interim fiscal 2025 budget (year-ending March 2025), announced ahead of the general election in April-May, signals the government’s intentions to accelerate capital spending. Direct capital spending is projected to rise to INR11.1 trillion in FY2025 (US$134 billion), equal to 3.4% of GDP. That would be the highest public capital spending as a share of GDP since FY2005. Grants for states and public sector enterprises imply an even bigger boost (Chart). The broad infrastructure push, alongside strong domestic demand, is expected to see India remain the fastest-growing major economy in 2024 and 2025, with GDP growth of 6.5% per annum according to the IMF. Spending on physical infrastructure—targeted towards railways to boost connectivity between major cities—should help enhance the business environment, which remains challenging due to significant red tape, high tariff rates, trade protectionism, a complex tax system and several layers of bureaucracy.

The planned reduction in the fiscal deficit from 5.8% of GDP in FY2024 to 5.1% in FY2025 and 4.5% in FY2026 reflects restraint in operational spending and fast nominal GDP growth. Although India’s debt composition helps mitigate debt sustainability risks, fiscal consolidation efforts are important given elevated public debt levels and contingent liability risks. A lack of populist measures signals the government’s strong confidence in its electoral prospects; indeed, polls suggest Prime Minister Modi is the world’s most popular major leader, with approval ratings of about 78%.

Australian exports to India rose to $33 billion in FY2023, 50% higher than the pre-COVID (2017-19) average. Higher Indian spending on roads, bridges and other infrastructure has helped boost demand for Australia’s resources and energy exports, a trend that is likely to continue. The Australia-India Economic Cooperation and Trade Agreement further supports Indian demand for Australian exports.